-

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

Get Rich with Dividends

1 × $6.00

Get Rich with Dividends

1 × $6.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

Gillen Predicts with Jack Gillen

1 × $6.00

Gillen Predicts with Jack Gillen

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Five Trading Trends of 2005 with Dan Denning

1 × $6.00

Five Trading Trends of 2005 with Dan Denning

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Advanced Group Analysis Turorial with David Vomund

1 × $6.00

Advanced Group Analysis Turorial with David Vomund

1 × $6.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

SRC (Smart Raja Concepts) with Forex 101

1 × $5.00

SRC (Smart Raja Concepts) with Forex 101

1 × $5.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

Scientific Trading Machine with Nicola Delic

1 × $54.00

Scientific Trading Machine with Nicola Delic

1 × $54.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

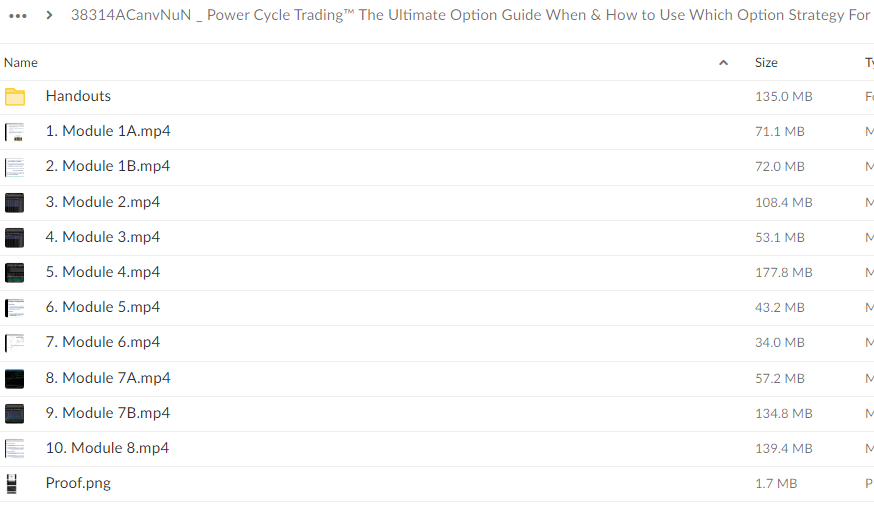

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading

$597.00 Original price was: $597.00.$69.00Current price is: $69.00.

File Size: 1.00 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” below:

Unlocking the Power of Options Trading: Your Ultimate Guide

In the fast-paced world of options trading, having a solid understanding of different option strategies can make all the difference between success and failure. This guide, brought to you by Power Cycle Trading, aims to demystify options trading and provide you with the knowledge and tools needed to navigate the markets effectively.

Understanding Options Trading

What Are Options?

Options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame.

Why Trade Options?

Options offer traders the opportunity to profit from market movements with limited risk, making them an attractive instrument for both speculators and hedgers.

The Power Cycle Approach to Options Trading

At Power Cycle Trading, we believe in harnessing the power of market cycles to identify high-probability trading opportunities. Our approach to options trading is based on the following principles:

1. Understanding Market Cycles

- We analyze market cycles to identify key turning points and trends, allowing us to enter trades at optimal times.

2. Selecting the Right Option Strategy

- Different market conditions call for different option strategies. We teach traders how to choose the right strategy based on market direction, volatility, and risk tolerance.

3. Risk Management

- We emphasize the importance of risk management in options trading, helping traders protect their capital and minimize losses.

The Ultimate Option Guide: When & How to Use Which Option Strategy

Options trading can be complex, with numerous strategies available to traders. In our Ultimate Option Guide, we break down the various option strategies and provide guidance on when and how to use them for the best results.

1. Covered Calls

- Ideal for generating income on stocks you already own, covered calls involve selling call options against your stock holdings.

2. Protective Puts

- Protective puts are used to hedge against potential downside risk in a stock position. They involve buying put options to protect against losses.

3. Straddles and Strangles

- Straddles and strangles are volatility strategies used to profit from significant price movements, regardless of market direction.

4. Iron Condors

- Iron condors are neutral strategies used to profit from sideways or range-bound markets, combining both put and call options.

5. Butterfly Spreads

- Butterfly spreads are directional strategies used to profit from a narrow range of price movement, involving the simultaneous purchase and sale of multiple options.

Conclusion

Options trading offers traders a versatile and flexible way to profit from the financial markets. By understanding the different option strategies and knowing when to use them, traders can maximize their potential for success. With the Ultimate Option Guide from Power Cycle Trading, you’ll have all the tools you need to take your options trading to the next level.

FAQs

1. Can beginners trade options using the Ultimate Option Guide?

Yes, the Ultimate Option Guide is suitable for traders of all experience levels, providing comprehensive guidance on different option strategies.

2. How can I access the Ultimate Option Guide?

The Ultimate Option Guide is available for purchase on the Power Cycle Trading website, along with other educational resources and tools.

3. Are there any prerequisites for using the Ultimate Option Guide?

No prior knowledge of options trading is required to benefit from the Ultimate Option Guide. It is designed to be accessible to traders of all backgrounds.

4. Does the Ultimate Option Guide provide ongoing support and updates?

Yes, purchasers of the Ultimate Option Guide receive access to ongoing support and updates, ensuring they stay up-to-date with the latest developments in options trading.

5. Can I use the strategies outlined in the Ultimate Option Guide for day trading?

While some strategies may be suitable for day trading, others are better suited for longer-term trading. The Ultimate Option Guide provides guidance on selecting the right strategy based on your trading style and objectives.

Be the first to review “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” Cancel reply

You must be logged in to post a review.

Related products

Others

Others

Others

Reviews

There are no reviews yet.