-

×

Random Walk Trading - J.L.Lord - Option Greeks for Profit

1 × $15.00

Random Walk Trading - J.L.Lord - Option Greeks for Profit

1 × $15.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

International Assignments with Linda K.Stroh

1 × $6.00

International Assignments with Linda K.Stroh

1 × $6.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00 -

×

The Unified Theory of Markets with Earik Beann

1 × $78.00

The Unified Theory of Markets with Earik Beann

1 × $78.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The TLM Playbook 2022 with Trade Like Mike

1 × $39.00

The TLM Playbook 2022 with Trade Like Mike

1 × $39.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00 -

×

Transparent FX Course

1 × $6.00

Transparent FX Course

1 × $6.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

FX SpeedRunner

1 × $5.00

FX SpeedRunner

1 × $5.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Money Management Strategies for Futures Traders with Nauzer Balsara

1 × $6.00

Money Management Strategies for Futures Traders with Nauzer Balsara

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Complete Course (Lectures 1-6) - Selling Options for Profits with Rodrigo Santano - Top Trader Academy

1 × $23.00

Complete Course (Lectures 1-6) - Selling Options for Profits with Rodrigo Santano - Top Trader Academy

1 × $23.00 -

×

Learn Forex Cash Bomb

1 × $6.00

Learn Forex Cash Bomb

1 × $6.00 -

×

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Spotting Big Money with Market Profile with John Kepler

1 × $23.00

Spotting Big Money with Market Profile with John Kepler

1 × $23.00 -

×

Calendar Spreads with Todd Mitchell

1 × $31.00

Calendar Spreads with Todd Mitchell

1 × $31.00 -

×

The Value Connection with Marc Gerstein

1 × $5.00

The Value Connection with Marc Gerstein

1 × $5.00 -

×

Winning on the Stock Market with Brian J.Millard

1 × $6.00

Winning on the Stock Market with Brian J.Millard

1 × $6.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market with Gil Morales

1 × $6.00

Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market with Gil Morales

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Elliott Wave Street Course with Juan Maldonado

1 × $17.00

Elliott Wave Street Course with Juan Maldonado

1 × $17.00 -

×

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00 -

×

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00 -

×

Claytrader - Risk vs Reward Trading

1 × $23.00

Claytrader - Risk vs Reward Trading

1 × $23.00 -

×

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00 -

×

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00 -

×

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Self - Paced Course with Andrew Menaker

1 × $17.00

Self - Paced Course with Andrew Menaker

1 × $17.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00 -

×

The Silver Edge Forex Training Program with T3 Live

1 × $5.00

The Silver Edge Forex Training Program with T3 Live

1 × $5.00 -

×

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00 -

×

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

Trade with Precision Price Action Course Silver+Bronze By Nick McDonald

1 × $116.00

Trade with Precision Price Action Course Silver+Bronze By Nick McDonald

1 × $116.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00 -

×

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

The WWA Bootcamp

1 × $7.00

The WWA Bootcamp

1 × $7.00 -

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

TTM Squeeze Clone for eSignal

1 × $6.00

TTM Squeeze Clone for eSignal

1 × $6.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00 -

×

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

Stock Speculation (Volume I & II) with Joseph A.Wyler

1 × $4.00

Stock Speculation (Volume I & II) with Joseph A.Wyler

1 × $4.00 -

×

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00 -

×

Trading Hub 3.0 (Ebook)

1 × $6.00

Trading Hub 3.0 (Ebook)

1 × $6.00 -

×

Intermarket Analysis with John Murphy

1 × $6.00

Intermarket Analysis with John Murphy

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00 -

×

Tradeonix Trading System

1 × $31.00

Tradeonix Trading System

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Time Factors in the Stock Market

1 × $6.00

Time Factors in the Stock Market

1 × $6.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

Supreme Ecom Blueprint - Updated 2020

1 × $31.00

Supreme Ecom Blueprint - Updated 2020

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Astro FX 2.0

1 × $6.00

Astro FX 2.0

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00 -

×

Trading Techniques 2008 - One Day Workshop Manual

1 × $6.00

Trading Techniques 2008 - One Day Workshop Manual

1 × $6.00 -

×

The Options Course Workbook: Step-by-Step Exercises and Tests to Help You Master the Options Course - George Fontanills

1 × $6.00

The Options Course Workbook: Step-by-Step Exercises and Tests to Help You Master the Options Course - George Fontanills

1 × $6.00 -

×

Training Program

1 × $15.00

Training Program

1 × $15.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00 -

×

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

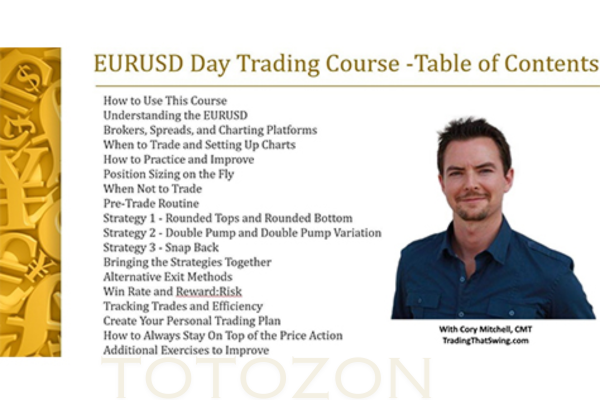

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Mastering The Markets

1 × $4.00

Mastering The Markets

1 × $4.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Zedd Monopoly Platinum

1 × $5.00

Zedd Monopoly Platinum

1 × $5.00

Option Strategies with Courtney Smith

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Option Strategies with Courtney Smith” below:

Option Strategies with Courtney Smith

Options trading can be a powerful tool for investors seeking to enhance their portfolios. Courtney Smith, a seasoned trader and author, provides invaluable insights into effective options strategies. This article delves into his methods, offering practical advice for traders at all levels.

Introduction to Options Trading

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price. Trading options can be complex, but with the right strategies, it can be highly profitable.

Who is Courtney Smith?

Courtney Smith is a renowned trader, author, and educator with extensive experience in options trading. His strategies and insights have helped many traders navigate the complexities of the options market.

The Basics of Options

Types of Options

- Call Options: Give the holder the right to buy an asset at a specific price.

- Put Options: Give the holder the right to sell an asset at a specific price.

Key Concepts

- Strike Price: The predetermined price at which an option can be exercised.

- Expiration Date: The date on which the option expires.

- Premium: The price paid for the option.

Courtney Smith’s Option Strategies

Covered Call Strategy

The covered call strategy involves holding a long position in an asset and selling call options on that same asset. This strategy generates income through premiums and provides limited downside protection.

How to Implement a Covered Call

- Buy the Underlying Asset: Purchase shares of the stock you want to write options on.

- Sell Call Options: Write call options at a strike price above the current market price.

- Collect Premiums: Earn income from the premiums received for selling the options.

Protective Put Strategy

The protective put strategy involves buying put options to hedge against potential losses in a long stock position.

Steps to Use a Protective Put

- Own the Stock: Maintain a long position in the stock.

- Buy Put Options: Purchase put options with a strike price below the current market price.

- Limit Downside Risk: The put options provide insurance against significant losses.

Straddle Strategy

The straddle strategy involves buying both a call and a put option at the same strike price and expiration date, allowing traders to profit from significant price movements in either direction.

Executing a Straddle

- Select the Underlying Asset: Choose a stock with high volatility potential.

- Buy a Call Option: Purchase a call option at the current market price.

- Buy a Put Option: Purchase a put option at the same strike price and expiration date.

Iron Condor Strategy

The iron condor strategy involves selling a lower-strike put and a higher-strike call, while simultaneously buying a higher-strike put and a lower-strike call. This strategy profits from low volatility in the underlying asset.

Implementing an Iron Condor

- Sell a Lower-Strike Put: Write a put option below the current market price.

- Buy a Higher-Strike Put: Purchase a put option at a higher strike price.

- Sell a Higher-Strike Call: Write a call option above the current market price.

- Buy a Lower-Strike Call: Purchase a call option at a lower strike price.

Risk Management in Options Trading

The Importance of Risk Management

Effective risk management is crucial in options trading to protect against significant losses and ensure long-term success.

Risk Management Techniques

- Position Sizing: Determine the amount to trade based on your account size and risk tolerance.

- Stop-Loss Orders: Set predetermined exit points to limit losses.

- Diversification: Spread your trades across different assets and strategies to reduce risk.

Courtney Smith’s Risk Management Rules

Courtney Smith emphasizes the importance of strict risk management rules to protect capital and enhance trading performance.

Developing a Trading Plan

Components of a Trading Plan

A comprehensive trading plan outlines your trading goals, strategies, risk management rules, and evaluation criteria.

Steps to Create a Trading Plan

- Define Your Goals: Set clear, achievable trading goals.

- Choose Your Strategies: Select options strategies that align with your goals and risk tolerance.

- Implement Risk Management: Establish rules for managing risk.

- Evaluate Your Performance: Regularly review your trades and adjust your plan as needed.

Practicing Options Trading

Using Demo Accounts

Before trading with real money, practice with a demo account. This allows you to test your strategies without risking your capital.

Benefits of Demo Trading

- Build Confidence: Gain experience and confidence in your trading abilities.

- Refine Strategies: Test and refine your trading strategies in a risk-free environment.

Transitioning to Live Trading

Once you are confident in your strategies, gradually transition to live trading. Start with small positions and increase your exposure as you gain experience.

Tools and Resources for Options Traders

Trading Platforms

Choosing the right trading platform is essential for successful options trading.

Popular Trading Platforms

- Thinkorswim: Known for its advanced charting tools and options analysis.

- Interactive Brokers: Offers a wide range of options trading tools and competitive commissions.

Educational Resources

Continual learning is vital for staying ahead in options trading. Utilize educational resources such as books, online courses, and webinars.

Conclusion

Courtney Smith’s option strategies provide traders with a comprehensive framework for successful options trading. By understanding the basics, applying effective strategies, and practicing diligent risk management, traders can enhance their trading performance and achieve consistent success. Embrace the insights from Courtney Smith to navigate the options market with confidence and precision.

FAQs

What are call and put options?

Call options give the holder the right to buy an asset, while put options give the holder the right to sell an asset at a predetermined price.

Who is Courtney Smith?

Courtney Smith is a renowned trader and author known for his expertise in options trading.

What is the covered call strategy?

The covered call strategy involves holding a long position in an asset and selling call options on that asset to generate income.

Why is risk management important in options trading?

Risk management helps protect your capital and minimize losses, ensuring long-term trading success.

What are some popular trading platforms for options trading?

Popular platforms include Thinkorswim and Interactive Brokers, known for their advanced tools and competitive commissions.

Be the first to review “Option Strategies with Courtney Smith” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.