-

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Winning with Value Charts with Dave Stendahl

1 × $6.00

Winning with Value Charts with Dave Stendahl

1 × $6.00 -

×

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Member Only Videos with Henry W Steele

1 × $27.00

Member Only Videos with Henry W Steele

1 × $27.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Options Master Class

1 × $54.00

Options Master Class

1 × $54.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

MarketSharks Forex Training

1 × $31.00

MarketSharks Forex Training

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Long/Short Market Dynamics: Trading Strategies for Today's Markets with Clive Corcoran

1 × $6.00

Long/Short Market Dynamics: Trading Strategies for Today's Markets with Clive Corcoran

1 × $6.00 -

×

Theo Trade - 128 Course Bundle

1 × $93.00

Theo Trade - 128 Course Bundle

1 × $93.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Atlas Forex Trading Course

1 × $5.00

Atlas Forex Trading Course

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

iMarketsLive Academy Course

1 × $5.00

iMarketsLive Academy Course

1 × $5.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Technical Analysis Package with Martin Pring

1 × $4.00

Technical Analysis Package with Martin Pring

1 × $4.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00 -

×

Intra-Day Trading Techniques DVD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques DVD with Greg Capra

1 × $6.00 -

×

Jtrader - A+ Setups Small Caps

1 × $23.00

Jtrader - A+ Setups Small Caps

1 × $23.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Trading Strategies with Larry Sanders

1 × $6.00

Trading Strategies with Larry Sanders

1 × $6.00 -

×

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

FX Accelerator 2

1 × $31.00

FX Accelerator 2

1 × $31.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00 -

×

Andrew Keene's Most Confident Trade Yet

1 × $54.00

Andrew Keene's Most Confident Trade Yet

1 × $54.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Option Express Plugin

1 × $6.00

Option Express Plugin

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00

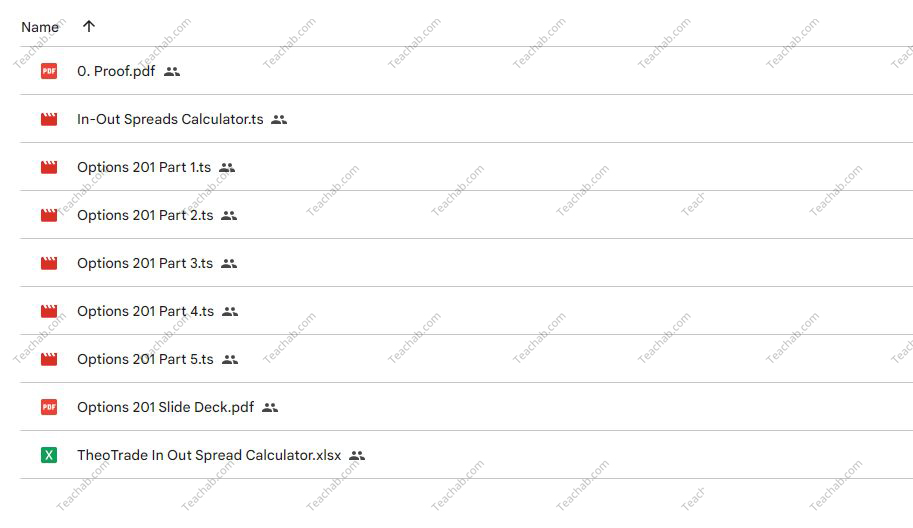

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

$150.00 Original price was: $150.00.$6.00Current price is: $6.00.

File Size: 1.48 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” below:

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

Introduction

Options trading can be complex, but with the right knowledge and strategies, it also offers significant opportunities for profit. Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” is a comprehensive five-part class designed to equip traders with advanced strategies in options trading.

Understanding Options Spreads

What Are Options Spreads?

Options spreads involve simultaneously buying and selling options of the same class to capitalize on changes in their price differentials.

Benefits of Using Spreads in Options Trading

Spreads can limit risk while providing strategic alternatives to simple buying or selling.

Vertical Spreads Explained

Introduction to Vertical Spreads

This section covers the basics of vertical spreads, including bull and bear spreads.

Setting Up a Vertical Spread

Step-by-step guide on how to set up a vertical spread, including selecting strike prices and expiration dates.

Calendar Spreads Unfolded

Understanding Calendar Spreads

Explaining the mechanics of calendar spreads and how they differ from vertical spreads.

Implementing a Calendar Spread

Detailed instructions on how to establish a calendar spread effectively.

Deciding Between Spreads

When to Use Vertical vs. Calendar Spreads

Guidance on choosing between vertical and calendar spreads based on market conditions and financial goals.

Risk Assessment for Each Spread Type

Analyzing the risk factors associated with each type of spread and strategies to mitigate them.

Trade Management Techniques

Monitoring and Adjusting Open Spreads

Tips on how to monitor and adjust spreads based on market movements to maximize profits or minimize losses.

Exit Strategies for Spreads

Best practices for exiting spread trades to protect gains or cut losses.

Leveraging Technical Analysis

Using Technical Indicators with Spreads

How to use technical indicators to enhance decision-making in trading spreads.

Chart Patterns and Spread Trading

Identifying chart patterns that signal optimal times for initiating or closing spread trades.

Risk Management in Spread Trading

Managing Downside Risk

Strategies for managing downside risks when trading spreads.

Importance of Diversification

The role of diversification in a spread trading strategy to balance risk across different assets.

Learning from the Pros

Key Takeaways from Don Kaufman

Insights and lessons learned from Don Kaufman’s extensive experience in options trading.

Success Stories

Real-world examples of successful trades using the strategies taught in the class.

Tools and Resources

Recommended Trading Platforms

Overview of the best trading platforms for executing spread trades.

Further Learning and Resources

Additional resources for those looking to deepen their understanding of options spread strategies.

Conclusion

Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” offers invaluable insights into sophisticated trading strategies that can lead to successful outcomes in options trading. By understanding and applying these strategies, traders can significantly enhance their trading skills and financial results.

FAQs

1. Who should take this class?

This class is ideal for intermediate to advanced options traders looking to expand their knowledge and refine their strategies.

2. What are the prerequisites for this class?

A basic understanding of options and some experience with options trading are recommended before taking this class.

3. How can I access the on-demand replay?

The on-demand replay is available online, allowing you to watch and learn at your convenience.

4. Can these strategies be applied in any market condition?

Yes, vertical and calendar spreads are versatile strategies that can be adjusted to suit various market conditions.

5. How important is risk management in options spread trading?

Risk management is crucial in options spread trading as it helps protect against substantial losses and ensures long-term sustainability.

Be the first to review “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.