-

×

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00 -

×

Tandem Trader - The Ultimate Day Trading Course with Nathan Michaud - Investors Underground

1 × $54.00

Tandem Trader - The Ultimate Day Trading Course with Nathan Michaud - Investors Underground

1 × $54.00 -

×

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00 -

×

Broke: The New American Dream with Michael Covel

1 × $6.00

Broke: The New American Dream with Michael Covel

1 × $6.00 -

×

Takeover Talk The Q.U.I.C.K. Strategy to High Return, Low Risk Investing with Lou Bass

1 × $6.00

Takeover Talk The Q.U.I.C.K. Strategy to High Return, Low Risk Investing with Lou Bass

1 × $6.00 -

×

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00 -

×

W.D.Ganns Astrological Method

1 × $6.00

W.D.Ganns Astrological Method

1 × $6.00 -

×

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

Bobokus Training Program

1 × $6.00

Bobokus Training Program

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

Currency Trading and Intermarket Analysis

1 × $6.00

Currency Trading and Intermarket Analysis

1 × $6.00 -

×

Sure Thing Stock Investing with Larry Williams

1 × $6.00

Sure Thing Stock Investing with Larry Williams

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00 -

×

FOREX TRADING: Beginner's Course To Becoming A Top Trader with Karen Foo

1 × $6.00

FOREX TRADING: Beginner's Course To Becoming A Top Trader with Karen Foo

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Road Congestion Pricing in Europe: Implications for the United States with Harry Richardson & Chang-Hee Christine Bae

1 × $6.00

Road Congestion Pricing in Europe: Implications for the United States with Harry Richardson & Chang-Hee Christine Bae

1 × $6.00 -

×

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00 -

×

Rapid Results Method with Russ Horn

1 × $6.00

Rapid Results Method with Russ Horn

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00 -

×

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market with Gil Morales

1 × $6.00

Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market with Gil Morales

1 × $6.00 -

×

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

Forex Masterclass - BKForex

1 × $5.00

Forex Masterclass - BKForex

1 × $5.00 -

×

Indicators & BWT Bar Types for NT7

1 × $139.00

Indicators & BWT Bar Types for NT7

1 × $139.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

Forex Income Engine Course 2008 - 6 CDs + Manual

1 × $6.00

Forex Income Engine Course 2008 - 6 CDs + Manual

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

Applied Portfolio Management with Catherine Shenoy

1 × $6.00

Applied Portfolio Management with Catherine Shenoy

1 × $6.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00 -

×

Foundation Options - Time Decay, Implied Volatility, Greeks

1 × $6.00

Foundation Options - Time Decay, Implied Volatility, Greeks

1 × $6.00 -

×

The Ultimate Trading Guide & Code with George Pruitt, John R.Hill

1 × $6.00

The Ultimate Trading Guide & Code with George Pruitt, John R.Hill

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Surefire Trading Plans with Mark McRae

1 × $6.00

Surefire Trading Plans with Mark McRae

1 × $6.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00 -

×

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

PROPRIETARY TRADING PROGRAM with Bid Ask Trader

1 × $31.00

PROPRIETARY TRADING PROGRAM with Bid Ask Trader

1 × $31.00 -

×

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00 -

×

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

Price Action Stock Day Trading Course with Trade That Swing

1 × $62.00

Price Action Stock Day Trading Course with Trade That Swing

1 × $62.00 -

×

Rich Jerk Program

1 × $15.00

Rich Jerk Program

1 × $15.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00 -

×

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Renko Mastery with Thomas Wood

1 × $15.00

Renko Mastery with Thomas Wood

1 × $15.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

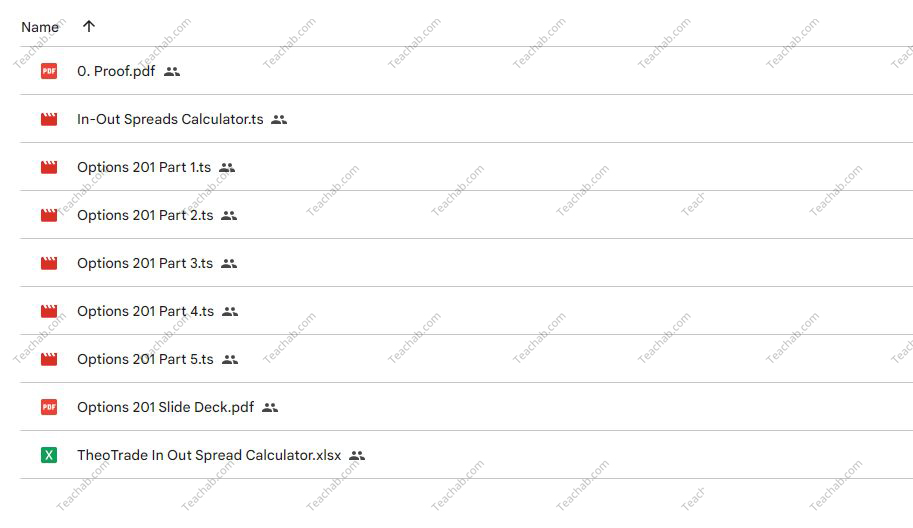

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

$150.00 Original price was: $150.00.$6.00Current price is: $6.00.

File Size: 1.48 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” below:

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

Introduction

Options trading can be complex, but with the right knowledge and strategies, it also offers significant opportunities for profit. Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” is a comprehensive five-part class designed to equip traders with advanced strategies in options trading.

Understanding Options Spreads

What Are Options Spreads?

Options spreads involve simultaneously buying and selling options of the same class to capitalize on changes in their price differentials.

Benefits of Using Spreads in Options Trading

Spreads can limit risk while providing strategic alternatives to simple buying or selling.

Vertical Spreads Explained

Introduction to Vertical Spreads

This section covers the basics of vertical spreads, including bull and bear spreads.

Setting Up a Vertical Spread

Step-by-step guide on how to set up a vertical spread, including selecting strike prices and expiration dates.

Calendar Spreads Unfolded

Understanding Calendar Spreads

Explaining the mechanics of calendar spreads and how they differ from vertical spreads.

Implementing a Calendar Spread

Detailed instructions on how to establish a calendar spread effectively.

Deciding Between Spreads

When to Use Vertical vs. Calendar Spreads

Guidance on choosing between vertical and calendar spreads based on market conditions and financial goals.

Risk Assessment for Each Spread Type

Analyzing the risk factors associated with each type of spread and strategies to mitigate them.

Trade Management Techniques

Monitoring and Adjusting Open Spreads

Tips on how to monitor and adjust spreads based on market movements to maximize profits or minimize losses.

Exit Strategies for Spreads

Best practices for exiting spread trades to protect gains or cut losses.

Leveraging Technical Analysis

Using Technical Indicators with Spreads

How to use technical indicators to enhance decision-making in trading spreads.

Chart Patterns and Spread Trading

Identifying chart patterns that signal optimal times for initiating or closing spread trades.

Risk Management in Spread Trading

Managing Downside Risk

Strategies for managing downside risks when trading spreads.

Importance of Diversification

The role of diversification in a spread trading strategy to balance risk across different assets.

Learning from the Pros

Key Takeaways from Don Kaufman

Insights and lessons learned from Don Kaufman’s extensive experience in options trading.

Success Stories

Real-world examples of successful trades using the strategies taught in the class.

Tools and Resources

Recommended Trading Platforms

Overview of the best trading platforms for executing spread trades.

Further Learning and Resources

Additional resources for those looking to deepen their understanding of options spread strategies.

Conclusion

Don Kaufman’s “Options 201: Vertical and Calendar Spread Essentials” offers invaluable insights into sophisticated trading strategies that can lead to successful outcomes in options trading. By understanding and applying these strategies, traders can significantly enhance their trading skills and financial results.

FAQs

1. Who should take this class?

This class is ideal for intermediate to advanced options traders looking to expand their knowledge and refine their strategies.

2. What are the prerequisites for this class?

A basic understanding of options and some experience with options trading are recommended before taking this class.

3. How can I access the on-demand replay?

The on-demand replay is available online, allowing you to watch and learn at your convenience.

4. Can these strategies be applied in any market condition?

Yes, vertical and calendar spreads are versatile strategies that can be adjusted to suit various market conditions.

5. How important is risk management in options spread trading?

Risk management is crucial in options spread trading as it helps protect against substantial losses and ensures long-term sustainability.

Be the first to review “Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.