-

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Super Structure Trading Home Study Course

1 × $23.00

Super Structure Trading Home Study Course

1 × $23.00 -

×

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Gillen Predicts with Jack Gillen

1 × $6.00

Gillen Predicts with Jack Gillen

1 × $6.00 -

×

Alexander Elder Full Courses Package

1 × $6.00

Alexander Elder Full Courses Package

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00 -

×

The Ticker Investment Digest Articles

1 × $6.00

The Ticker Investment Digest Articles

1 × $6.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Binary Trigger (Video, Books) with John Piper

1 × $6.00

The Binary Trigger (Video, Books) with John Piper

1 × $6.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Market Controller Course with Controller FX

1 × $5.00

Market Controller Course with Controller FX

1 × $5.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Advanced Trading Course with Edney Pinheiro

1 × $5.00

Advanced Trading Course with Edney Pinheiro

1 × $5.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

ProfileTraders - Advanced Market Profile (May 2014)

1 × $6.00

ProfileTraders - Advanced Market Profile (May 2014)

1 × $6.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00 -

×

Weekly Options Boot Camp with Price Headley

1 × $15.00

Weekly Options Boot Camp with Price Headley

1 × $15.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00

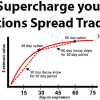

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.