-

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Learn Plan Profit – How To Trade Stocks

1 × $15.00

Learn Plan Profit – How To Trade Stocks

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How to Manage Profit and Cash Flow: Mining the Numbers for Gold with John Tracy & Tage Tracy

1 × $6.00

How to Manage Profit and Cash Flow: Mining the Numbers for Gold with John Tracy & Tage Tracy

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

The Complete Guide to Option Selling with James Cordier

1 × $6.00

The Complete Guide to Option Selling with James Cordier

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00 -

×

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Gann Course (Video & Audio 1.1 GB)

1 × $6.00

Gann Course (Video & Audio 1.1 GB)

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00 -

×

Humbled Trader Academy

1 × $5.00

Humbled Trader Academy

1 × $5.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

Forex 800k Workshop with Spartan Trader

1 × $23.00

Forex 800k Workshop with Spartan Trader

1 × $23.00 -

×

Precise Exits & Entries with Charles LeBeau

1 × $6.00

Precise Exits & Entries with Charles LeBeau

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

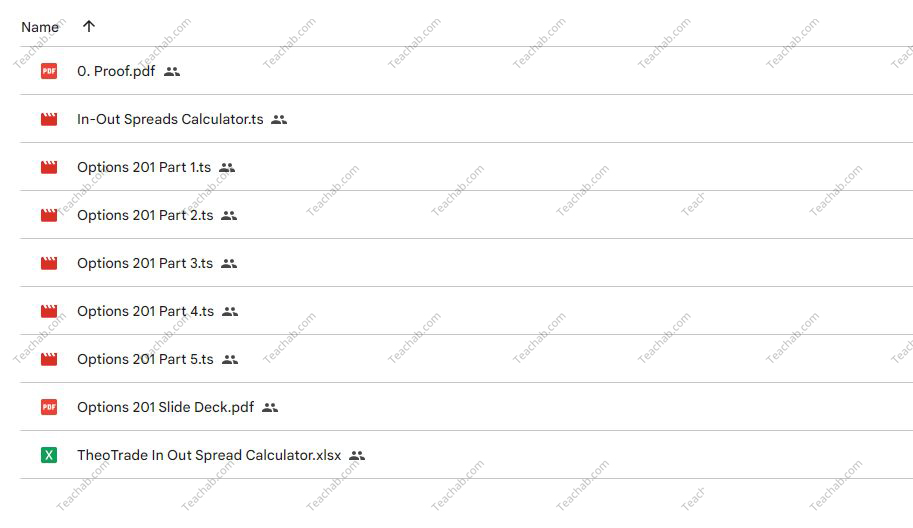

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

$150.00 Original price was: $150.00.$6.00Current price is: $6.00.

File Size: 1.48 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” below:

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

Introduction

Options trading can be complex, but with the right knowledge and strategies, it also offers significant opportunities for profit. Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” is a comprehensive five-part class designed to equip traders with advanced strategies in options trading.

Understanding Options Spreads

What Are Options Spreads?

Options spreads involve simultaneously buying and selling options of the same class to capitalize on changes in their price differentials.

Benefits of Using Spreads in Options Trading

Spreads can limit risk while providing strategic alternatives to simple buying or selling.

Vertical Spreads Explained

Introduction to Vertical Spreads

This section covers the basics of vertical spreads, including bull and bear spreads.

Setting Up a Vertical Spread

Step-by-step guide on how to set up a vertical spread, including selecting strike prices and expiration dates.

Calendar Spreads Unfolded

Understanding Calendar Spreads

Explaining the mechanics of calendar spreads and how they differ from vertical spreads.

Implementing a Calendar Spread

Detailed instructions on how to establish a calendar spread effectively.

Deciding Between Spreads

When to Use Vertical vs. Calendar Spreads

Guidance on choosing between vertical and calendar spreads based on market conditions and financial goals.

Risk Assessment for Each Spread Type

Analyzing the risk factors associated with each type of spread and strategies to mitigate them.

Trade Management Techniques

Monitoring and Adjusting Open Spreads

Tips on how to monitor and adjust spreads based on market movements to maximize profits or minimize losses.

Exit Strategies for Spreads

Best practices for exiting spread trades to protect gains or cut losses.

Leveraging Technical Analysis

Using Technical Indicators with Spreads

How to use technical indicators to enhance decision-making in trading spreads.

Chart Patterns and Spread Trading

Identifying chart patterns that signal optimal times for initiating or closing spread trades.

Risk Management in Spread Trading

Managing Downside Risk

Strategies for managing downside risks when trading spreads.

Importance of Diversification

The role of diversification in a spread trading strategy to balance risk across different assets.

Learning from the Pros

Key Takeaways from Don Kaufman

Insights and lessons learned from Don Kaufman’s extensive experience in options trading.

Success Stories

Real-world examples of successful trades using the strategies taught in the class.

Tools and Resources

Recommended Trading Platforms

Overview of the best trading platforms for executing spread trades.

Further Learning and Resources

Additional resources for those looking to deepen their understanding of options spread strategies.

Conclusion

Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” offers invaluable insights into sophisticated trading strategies that can lead to successful outcomes in options trading. By understanding and applying these strategies, traders can significantly enhance their trading skills and financial results.

FAQs

1. Who should take this class?

This class is ideal for intermediate to advanced options traders looking to expand their knowledge and refine their strategies.

2. What are the prerequisites for this class?

A basic understanding of options and some experience with options trading are recommended before taking this class.

3. How can I access the on-demand replay?

The on-demand replay is available online, allowing you to watch and learn at your convenience.

4. Can these strategies be applied in any market condition?

Yes, vertical and calendar spreads are versatile strategies that can be adjusted to suit various market conditions.

5. How important is risk management in options spread trading?

Risk management is crucial in options spread trading as it helps protect against substantial losses and ensures long-term sustainability.

Be the first to review “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.