-

×

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Mastering the Gaps - Trading Gaps

1 × $15.00

Mastering the Gaps - Trading Gaps

1 × $15.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Strike Zone Strategy 2.0 Elite Package with Joe Rokop

1 × $39.00

Strike Zone Strategy 2.0 Elite Package with Joe Rokop

1 × $39.00 -

×

Learning KST

1 × $6.00

Learning KST

1 × $6.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

Maximum Lots Trading Course with Joe Wright

1 × $34.00

Maximum Lots Trading Course with Joe Wright

1 × $34.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

The Fx220 1 on 1 Mentoring Program

1 × $5.00

The Fx220 1 on 1 Mentoring Program

1 × $5.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

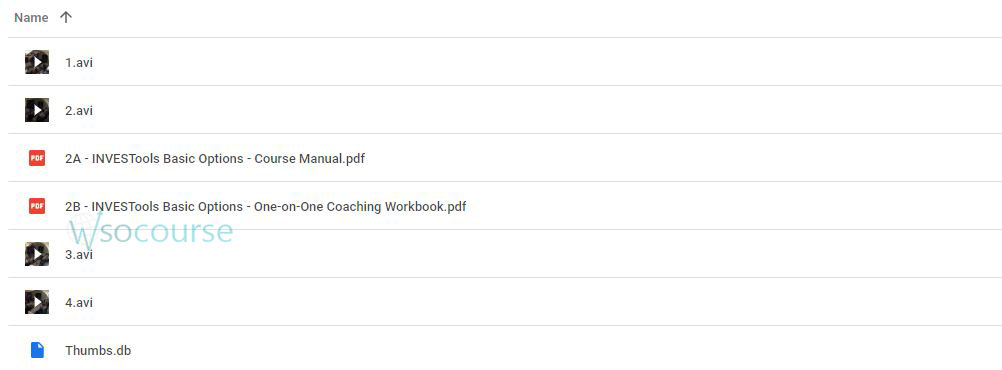

Content Proof: Watch Here!

You may check content proof of “Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew” below:

Basic Options Course: Cash Flow, Diversification, and Flexibility with Michael Drew

Introduction

Welcome to the world of options trading! This course, led by Michael Drew, is designed to introduce you to the principles of cash flow, diversification, and flexibility through options trading. Let’s explore how these elements can enhance your investment strategy.

Who is Michael Drew?

Michael Drew is a seasoned options trader and educator known for simplifying complex financial concepts for his students.

Expertise and Experience

Drew brings years of trading experience and a passion for teaching to help you understand the nuances of the options market.

Understanding Options Trading

What Are Options?

Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific period.

Types of Options

- Call Options

- Put Options

The Role of Cash Flow in Options Trading

Generating Regular Income

Discover how selling options can create regular income streams from the premiums collected.

Cash Flow Strategies

- Covered calls

- Cash-secured puts

Diversification through Options

Reducing Portfolio Risk

Learn how options can help diversify your investment portfolio and reduce risk.

Diversification Techniques

- Protective puts

- Using options on different asset classes

Flexibility in Trading Strategies

Adapting to Market Conditions

Options allow you to adjust your positions based on changing market conditions for greater control over your investments.

Examples of Flexible Strategies

- Straddles

- Strangles

Key Benefits of Options Trading

Why Choose Options?

Understand the unique advantages options trading offers, from leverage to hedging capabilities.

Benefits Overview

- Leverage

- Hedging

- Speculation

Setting Up Your Options Trading Account

Choosing the Right Broker

Tips for selecting a broker that suits your options trading needs.

Considerations

- Commission fees

- Platform tools and features

Fundamental Analysis for Options Traders

Evaluating Underlying Assets

Learn how to assess the stocks or other assets underlying the options you trade.

Analysis Techniques

- Financial statement analysis

- Market sentiment

Technical Analysis in Options Trading

Charting and Patterns

Use technical analysis to make informed decisions about when to enter and exit options trades.

Key Indicators

- Moving averages

- Volume

Risk Management Strategies

Protecting Your Investments

Effective risk management techniques are crucial in options trading to protect your capital.

Risk Management Tools

- Stop-loss orders

- Position sizing

Options Trading Mistakes to Avoid

Common Pitfalls

Identify and learn how to avoid the most common mistakes made by new options traders.

Typical Errors

- Overleveraging

- Ignoring exit strategies

Advanced Options Strategies

For the Experienced Trader

Once you’ve mastered the basics, explore more complex strategies to enhance your trading performance.

Advanced Tactics

- Iron condors

- Butterfly spreads

Conclusion

Starting your journey in options trading with Michael Drew provides a solid foundation in understanding cash flow, diversification, and flexibility. These skills are essential for anyone looking to enhance their trading strategy and financial well-being.

The Path Forward

With the knowledge gained from this course, you’re well-prepared to tackle the options market with confidence and skill.

FAQs

- How much money do I need to start options trading?

- You can start with a relatively small amount of capital, often a few hundred dollars, depending on the broker’s requirements.

- Is options trading suitable for beginners?

- While options trading can be complex, starting with a basic understanding and gradually advancing can make it suitable for beginners.

- How long does it take to learn options trading?

- The basics can be grasped within a few weeks, but becoming proficient may take several months of practice.

- Can options trading be done part-time?

- Yes, options trading is flexible enough to be pursued on a part-time basis, especially strategies that do not require constant market monitoring.

- What is the best way to continue learning about options trading?

- Continuously educate yourself through courses, seminars, and staying updated with financial news and trends.

Be the first to review “Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.