-

×

The FX Swing Trading Blueprint with Swing FX

1 × $6.00

The FX Swing Trading Blueprint with Swing FX

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

Reversal Magic Video Course

1 × $15.00

Reversal Magic Video Course

1 × $15.00 -

×

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

Bulls on Wall Street Mentorship

1 × $31.00

Bulls on Wall Street Mentorship

1 × $31.00 -

×

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

Advanced Price Action Course with Chris Capre

1 × $7.00

Advanced Price Action Course with Chris Capre

1 × $7.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00 -

×

Scalping Master Course with Dayonetraders

1 × $6.00

Scalping Master Course with Dayonetraders

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

TREND/REV BLOCK AND EA FOREX SYSTEM (No MT4 Indicator) with IFXSuccess

1 × $69.00

TREND/REV BLOCK AND EA FOREX SYSTEM (No MT4 Indicator) with IFXSuccess

1 × $69.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

Programming in Python For Traders with Trading Markets

1 × $15.00

Programming in Python For Traders with Trading Markets

1 × $15.00 -

×

Intro To Short Selling with Madaz Money

1 × $31.00

Intro To Short Selling with Madaz Money

1 × $31.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00 -

×

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00 -

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

MahadFX Lifetime Discord Access

1 × $20.00

MahadFX Lifetime Discord Access

1 × $20.00 -

×

Forex Trading Using Fibonacci & Elliott Wave with Todd Gordon

1 × $6.00

Forex Trading Using Fibonacci & Elliott Wave with Todd Gordon

1 × $6.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

TRADING WITH TIME with Frank Barillaro

1 × $8.00

TRADING WITH TIME with Frank Barillaro

1 × $8.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

eASCTrend Training Seminar with Richard Kalla by Ablesys

1 × $6.00

eASCTrend Training Seminar with Richard Kalla by Ablesys

1 × $6.00 -

×

Stock Patterns for DayTrading. Home Study Course

1 × $6.00

Stock Patterns for DayTrading. Home Study Course

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Black Gold Strategies

1 × $23.00

Black Gold Strategies

1 × $23.00 -

×

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00 -

×

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00 -

×

Unreal Series - Forex Trading Master - Surreal Abilities with Talmadge Harper - Harper Healing

1 × $8.00

Unreal Series - Forex Trading Master - Surreal Abilities with Talmadge Harper - Harper Healing

1 × $8.00 -

×

Technician’s Guide to Day and Swing Trading with Martin Pring

1 × $6.00

Technician’s Guide to Day and Swing Trading with Martin Pring

1 × $6.00 -

×

The Pattern Trader with Mark Shawzin

1 × $6.00

The Pattern Trader with Mark Shawzin

1 × $6.00 -

×

Ultimate and Options Trading MasterClass Bundle with FX Evolution

1 × $54.00

Ultimate and Options Trading MasterClass Bundle with FX Evolution

1 × $54.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

Learn to Trade Course with Mike Aston

1 × $6.00

Learn to Trade Course with Mike Aston

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

Daytraders Survival Guide with Christopher Farrell

1 × $6.00

Daytraders Survival Guide with Christopher Farrell

1 × $6.00 -

×

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

B.O.S.S. SPY Sniper with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. SPY Sniper with Pat Mitchell – Trick Trades

1 × $39.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

Options University - FX Technical Analysis

1 × $6.00

Options University - FX Technical Analysis

1 × $6.00 -

×

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Member Only Videos with Henry W Steele

1 × $27.00

Member Only Videos with Henry W Steele

1 × $27.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

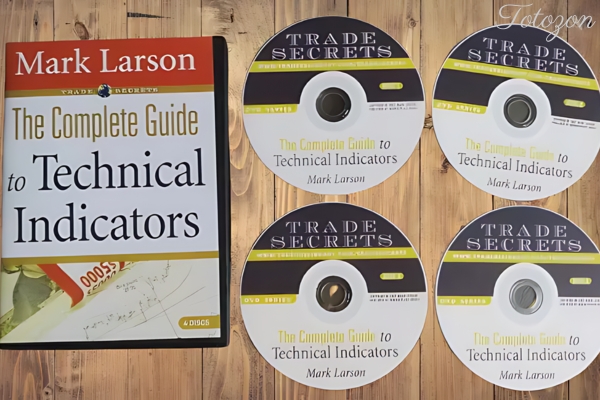

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

The Trap Trade Workshop with Doc Severson

1 × $6.00

The Trap Trade Workshop with Doc Severson

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Option Trading Camp

$15.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Option Trading Camp: Mastering the Market

Introduction

Welcome to the Option Trading Camp, where we dive deep into the dynamic world of options trading. Our camp is designed for both beginners and experienced traders looking to enhance their strategies and boost their market performance. In this article, we’ll cover everything you need to know about option trading, from the basics to advanced techniques.

What is Option Trading?

Option trading is a form of investment that allows traders to buy or sell options contracts, which give the holder the right (but not the obligation) to buy or sell an underlying asset at a predetermined price before a certain date. This can be a powerful tool for hedging risks or generating profits.

Why Attend an Option Trading Camp?

Attending an Option Trading Camp provides hands-on experience, expert guidance, and a supportive community. Here’s why it’s beneficial:

- Expert Instruction: Learn from seasoned traders with proven track records.

- Practical Application: Engage in live trading sessions and simulations.

- Networking Opportunities: Connect with fellow traders and industry professionals.

- Customized Learning: Tailored sessions to meet individual skill levels and goals.

Understanding Options: Calls and Puts

Call Options

A call option gives the holder the right to buy an asset at a specified price within a certain period. It’s a bullish strategy used when you anticipate the price of the asset will rise.

Put Options

Conversely, a put option gives the holder the right to sell an asset at a specified price within a certain period. This is a bearish strategy used when you expect the asset’s price to decline.

Key Components of Option Contracts

Strike Price

The strike price is the predetermined price at which the option holder can buy or sell the underlying asset.

Expiration Date

The expiration date is the last date on which the option can be exercised.

Premium

The premium is the price paid for purchasing the option contract.

Strategies for Option Trading

Basic Strategies

Covered Call

A covered call involves holding a long position in an asset and selling call options on the same asset to generate income.

Protective Put

A protective put strategy involves buying a put option for an asset you already own to guard against potential losses.

Advanced Strategies

Straddles and Strangles

These strategies involve buying both a call and a put option with the same expiration date but different strike prices to profit from significant price movements.

Spreads

Spreads involve buying and selling options of the same type (calls or puts) but with different strike prices or expiration dates to limit potential losses.

Risk Management in Option Trading

Importance of Risk Management

Effective risk management is crucial in options trading to protect your capital and ensure long-term success.

Risk Management Techniques

- Diversification: Spread your investments across different assets and strategies.

- Position Sizing: Determine the appropriate amount to invest in each trade.

- Stop-Loss Orders: Set predetermined levels to exit a trade and limit losses.

Tools and Resources for Option Traders

Trading Platforms

Select a robust trading platform that offers real-time data, analytical tools, and a user-friendly interface.

Educational Resources

Utilize books, online courses, webinars, and workshops to enhance your knowledge and skills.

Market Analysis Tools

Use technical and fundamental analysis tools to make informed trading decisions.

The Benefits of Option Trading Camps

Immersive Learning Experience

Engage in comprehensive learning sessions that cover theoretical and practical aspects of option trading.

Expert Guidance

Receive personalized coaching and mentorship from experienced traders.

Community Support

Join a community of like-minded individuals for networking and support.

Success Stories from Option Trading Camp

John’s Journey

John, a novice trader, attended our camp and transformed his trading approach. He now consistently achieves profitable trades.

Sarah’s Strategy

Sarah, an experienced trader, refined her strategies at our camp, resulting in a significant increase in her trading performance.

Conclusion

The Option Trading Camp is your gateway to mastering the complexities of options trading. Whether you’re a beginner looking to understand the basics or an experienced trader aiming to refine your strategies, our camp offers the tools, knowledge, and support you need to succeed. Join us and take your trading skills to the next level.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Option Trading Camp” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.