-

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

All About Technical Analysis with Constance Brown

1 × $6.00

All About Technical Analysis with Constance Brown

1 × $6.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00 -

×

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Astrology of the Old Testament or The Lost World Regained with Karl Anderson

1 × $6.00

The Astrology of the Old Testament or The Lost World Regained with Karl Anderson

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Simple Cyclical Analysis with Stan Erlich

1 × $6.00

Simple Cyclical Analysis with Stan Erlich

1 × $6.00 -

×

Pablo Order Flow Education with Pablo

1 × $6.00

Pablo Order Flow Education with Pablo

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Trend Trading My Way with Markay Latimer

1 × $15.00

Trend Trading My Way with Markay Latimer

1 × $15.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Secrets of Investors on WallStreet (Audio) with Ken Fisher

1 × $6.00

Secrets of Investors on WallStreet (Audio) with Ken Fisher

1 × $6.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Toni’s Market Club with Toni Turner

1 × $6.00

Toni’s Market Club with Toni Turner

1 × $6.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00 -

×

Gold & Silver Profit System with Bill Poulos

1 × $6.00

Gold & Silver Profit System with Bill Poulos

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Advanced Iron Condor Course in 2021

1 × $6.00

Advanced Iron Condor Course in 2021

1 × $6.00 -

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00 -

×

![Strike Zone Trading - Forex Course [81 Videos (MP4) + 96 Software files (EXEEX4MQ4CHRWNDTPL) + 17 DOCS (TXTCSVXLSXPDF) + Images (PNGJPGGIF)]](https://www.totozon.com/wp-content/uploads/2024/05/Strike-Zone-Trading-Forex-Course-81-Videos-MP4-96-Software-files-EXEEX4MQ4CHRWNDTPL-17-DOCS-TXTCSVXLSXPDF-Images-PNGJPGGIF.jpg) Strike Zone Trading - Forex Course [81 Videos (MP4) + 96 Software files (EXE/EX4/MQ4/CHR/WND/TPL) + 17 DOCS (TXT/CSV/XLSX/PDF) + Images (PNG/JPG/GIF)]

1 × $6.00

Strike Zone Trading - Forex Course [81 Videos (MP4) + 96 Software files (EXE/EX4/MQ4/CHR/WND/TPL) + 17 DOCS (TXT/CSV/XLSX/PDF) + Images (PNG/JPG/GIF)]

1 × $6.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

FXStreet Unrecorded Webinars Sept & Oct, 2011 with Sam Seiden

1 × $6.00

FXStreet Unrecorded Webinars Sept & Oct, 2011 with Sam Seiden

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Carolyn Boroden Package

1 × $15.00

Carolyn Boroden Package

1 × $15.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Broke: The New American Dream with Michael Covel

1 × $6.00

Broke: The New American Dream with Michael Covel

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

Forex Commander Package by Amin Sadak

1 × $6.00

Forex Commander Package by Amin Sadak

1 × $6.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

ENG Renko Mastery with International Scalpers

1 × $10.00

ENG Renko Mastery with International Scalpers

1 × $10.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

Setups of a Winning Trader with Gareth Soloway

1 × $521.00

Setups of a Winning Trader with Gareth Soloway

1 × $521.00 -

×

Elite Price Action Tutorials with Wmd4x

1 × $8.00

Elite Price Action Tutorials with Wmd4x

1 × $8.00 -

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

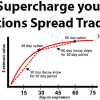

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.