-

×

Boiler Room Trading

1 × $15.00

Boiler Room Trading

1 × $15.00 -

×

Scalping Betfair For Daily Profits

1 × $6.00

Scalping Betfair For Daily Profits

1 × $6.00 -

×

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00 -

×

Currency Trading System 2003 with Peter Bain

1 × $6.00

Currency Trading System 2003 with Peter Bain

1 × $6.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

Understanding the Markets with David Loader

1 × $6.00

Understanding the Markets with David Loader

1 × $6.00 -

×

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00 -

×

Bollinger Bands Trading Strategies That Work

1 × $6.00

Bollinger Bands Trading Strategies That Work

1 × $6.00 -

×

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trading Hub 2.0 Book

1 × $6.00

Trading Hub 2.0 Book

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00 -

×

Forex Masterclass with 20 Minute Trader

1 × $23.00

Forex Masterclass with 20 Minute Trader

1 × $23.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

Forex for Profits with Todd Mitchell

1 × $85.00

Forex for Profits with Todd Mitchell

1 × $85.00 -

×

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00 -

×

Trading Full Circle with Jea Yu

1 × $6.00

Trading Full Circle with Jea Yu

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

Intermediate Options Trading Course

1 × $39.00

Intermediate Options Trading Course

1 × $39.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

Time by Degrees Online Coaching 2009 + PDF Workbooks

1 × $54.00

Time by Degrees Online Coaching 2009 + PDF Workbooks

1 × $54.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Train & Trade Academy with Omar Agag

1 × $5.00

Train & Trade Academy with Omar Agag

1 × $5.00 -

×

The Options Traders Success Formula Course with Simpler Options

1 × $6.00

The Options Traders Success Formula Course with Simpler Options

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00 -

×

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00 -

×

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

Complete 32+ Hour Video Training Course 2008

1 × $23.00

Complete 32+ Hour Video Training Course 2008

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

TechnicalGodsFX Advanced Forex Education

1 × $7.00

TechnicalGodsFX Advanced Forex Education

1 × $7.00 -

×

Mastering Debit Spreads with Vince Vora

1 × $15.00

Mastering Debit Spreads with Vince Vora

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Point of Control and Imbalance Course with Mike Valtos - Orderflows

1 × $15.00

The Point of Control and Imbalance Course with Mike Valtos - Orderflows

1 × $15.00 -

×

Rapid Results Method with Russ Horn

1 × $6.00

Rapid Results Method with Russ Horn

1 × $6.00 -

×

Interactive Brokers Data Downloader 3.0 (software)

1 × $6.00

Interactive Brokers Data Downloader 3.0 (software)

1 × $6.00 -

×

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00 -

×

Day Trading Stocks - Gap Trading

1 × $23.00

Day Trading Stocks - Gap Trading

1 × $23.00 -

×

Position Dissection with Charles Cottle

1 × $4.00

Position Dissection with Charles Cottle

1 × $4.00 -

×

Reversal Magic Video Course

1 × $15.00

Reversal Magic Video Course

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Ultimate Trading Solution

1 × $15.00

The Ultimate Trading Solution

1 × $15.00 -

×

QuantZilla

1 × $39.00

QuantZilla

1 × $39.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

The Options Course Workbook: Step-by-Step Exercises and Tests to Help You Master the Options Course - George Fontanills

1 × $6.00

The Options Course Workbook: Step-by-Step Exercises and Tests to Help You Master the Options Course - George Fontanills

1 × $6.00 -

×

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00 -

×

The Squeeze Pro System: How to Catch Bigger and Faster Squeezes More Often

1 × $54.00

The Squeeze Pro System: How to Catch Bigger and Faster Squeezes More Often

1 × $54.00 -

×

Support Resistance

1 × $23.00

Support Resistance

1 × $23.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Bobokus Training Program

1 × $6.00

Bobokus Training Program

1 × $6.00 -

×

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00 -

×

The Secret Mindset Academy 2023 with The Secret Mindset Academy

1 × $5.00

The Secret Mindset Academy 2023 with The Secret Mindset Academy

1 × $5.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

Forex Fundamentals Course with Bkforex

1 × $23.00

Forex Fundamentals Course with Bkforex

1 × $23.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Unlearn and Relearn with Market Fluidity

1 × $6.00

Unlearn and Relearn with Market Fluidity

1 × $6.00 -

×

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

Turtle Trading Concepts with Russell Sands

1 × $6.00

Turtle Trading Concepts with Russell Sands

1 × $6.00 -

×

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00 -

×

Elliott Wave DNA with Nicola Delic

1 × $31.00

Elliott Wave DNA with Nicola Delic

1 × $31.00 -

×

The Foundation with Dan Maxwell

1 × $6.00

The Foundation with Dan Maxwell

1 × $6.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00 -

×

Live Video Revolution

1 × $15.00

Live Video Revolution

1 × $15.00 -

×

ART Trading - Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

1 × $15.00

ART Trading - Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

1 × $15.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Making The Leap Learning To Trade With Robots with Scott Welsh

1 × $15.00

Making The Leap Learning To Trade With Robots with Scott Welsh

1 × $15.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

BalanceTrader II – For Advanced Traders

1 × $6.00

BalanceTrader II – For Advanced Traders

1 × $6.00 -

×

The Perfect Execution 1-Minute Strategy Course

1 × $6.00

The Perfect Execution 1-Minute Strategy Course

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00 -

×

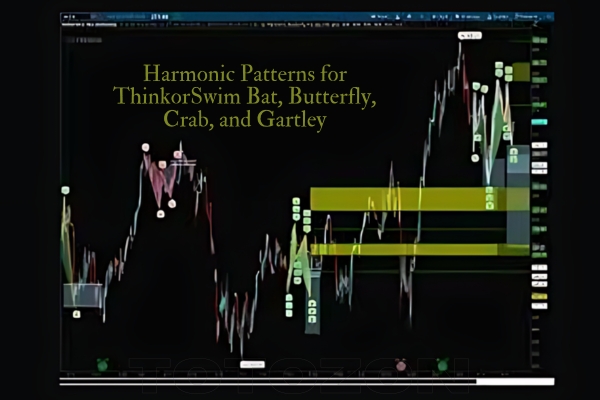

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00 -

×

TopTradeTools - Trend Breakout Levels

1 × $15.00

TopTradeTools - Trend Breakout Levels

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

Spotting Big Money with Market Profile with John Kepler

1 × $23.00

Spotting Big Money with Market Profile with John Kepler

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00 -

×

Schwager on Futures: Managed Trading with Jack Schwager

1 × $4.00

Schwager on Futures: Managed Trading with Jack Schwager

1 × $4.00 -

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The WWA Core Concepts Bootcamp

1 × $6.00

The WWA Core Concepts Bootcamp

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

Characteristics and Risks of Standardized Options

1 × $6.00

Characteristics and Risks of Standardized Options

1 × $6.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00

Option, Futures and Other Derivates 9th Edition

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Options, Futures and Other Derivatives (9th Edition)

Introduction to Derivatives

What Are Derivatives?

Derivatives are financial instruments whose value is derived from the value of underlying assets such as stocks, bonds, commodities, currencies, interest rates, or market indexes. They play a crucial role in modern finance by providing mechanisms for hedging risk, speculating on price movements, and enhancing liquidity.

Importance in Financial Markets

Derivatives are indispensable tools for managing financial risks and ensuring market efficiency. They offer investors and institutions a way to protect against adverse price movements and to take advantage of market opportunities.

Overview of the 9th Edition

Author’s Expertise

“Options, Futures and Other Derivatives (9th Edition)” by John Hull is a comprehensive guide that delves into the complexities of derivatives. John Hull, a renowned finance professor, provides deep insights into the principles and applications of these financial instruments.

Key Updates and Enhancements

The 9th edition includes updated content reflecting the latest trends, regulatory changes, and innovations in the derivatives market. It offers expanded coverage on topics like risk management, exotic options, and the impact of technology on derivatives trading.

Understanding Futures Markets

Definition and Function

Futures markets involve standardized contracts to buy or sell assets at a future date. These contracts are essential for price stability and risk management, allowing participants to lock in prices and hedge against price fluctuations.

Types of Futures Contracts

- Commodity Futures: Contracts for physical goods like oil, gold, and agricultural products.

- Financial Futures: Contracts for financial instruments like currencies, interest rates, and stock indices.

Key Players in Futures Markets

- Hedgers: Use futures to mitigate risk by locking in prices.

- Speculators: Aim to profit from price movements by taking on risk.

- Arbitrageurs: Exploit price discrepancies across different markets for profit.

Exploring Options Markets

Definition and Function

Options markets provide contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specified price before the contract expires. This flexibility makes options a powerful tool for managing risk and enhancing returns.

Types of Options

- Call Options: Provide the right to buy an asset at a predetermined price.

- Put Options: Provide the right to sell an asset at a predetermined price.

Key Concepts in Options Trading

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The last date the option can be exercised.

- Premium: The cost of purchasing the option.

Pricing and Valuation

Pricing Models

The 9th edition delves into various pricing models, including the Black-Scholes model for options and the cost-of-carry model for futures. These models are essential for accurately valuing derivatives and making informed trading decisions.

Understanding the Greeks

The Greeks are measures of the sensitivity of an option’s price to various factors, crucial for managing options portfolios and assessing risk. They include:

- Delta: Sensitivity to changes in the underlying asset’s price.

- Gamma: The rate of change of delta.

- Theta: Time decay of the option’s value.

- Vega: Sensitivity to volatility changes.

- Rho: Sensitivity to interest rate changes.

Practical Applications

Hedging Strategies

Hedging involves using derivatives to offset potential losses in other investments. This strategy is vital for businesses and investors seeking to protect their portfolios from adverse price movements.

Speculation and Arbitrage

Speculators use derivatives to profit from market movements, while arbitrageurs seek risk-free profits through price discrepancies across different markets.

Case Studies

The book includes practical case studies that demonstrate the application of derivatives strategies in real-world scenarios, enhancing practical knowledge and skills.

Regulatory Environment

Importance of Regulation

Regulation ensures market integrity, transparency, and protection for participants. The 9th edition discusses significant regulatory changes and their impacts on market practices.

Key Regulatory Bodies

- Commodity Futures Trading Commission (CFTC)

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

Learning Futures and Options

Structured Learning Approach

A systematic approach to learning involves starting with basic concepts and progressing to more complex topics, reinforced through practical exercises and case studies.

Practical Exercises

Engage with the exercises at the end of each chapter to reinforce learning and test comprehension, ensuring a solid grasp of fundamental concepts.

Utilizing Additional Resources

Leverage additional resources such as online tutorials, market simulations, and professional courses to deepen understanding and enhance practical skills.

Conclusion

“Options, Futures and Other Derivatives (9th Edition)” by John Hull is an essential resource for anyone looking to understand the intricacies of financial derivatives. It offers comprehensive insights and practical knowledge crucial for navigating these complex markets, making it a must-read for students, professionals, and individual investors.

FAQs

What are the primary uses of derivatives?

Derivatives are used for hedging risk, speculating on price movements, and engaging in arbitrage.

How do futures contracts differ from options contracts?

Futures contracts obligate the holder to buy or sell an asset at a set price on a future date, while options contracts give the holder the right, but not the obligation, to buy or sell at a predetermined price before the expiration date.

Why is understanding the Greeks important in options trading?

The Greeks measure the sensitivity of an option’s price to various factors, helping traders manage risk and make informed trading decisions.

What updates are included in the 9th edition of this book?

The 9th edition includes updates on market practices, regulatory changes, and new financial instruments, providing a current and comprehensive understanding of the markets.

How can this book help beginners in the financial markets?

The book provides a structured introduction to derivatives, covering fundamental concepts, practical applications, and advanced strategies, making it an ideal resource for beginners.

Be the first to review “Option, Futures and Other Derivates 9th Edition” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.