-

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

How to Trade Better with Larry Williams

1 × $6.00

How to Trade Better with Larry Williams

1 × $6.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

Fire Your Stock Analyst: Analyzing Stocks on Your Own with Harry Domash

1 × $6.00

Fire Your Stock Analyst: Analyzing Stocks on Your Own with Harry Domash

1 × $6.00 -

×

PFA SD Model Trading System (Apr 2013)

1 × $31.00

PFA SD Model Trading System (Apr 2013)

1 × $31.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00 -

×

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

Learning Track: Quantitative Approach in Options Trading

1 × $39.00

Learning Track: Quantitative Approach in Options Trading

1 × $39.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

Basecamptrading - Naked Trading Part 2

1 × $6.00

Basecamptrading - Naked Trading Part 2

1 × $6.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00 -

×

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

![Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)] img](https://www.totozon.com/wp-content/uploads/2024/05/Robert-Miner-Complete-Price-Tutorial-Series-5-Videos-AVI-img.png) Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00

Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

Market Expectations & Option Prices with Martin Mandler

1 × $6.00

Market Expectations & Option Prices with Martin Mandler

1 × $6.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00 -

×

Profiletraders - Market Profile Day Trading

1 × $15.00

Profiletraders - Market Profile Day Trading

1 × $15.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

Developting a Forex Trading Plan Webminar

1 × $6.00

Developting a Forex Trading Plan Webminar

1 × $6.00 -

×

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

Forex Strategies Guide for Day and Swing Traders with Cory Mitchell - Vantage Point Trading

1 × $4.00

Forex Strategies Guide for Day and Swing Traders with Cory Mitchell - Vantage Point Trading

1 × $4.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Option Buying Course

1 × $5.00

Option Buying Course

1 × $5.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

Day Trading Freedom Course & Members Area Videos

1 × $6.00

Day Trading Freedom Course & Members Area Videos

1 × $6.00 -

×

Master The Markets 2.0 with French Trader

1 × $6.00

Master The Markets 2.0 with French Trader

1 × $6.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Pete Fader VSA Course

1 × $6.00

Pete Fader VSA Course

1 × $6.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Sovereign Man Price Value International 2016

1 × $15.00

Sovereign Man Price Value International 2016

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

E-mini Weekly Options Income with Peter Titus

1 × $15.00

E-mini Weekly Options Income with Peter Titus

1 × $15.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

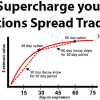

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.