-

×

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

The Master Indicator 2023 with Lance Ippolito

1 × $101.00

The Master Indicator 2023 with Lance Ippolito

1 × $101.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Security Analysis Sixth Edition, Foreword by Warren Buffett with Benjamin Graham, David Dodd

1 × $6.00

Security Analysis Sixth Edition, Foreword by Warren Buffett with Benjamin Graham, David Dodd

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

SMT FX Trading

1 × $5.00

SMT FX Trading

1 × $5.00 -

×

SOT Advanced Course (May 2014)

1 × $23.00

SOT Advanced Course (May 2014)

1 × $23.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

Self-Destructing Trader with Ryan Jonesc

1 × $6.00

Self-Destructing Trader with Ryan Jonesc

1 × $6.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading

$597.00 Original price was: $597.00.$69.00Current price is: $69.00.

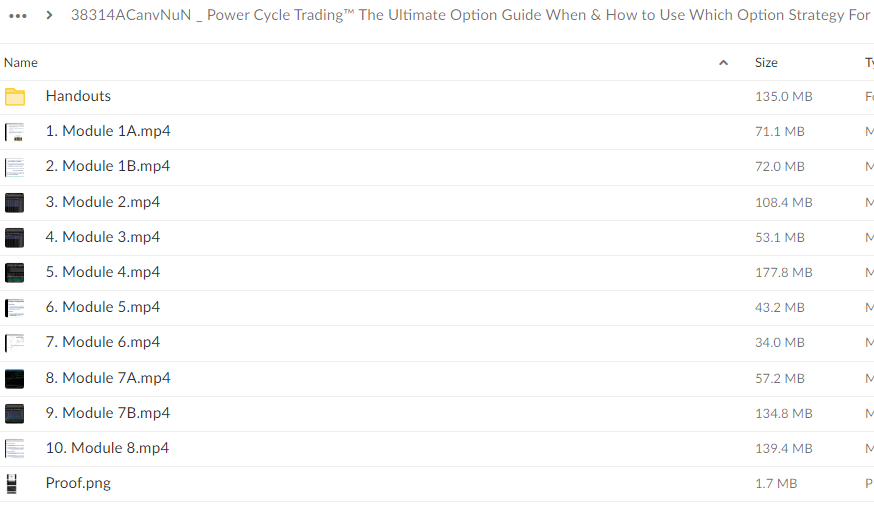

File Size: 1.00 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” below:

Unlocking the Power of Options Trading: Your Ultimate Guide

In the fast-paced world of options trading, having a solid understanding of different option strategies can make all the difference between success and failure. This guide, brought to you by Power Cycle Trading, aims to demystify options trading and provide you with the knowledge and tools needed to navigate the markets effectively.

Understanding Options Trading

What Are Options?

Options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame.

Why Trade Options?

Options offer traders the opportunity to profit from market movements with limited risk, making them an attractive instrument for both speculators and hedgers.

The Power Cycle Approach to Options Trading

At Power Cycle Trading, we believe in harnessing the power of market cycles to identify high-probability trading opportunities. Our approach to options trading is based on the following principles:

1. Understanding Market Cycles

- We analyze market cycles to identify key turning points and trends, allowing us to enter trades at optimal times.

2. Selecting the Right Option Strategy

- Different market conditions call for different option strategies. We teach traders how to choose the right strategy based on market direction, volatility, and risk tolerance.

3. Risk Management

- We emphasize the importance of risk management in options trading, helping traders protect their capital and minimize losses.

The Ultimate Option Guide: When & How to Use Which Option Strategy

Options trading can be complex, with numerous strategies available to traders. In our Ultimate Option Guide, we break down the various option strategies and provide guidance on when and how to use them for the best results.

1. Covered Calls

- Ideal for generating income on stocks you already own, covered calls involve selling call options against your stock holdings.

2. Protective Puts

- Protective puts are used to hedge against potential downside risk in a stock position. They involve buying put options to protect against losses.

3. Straddles and Strangles

- Straddles and strangles are volatility strategies used to profit from significant price movements, regardless of market direction.

4. Iron Condors

- Iron condors are neutral strategies used to profit from sideways or range-bound markets, combining both put and call options.

5. Butterfly Spreads

- Butterfly spreads are directional strategies used to profit from a narrow range of price movement, involving the simultaneous purchase and sale of multiple options.

Conclusion

Options trading offers traders a versatile and flexible way to profit from the financial markets. By understanding the different option strategies and knowing when to use them, traders can maximize their potential for success. With the Ultimate Option Guide from Power Cycle Trading, you’ll have all the tools you need to take your options trading to the next level.

FAQs

1. Can beginners trade options using the Ultimate Option Guide?

Yes, the Ultimate Option Guide is suitable for traders of all experience levels, providing comprehensive guidance on different option strategies.

2. How can I access the Ultimate Option Guide?

The Ultimate Option Guide is available for purchase on the Power Cycle Trading website, along with other educational resources and tools.

3. Are there any prerequisites for using the Ultimate Option Guide?

No prior knowledge of options trading is required to benefit from the Ultimate Option Guide. It is designed to be accessible to traders of all backgrounds.

4. Does the Ultimate Option Guide provide ongoing support and updates?

Yes, purchasers of the Ultimate Option Guide receive access to ongoing support and updates, ensuring they stay up-to-date with the latest developments in options trading.

5. Can I use the strategies outlined in the Ultimate Option Guide for day trading?

While some strategies may be suitable for day trading, others are better suited for longer-term trading. The Ultimate Option Guide provides guidance on selecting the right strategy based on your trading style and objectives.

Be the first to review “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” Cancel reply

You must be logged in to post a review.

Related products

Others

Reviews

There are no reviews yet.