-

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00 -

×

Weekly Credit Spreads for Income

1 × $6.00

Weekly Credit Spreads for Income

1 × $6.00 -

×

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00 -

×

Advance Courses for Members

1 × $15.00

Advance Courses for Members

1 × $15.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Maximum Returns with Infinity Spreads Class with Don Kaufman

1 × $6.00

Maximum Returns with Infinity Spreads Class with Don Kaufman

1 × $6.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

NFTMastermind with Charting Wizards

1 × $5.00

NFTMastermind with Charting Wizards

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

Weekly Options Boot Camp with Price Headley

1 × $15.00

Weekly Options Boot Camp with Price Headley

1 × $15.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Price Action Stock Day Trading Course with Trade That Swing

1 × $62.00

Price Action Stock Day Trading Course with Trade That Swing

1 × $62.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Ambush Trading Method (EBOOK) with MARCO MAYER - Trading Educators

1 × $256.00

Ambush Trading Method (EBOOK) with MARCO MAYER - Trading Educators

1 × $256.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00 -

×

Master Forex Fundamentals

1 × $15.00

Master Forex Fundamentals

1 × $15.00 -

×

Timing the Market with Curtis Arnold

1 × $6.00

Timing the Market with Curtis Arnold

1 × $6.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00 -

×

Time, Price & Pattern with John Crane

1 × $6.00

Time, Price & Pattern with John Crane

1 × $6.00 -

×

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00 -

×

Planetary Economic Forecasting with Bill Meridian

1 × $6.00

Planetary Economic Forecasting with Bill Meridian

1 × $6.00 -

×

Dan Dowd Trading

1 × $5.00

Dan Dowd Trading

1 × $5.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Original Charting 1936 with W.D.Gann

1 × $6.00

Original Charting 1936 with W.D.Gann

1 × $6.00 -

×

Building Winning Trading Systems

1 × $6.00

Building Winning Trading Systems

1 × $6.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

TickScalper Trading System

1 × $23.00

TickScalper Trading System

1 × $23.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00 -

×

Day Trading Institution 2.0 with Raul Gonzalez

1 × $5.00

Day Trading Institution 2.0 with Raul Gonzalez

1 × $5.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

Day Trading Freedom Course & Members Area Videos

1 × $6.00

Day Trading Freedom Course & Members Area Videos

1 × $6.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

Outperforming the Market with John Merrill

1 × $6.00

Outperforming the Market with John Merrill

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Gold Trading Academy Video Course

1 × $23.00

Gold Trading Academy Video Course

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

The Complete Guide to Spread Trading

1 × $6.00

The Complete Guide to Spread Trading

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00 -

×

Tradingconceptsinc - Calendar Spreads

1 × $23.00

Tradingconceptsinc - Calendar Spreads

1 × $23.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Traders Secret Library

1 × $6.00

Traders Secret Library

1 × $6.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

How to Manage Profit and Cash Flow: Mining the Numbers for Gold with John Tracy & Tage Tracy

1 × $6.00

How to Manage Profit and Cash Flow: Mining the Numbers for Gold with John Tracy & Tage Tracy

1 × $6.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

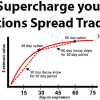

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.