-

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

How to Trade Better with Larry Williams

1 × $6.00

How to Trade Better with Larry Williams

1 × $6.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Trading Vault with Anne-Marie Baiynd

1 × $54.00

The Trading Vault with Anne-Marie Baiynd

1 × $54.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Toni’s Market Club with Toni Turner

1 × $6.00

Toni’s Market Club with Toni Turner

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Master Class with Gerald Appel

1 × $6.00

Master Class with Gerald Appel

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

The Futures Edge with Joshua Martinez

1 × $155.00

The Futures Edge with Joshua Martinez

1 × $155.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Futures Broker Home Study Course CTA Series 3 (Fourteenth Ed.) with Center for Futures Education

1 × $6.00

Futures Broker Home Study Course CTA Series 3 (Fourteenth Ed.) with Center for Futures Education

1 × $6.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

Gold XAUUSD Trading Strategy - The Gold Box with The Trading Guide

1 × $5.00

Gold XAUUSD Trading Strategy - The Gold Box with The Trading Guide

1 × $5.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00 -

×

The Astrology of the Old Testament or The Lost World Regained with Karl Anderson

1 × $6.00

The Astrology of the Old Testament or The Lost World Regained with Karl Anderson

1 × $6.00 -

×

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Magical Forex Trading System

1 × $6.00

Magical Forex Trading System

1 × $6.00 -

×

Japanese Trading Systems with Tradesmart University

1 × $9.00

Japanese Trading Systems with Tradesmart University

1 × $9.00 -

×

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

ShredderFX Compete Courses & Indicators

1 × $6.00

ShredderFX Compete Courses & Indicators

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

The Newsbeat Bandit Program with Mark Melnick - T3 Live

1 × $6.00

The Newsbeat Bandit Program with Mark Melnick - T3 Live

1 × $6.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

Sniper Entry Course with ALGOHUB

1 × $5.00

Sniper Entry Course with ALGOHUB

1 × $5.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Professional Strategies For Trading The DAX

1 × $6.00

Professional Strategies For Trading The DAX

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00 -

×

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

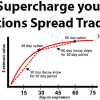

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.