-

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Art Of Adaptive Trading Using Market Profile & Market Delta

1 × $23.00

The Art Of Adaptive Trading Using Market Profile & Market Delta

1 × $23.00 -

×

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00 -

×

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

OilTradingAcademy - Oil Trading Academy Code 1 + 2 + 3 Video Course

1 × $6.00

OilTradingAcademy - Oil Trading Academy Code 1 + 2 + 3 Video Course

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Investing In Stocks The Complete Course! (11 Hour) with Steve Ballinger

1 × $6.00

Investing In Stocks The Complete Course! (11 Hour) with Steve Ballinger

1 × $6.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00 -

×

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00 -

×

Optimize Funding Program with Solo Network

1 × $5.00

Optimize Funding Program with Solo Network

1 × $5.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Options Foundations Class

1 × $23.00

Options Foundations Class

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Bullseye Trading Course with Ralph Garcia

1 × $39.00

Bullseye Trading Course with Ralph Garcia

1 × $39.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Full Credit Spreads with Ryan Litchfield

1 × $6.00

Full Credit Spreads with Ryan Litchfield

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

$150.00 Original price was: $150.00.$6.00Current price is: $6.00.

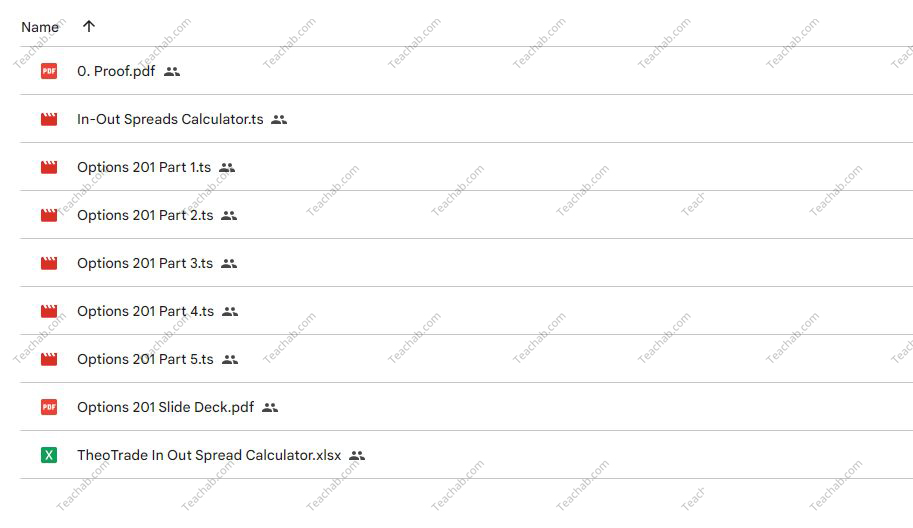

File Size: 1.48 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” below:

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

Introduction

Options trading can be complex, but with the right knowledge and strategies, it also offers significant opportunities for profit. Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” is a comprehensive five-part class designed to equip traders with advanced strategies in options trading.

Understanding Options Spreads

What Are Options Spreads?

Options spreads involve simultaneously buying and selling options of the same class to capitalize on changes in their price differentials.

Benefits of Using Spreads in Options Trading

Spreads can limit risk while providing strategic alternatives to simple buying or selling.

Vertical Spreads Explained

Introduction to Vertical Spreads

This section covers the basics of vertical spreads, including bull and bear spreads.

Setting Up a Vertical Spread

Step-by-step guide on how to set up a vertical spread, including selecting strike prices and expiration dates.

Calendar Spreads Unfolded

Understanding Calendar Spreads

Explaining the mechanics of calendar spreads and how they differ from vertical spreads.

Implementing a Calendar Spread

Detailed instructions on how to establish a calendar spread effectively.

Deciding Between Spreads

When to Use Vertical vs. Calendar Spreads

Guidance on choosing between vertical and calendar spreads based on market conditions and financial goals.

Risk Assessment for Each Spread Type

Analyzing the risk factors associated with each type of spread and strategies to mitigate them.

Trade Management Techniques

Monitoring and Adjusting Open Spreads

Tips on how to monitor and adjust spreads based on market movements to maximize profits or minimize losses.

Exit Strategies for Spreads

Best practices for exiting spread trades to protect gains or cut losses.

Leveraging Technical Analysis

Using Technical Indicators with Spreads

How to use technical indicators to enhance decision-making in trading spreads.

Chart Patterns and Spread Trading

Identifying chart patterns that signal optimal times for initiating or closing spread trades.

Risk Management in Spread Trading

Managing Downside Risk

Strategies for managing downside risks when trading spreads.

Importance of Diversification

The role of diversification in a spread trading strategy to balance risk across different assets.

Learning from the Pros

Key Takeaways from Don Kaufman

Insights and lessons learned from Don Kaufman’s extensive experience in options trading.

Success Stories

Real-world examples of successful trades using the strategies taught in the class.

Tools and Resources

Recommended Trading Platforms

Overview of the best trading platforms for executing spread trades.

Further Learning and Resources

Additional resources for those looking to deepen their understanding of options spread strategies.

Conclusion

Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” offers invaluable insights into sophisticated trading strategies that can lead to successful outcomes in options trading. By understanding and applying these strategies, traders can significantly enhance their trading skills and financial results.

FAQs

1. Who should take this class?

This class is ideal for intermediate to advanced options traders looking to expand their knowledge and refine their strategies.

2. What are the prerequisites for this class?

A basic understanding of options and some experience with options trading are recommended before taking this class.

3. How can I access the on-demand replay?

The on-demand replay is available online, allowing you to watch and learn at your convenience.

4. Can these strategies be applied in any market condition?

Yes, vertical and calendar spreads are versatile strategies that can be adjusted to suit various market conditions.

5. How important is risk management in options spread trading?

Risk management is crucial in options spread trading as it helps protect against substantial losses and ensures long-term sustainability.

Be the first to review “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.