-

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

JJ Dream Team Workshop Training Full Course

1 × $55.00

JJ Dream Team Workshop Training Full Course

1 × $55.00 -

×

Options Masterclass with WallStreet Trapper

1 × $13.00

Options Masterclass with WallStreet Trapper

1 × $13.00 -

×

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

FX Goat 4.0 Course

1 × $27.00

FX Goat 4.0 Course

1 × $27.00 -

×

Forex Libra Code Software

1 × $31.00

Forex Libra Code Software

1 × $31.00 -

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

Price Action Trading 101 By Steve Burns

1 × $15.00

Price Action Trading 101 By Steve Burns

1 × $15.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00 -

×

Emini Strategy #6 with Steve Primo

1 × $39.00

Emini Strategy #6 with Steve Primo

1 × $39.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

MotiveWave Course with Todd Gordon

1 × $23.00

MotiveWave Course with Todd Gordon

1 × $23.00 -

×

SOT Advanced Course (May 2014)

1 × $23.00

SOT Advanced Course (May 2014)

1 × $23.00 -

×

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00 -

×

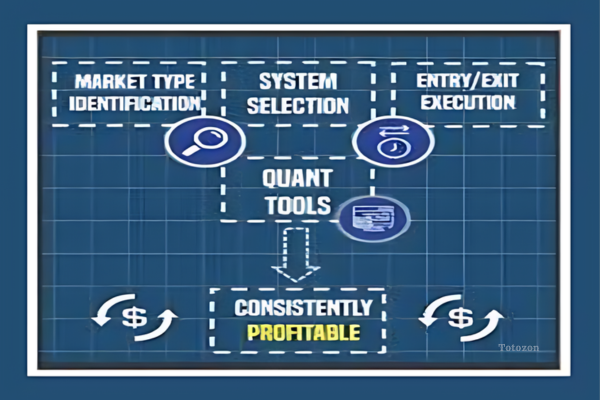

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Cashing in on Covered Calls Cash DVD

1 × $6.00

Cashing in on Covered Calls Cash DVD

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00 -

×

Fundamentals of Algorithmic Trading

1 × $23.00

Fundamentals of Algorithmic Trading

1 × $23.00 -

×

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00 -

×

Shecantrade – Day Trading Options

1 × $23.00

Shecantrade – Day Trading Options

1 × $23.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

Trend Harmony with Murray Ruggiero

1 × $15.00

Trend Harmony with Murray Ruggiero

1 × $15.00 -

×

Edges For Ledges 2 with Trader Dante

1 × $5.00

Edges For Ledges 2 with Trader Dante

1 × $5.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

ChartEngineers Course

1 × $5.00

ChartEngineers Course

1 × $5.00 -

×

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00 -

×

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Option Trader’s Handbook (2008) with Jeff Augen

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

The Option Trader’s Handbook (2008) with Jeff Augen

Options trading can be a complex yet rewarding endeavor, and Jeff Augen’s “The Option Trader’s Handbook” provides traders with a comprehensive guide to mastering this intricate field. In this article, we explore the key concepts and strategies from Augen’s 2008 handbook, offering insights and actionable steps for both novice and experienced traders.

Understanding Options Trading

What is Options Trading?

Options trading involves buying and selling options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price before a certain date.

Importance of Options Trading

Options trading allows investors to hedge against market risks, speculate on price movements, and generate income through premiums.

Key Concepts from The Option Trader’s Handbook

Time Decay

Time decay, or theta, is the reduction in the value of an options contract as it approaches expiration. Understanding time decay is crucial for successful options trading.

Volatility

Volatility measures the price fluctuations of an underlying asset. High volatility increases options premiums, providing opportunities for traders to profit.

Greeks

The Greeks are metrics that measure various factors affecting options pricing. Key Greeks include delta, gamma, theta, vega, and rho.

Strategies from The Option Trader’s Handbook

The Importance of Strategy

Having a well-defined strategy is essential for successful options trading. Jeff Augen emphasizes the need for discipline and precision.

1. Covered Call Strategy

The covered call strategy involves holding a long position in a stock while selling call options on the same stock. This generates income through premiums while providing some downside protection.

2. Protective Put Strategy

The protective put strategy involves buying put options on a stock that you already own. This acts as an insurance policy against a decline in the stock’s price.

3. Iron Condor Strategy

The iron condor strategy involves selling a lower-strike put and a higher-strike call while buying further out-of-the-money put and call options. This strategy profits from low volatility within a specific price range.

4. Straddle and Strangle Strategies

- Straddle: Buying both a call and a put option at the same strike price and expiration date to profit from significant price movements in either direction.

- Strangle: Similar to a straddle but with different strike prices for the call and put options.

Implementing Options Trading Strategies

Step-by-Step Guide

1. Develop a Trading Plan

A solid trading plan includes defined entry and exit points, risk management rules, and a clear strategy. Sticking to your plan helps avoid emotional decision-making.

2. Use Technical Analysis

Technical analysis is crucial for options trading. Utilize charts, indicators, and patterns to identify trading opportunities.

3. Monitor Market News

Stay updated with market news and events that can impact price movements. Economic reports, company earnings, and geopolitical events can create trading opportunities.

4. Set Realistic Goals

Set achievable profit targets and risk levels for each trade. Avoid the temptation to chase unrealistic returns, which can lead to excessive risk-taking.

5. Practice with a Demo Account

Before trading with real money, practice your strategies in a demo account. This allows you to refine your approach without financial risk.

Tools for Options Traders

Charting Software

Invest in reliable charting software that provides real-time data and advanced technical analysis tools.

Trading Platform

Choose a trading platform with fast execution speeds and low latency. This ensures your orders are executed quickly, reducing slippage.

Economic Calendars

Use economic calendars to keep track of important events and announcements that can influence market volatility.

Advantages of Options Trading

Leverage

Options provide leverage, enabling traders to control larger positions with a relatively small investment.

Flexibility

Options trading offers flexibility, allowing traders to adapt their strategies based on market conditions.

Hedging

Options can be used to hedge against potential losses in other investments, providing a safety net in volatile markets.

Challenges of Options Trading

Complexity

Options trading can be complex and requires a deep understanding of various factors affecting options pricing.

Risk Management

Effective risk management is crucial as options trading involves higher risk due to leverage and market volatility.

Market Sensitivity

Options trading is highly sensitive to market conditions. Traders need to stay informed and be prepared to adjust their strategies.

Conclusion

Jeff Augen’s “The Option Trader’s Handbook” provides valuable insights and strategies for mastering options trading. By understanding and implementing these strategies, traders can enhance their chances of success in the options market. Remember, effective risk management and continuous learning are key to thriving in this complex field.

FAQs

1. What is the main focus of The Option Trader’s Handbook?

The main focus is on providing comprehensive strategies and insights for successful options trading.

2. How important is time decay in options trading?

Time decay is crucial as it affects the value of options contracts as they approach expiration.

3. What are some common strategies covered in the book?

Common strategies include covered calls, protective puts, iron condors, and straddles/strangles.

4. How can options be used for hedging?

Options can be used to hedge against potential losses in other investments, providing a safety net in volatile markets.

5. What tools are essential for successful options trading?

Essential tools include reliable charting software, a fast trading platform, and economic calendars to track market-moving events.

Be the first to review “The Option Trader’s Handbook (2008) with Jeff Augen” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.