-

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Technical Timing Patterns

1 × $6.00

Technical Timing Patterns

1 × $6.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

Swing Trading College IX 2010 with Larry Connors

1 × $15.00

Swing Trading College IX 2010 with Larry Connors

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Kickstart Course with Tradelikerocket

1 × $46.00

Kickstart Course with Tradelikerocket

1 × $46.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

Profiletraders - MARKET PROFILE TACTICAL STRATEGIES FOR DAY TRADING

1 × $23.00

Profiletraders - MARKET PROFILE TACTICAL STRATEGIES FOR DAY TRADING

1 × $23.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Beat the Market with Edward O.Thorp

1 × $6.00

Beat the Market with Edward O.Thorp

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00 -

×

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Oil Trading Academy Code 3 Video Course

1 × $6.00

Oil Trading Academy Code 3 Video Course

1 × $6.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

FMG Online Course with FMG Traders

1 × $6.00

FMG Online Course with FMG Traders

1 × $6.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Currency Trading Seminar with Peter Bain

1 × $6.00

Currency Trading Seminar with Peter Bain

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Sami Abusaad Elite Mentorship

1 × $31.00

Sami Abusaad Elite Mentorship

1 × $31.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

Computational Financial Mathematics with Mathematica

1 × $6.00

Computational Financial Mathematics with Mathematica

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

OrderFlows Trader Package, (Sep 2015)

1 × $54.00

OrderFlows Trader Package, (Sep 2015)

1 × $54.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

Trading Course 2024 with ZMC x BMO

1 × $17.00

Trading Course 2024 with ZMC x BMO

1 × $17.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced Price Action Course with ZenFX

1 × $5.00

Advanced Price Action Course with ZenFX

1 × $5.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Advanced Day Trading Course with Doyle Exchange

1 × $8.00

Advanced Day Trading Course with Doyle Exchange

1 × $8.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00 -

×

Programming in Python For Traders

1 × $78.00

Programming in Python For Traders

1 × $78.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00

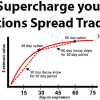

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.