-

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

OilTradingAcademy - Oil Trading Academy Code 1 + 2 + 3 Video Course

1 × $6.00

OilTradingAcademy - Oil Trading Academy Code 1 + 2 + 3 Video Course

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Finserv Corp Complete Course

1 × $4.00

Finserv Corp Complete Course

1 × $4.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

Sensitivity Analysis in Practice

1 × $6.00

Sensitivity Analysis in Practice

1 × $6.00 -

×

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Romeo’s University of Turtle Soup with Romeo

1 × $6.00

Romeo’s University of Turtle Soup with Romeo

1 × $6.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00 -

×

EFT – The Art of Delivery with Gary Craig

1 × $5.00

EFT – The Art of Delivery with Gary Craig

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Profiletraders - MARKET PROFILE TACTICAL STRATEGIES FOR DAY TRADING

1 × $23.00

Profiletraders - MARKET PROFILE TACTICAL STRATEGIES FOR DAY TRADING

1 × $23.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Pivotboss Masters - Become Elite

1 × $5.00

Pivotboss Masters - Become Elite

1 × $5.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading

$597.00 Original price was: $597.00.$69.00Current price is: $69.00.

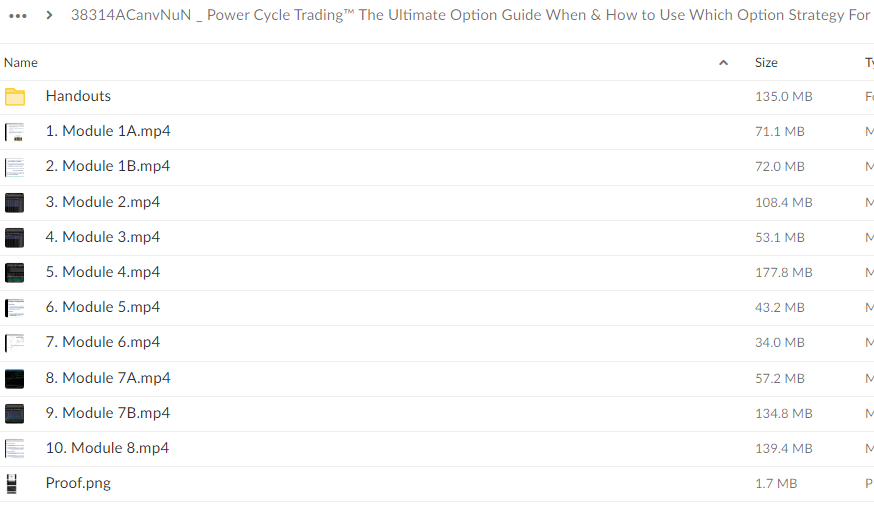

File Size: 1.00 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” below:

Unlocking the Power of Options Trading: Your Ultimate Guide

In the fast-paced world of options trading, having a solid understanding of different option strategies can make all the difference between success and failure. This guide, brought to you by Power Cycle Trading, aims to demystify options trading and provide you with the knowledge and tools needed to navigate the markets effectively.

Understanding Options Trading

What Are Options?

Options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame.

Why Trade Options?

Options offer traders the opportunity to profit from market movements with limited risk, making them an attractive instrument for both speculators and hedgers.

The Power Cycle Approach to Options Trading

At Power Cycle Trading, we believe in harnessing the power of market cycles to identify high-probability trading opportunities. Our approach to options trading is based on the following principles:

1. Understanding Market Cycles

- We analyze market cycles to identify key turning points and trends, allowing us to enter trades at optimal times.

2. Selecting the Right Option Strategy

- Different market conditions call for different option strategies. We teach traders how to choose the right strategy based on market direction, volatility, and risk tolerance.

3. Risk Management

- We emphasize the importance of risk management in options trading, helping traders protect their capital and minimize losses.

The Ultimate Option Guide: When & How to Use Which Option Strategy

Options trading can be complex, with numerous strategies available to traders. In our Ultimate Option Guide, we break down the various option strategies and provide guidance on when and how to use them for the best results.

1. Covered Calls

- Ideal for generating income on stocks you already own, covered calls involve selling call options against your stock holdings.

2. Protective Puts

- Protective puts are used to hedge against potential downside risk in a stock position. They involve buying put options to protect against losses.

3. Straddles and Strangles

- Straddles and strangles are volatility strategies used to profit from significant price movements, regardless of market direction.

4. Iron Condors

- Iron condors are neutral strategies used to profit from sideways or range-bound markets, combining both put and call options.

5. Butterfly Spreads

- Butterfly spreads are directional strategies used to profit from a narrow range of price movement, involving the simultaneous purchase and sale of multiple options.

Conclusion

Options trading offers traders a versatile and flexible way to profit from the financial markets. By understanding the different option strategies and knowing when to use them, traders can maximize their potential for success. With the Ultimate Option Guide from Power Cycle Trading, you’ll have all the tools you need to take your options trading to the next level.

FAQs

1. Can beginners trade options using the Ultimate Option Guide?

Yes, the Ultimate Option Guide is suitable for traders of all experience levels, providing comprehensive guidance on different option strategies.

2. How can I access the Ultimate Option Guide?

The Ultimate Option Guide is available for purchase on the Power Cycle Trading website, along with other educational resources and tools.

3. Are there any prerequisites for using the Ultimate Option Guide?

No prior knowledge of options trading is required to benefit from the Ultimate Option Guide. It is designed to be accessible to traders of all backgrounds.

4. Does the Ultimate Option Guide provide ongoing support and updates?

Yes, purchasers of the Ultimate Option Guide receive access to ongoing support and updates, ensuring they stay up-to-date with the latest developments in options trading.

5. Can I use the strategies outlined in the Ultimate Option Guide for day trading?

While some strategies may be suitable for day trading, others are better suited for longer-term trading. The Ultimate Option Guide provides guidance on selecting the right strategy based on your trading style and objectives.

Be the first to review “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” Cancel reply

You must be logged in to post a review.

Related products

Others

Others

Others

Reviews

There are no reviews yet.