-

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

24-Hour Un-Education Trading Course

1 × $54.00

24-Hour Un-Education Trading Course

1 × $54.00 -

×

10x Trade Formula Master Collection

1 × $54.00

10x Trade Formula Master Collection

1 × $54.00 -

×

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

Sensitivity Analysis in Practice

1 × $6.00

Sensitivity Analysis in Practice

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading

$597.00 Original price was: $597.00.$69.00Current price is: $69.00.

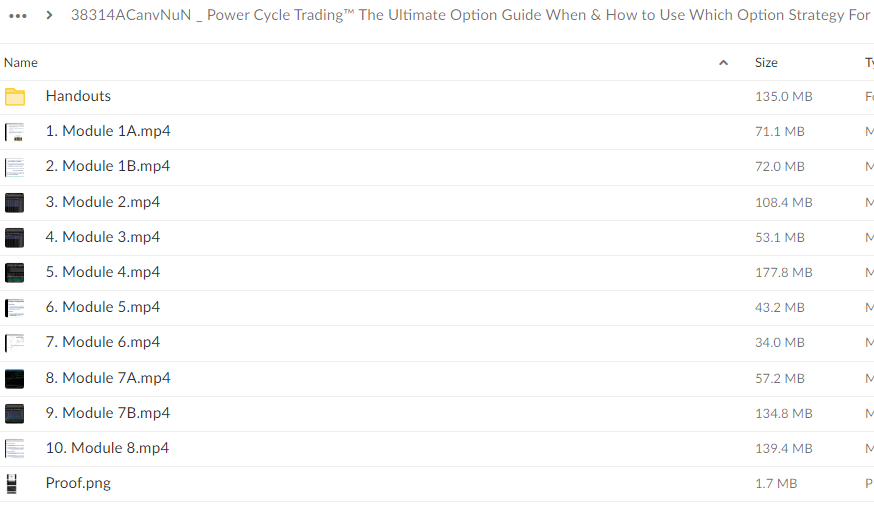

File Size: 1.00 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” below:

Unlocking the Power of Options Trading: Your Ultimate Guide

In the fast-paced world of options trading, having a solid understanding of different option strategies can make all the difference between success and failure. This guide, brought to you by Power Cycle Trading, aims to demystify options trading and provide you with the knowledge and tools needed to navigate the markets effectively.

Understanding Options Trading

What Are Options?

Options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame.

Why Trade Options?

Options offer traders the opportunity to profit from market movements with limited risk, making them an attractive instrument for both speculators and hedgers.

The Power Cycle Approach to Options Trading

At Power Cycle Trading, we believe in harnessing the power of market cycles to identify high-probability trading opportunities. Our approach to options trading is based on the following principles:

1. Understanding Market Cycles

- We analyze market cycles to identify key turning points and trends, allowing us to enter trades at optimal times.

2. Selecting the Right Option Strategy

- Different market conditions call for different option strategies. We teach traders how to choose the right strategy based on market direction, volatility, and risk tolerance.

3. Risk Management

- We emphasize the importance of risk management in options trading, helping traders protect their capital and minimize losses.

The Ultimate Option Guide: When & How to Use Which Option Strategy

Options trading can be complex, with numerous strategies available to traders. In our Ultimate Option Guide, we break down the various option strategies and provide guidance on when and how to use them for the best results.

1. Covered Calls

- Ideal for generating income on stocks you already own, covered calls involve selling call options against your stock holdings.

2. Protective Puts

- Protective puts are used to hedge against potential downside risk in a stock position. They involve buying put options to protect against losses.

3. Straddles and Strangles

- Straddles and strangles are volatility strategies used to profit from significant price movements, regardless of market direction.

4. Iron Condors

- Iron condors are neutral strategies used to profit from sideways or range-bound markets, combining both put and call options.

5. Butterfly Spreads

- Butterfly spreads are directional strategies used to profit from a narrow range of price movement, involving the simultaneous purchase and sale of multiple options.

Conclusion

Options trading offers traders a versatile and flexible way to profit from the financial markets. By understanding the different option strategies and knowing when to use them, traders can maximize their potential for success. With the Ultimate Option Guide from Power Cycle Trading, you’ll have all the tools you need to take your options trading to the next level.

FAQs

1. Can beginners trade options using the Ultimate Option Guide?

Yes, the Ultimate Option Guide is suitable for traders of all experience levels, providing comprehensive guidance on different option strategies.

2. How can I access the Ultimate Option Guide?

The Ultimate Option Guide is available for purchase on the Power Cycle Trading website, along with other educational resources and tools.

3. Are there any prerequisites for using the Ultimate Option Guide?

No prior knowledge of options trading is required to benefit from the Ultimate Option Guide. It is designed to be accessible to traders of all backgrounds.

4. Does the Ultimate Option Guide provide ongoing support and updates?

Yes, purchasers of the Ultimate Option Guide receive access to ongoing support and updates, ensuring they stay up-to-date with the latest developments in options trading.

5. Can I use the strategies outlined in the Ultimate Option Guide for day trading?

While some strategies may be suitable for day trading, others are better suited for longer-term trading. The Ultimate Option Guide provides guidance on selecting the right strategy based on your trading style and objectives.

Be the first to review “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” Cancel reply

You must be logged in to post a review.

Related products

Others

Others

Reviews

There are no reviews yet.