-

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Advanced Trader with Nikos Trading Academy

1 × $5.00

Advanced Trader with Nikos Trading Academy

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

The Master Trader Bundle with Gareth Soloway

1 × $39.00

The Master Trader Bundle with Gareth Soloway

1 × $39.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

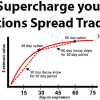

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.