-

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Secrets of Great Investors (Audio Book 471 MB) with Louis Rukeyser

1 × $6.00

Secrets of Great Investors (Audio Book 471 MB) with Louis Rukeyser

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

George Bayer Squarring the Circle for Excel

1 × $6.00

George Bayer Squarring the Circle for Excel

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

MT4 High Probability Forex Trading Method

1 × $6.00

MT4 High Probability Forex Trading Method

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading

$597.00 Original price was: $597.00.$69.00Current price is: $69.00.

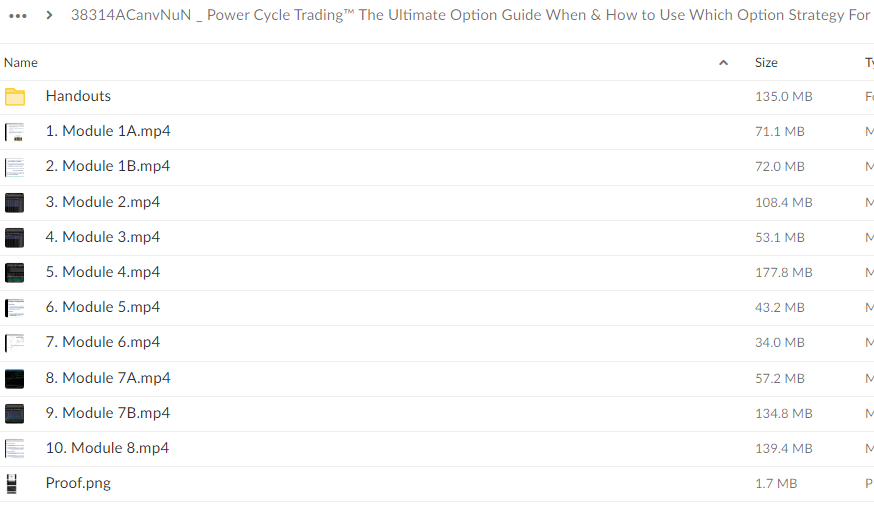

File Size: 1.00 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” below:

Unlocking the Power of Options Trading: Your Ultimate Guide

In the fast-paced world of options trading, having a solid understanding of different option strategies can make all the difference between success and failure. This guide, brought to you by Power Cycle Trading, aims to demystify options trading and provide you with the knowledge and tools needed to navigate the markets effectively.

Understanding Options Trading

What Are Options?

Options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame.

Why Trade Options?

Options offer traders the opportunity to profit from market movements with limited risk, making them an attractive instrument for both speculators and hedgers.

The Power Cycle Approach to Options Trading

At Power Cycle Trading, we believe in harnessing the power of market cycles to identify high-probability trading opportunities. Our approach to options trading is based on the following principles:

1. Understanding Market Cycles

- We analyze market cycles to identify key turning points and trends, allowing us to enter trades at optimal times.

2. Selecting the Right Option Strategy

- Different market conditions call for different option strategies. We teach traders how to choose the right strategy based on market direction, volatility, and risk tolerance.

3. Risk Management

- We emphasize the importance of risk management in options trading, helping traders protect their capital and minimize losses.

The Ultimate Option Guide: When & How to Use Which Option Strategy

Options trading can be complex, with numerous strategies available to traders. In our Ultimate Option Guide, we break down the various option strategies and provide guidance on when and how to use them for the best results.

1. Covered Calls

- Ideal for generating income on stocks you already own, covered calls involve selling call options against your stock holdings.

2. Protective Puts

- Protective puts are used to hedge against potential downside risk in a stock position. They involve buying put options to protect against losses.

3. Straddles and Strangles

- Straddles and strangles are volatility strategies used to profit from significant price movements, regardless of market direction.

4. Iron Condors

- Iron condors are neutral strategies used to profit from sideways or range-bound markets, combining both put and call options.

5. Butterfly Spreads

- Butterfly spreads are directional strategies used to profit from a narrow range of price movement, involving the simultaneous purchase and sale of multiple options.

Conclusion

Options trading offers traders a versatile and flexible way to profit from the financial markets. By understanding the different option strategies and knowing when to use them, traders can maximize their potential for success. With the Ultimate Option Guide from Power Cycle Trading, you’ll have all the tools you need to take your options trading to the next level.

FAQs

1. Can beginners trade options using the Ultimate Option Guide?

Yes, the Ultimate Option Guide is suitable for traders of all experience levels, providing comprehensive guidance on different option strategies.

2. How can I access the Ultimate Option Guide?

The Ultimate Option Guide is available for purchase on the Power Cycle Trading website, along with other educational resources and tools.

3. Are there any prerequisites for using the Ultimate Option Guide?

No prior knowledge of options trading is required to benefit from the Ultimate Option Guide. It is designed to be accessible to traders of all backgrounds.

4. Does the Ultimate Option Guide provide ongoing support and updates?

Yes, purchasers of the Ultimate Option Guide receive access to ongoing support and updates, ensuring they stay up-to-date with the latest developments in options trading.

5. Can I use the strategies outlined in the Ultimate Option Guide for day trading?

While some strategies may be suitable for day trading, others are better suited for longer-term trading. The Ultimate Option Guide provides guidance on selecting the right strategy based on your trading style and objectives.

Be the first to review “Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results – Powercycletrading” Cancel reply

You must be logged in to post a review.

Related products

Others

Reviews

There are no reviews yet.