-

×

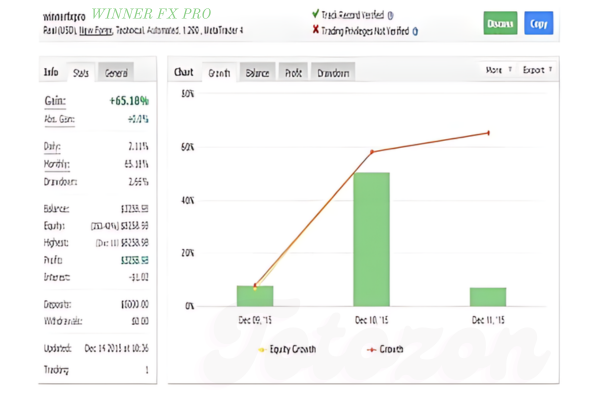

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading Pro System

1 × $31.00

Trading Pro System

1 × $31.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

The Viper Advanced Program

1 × $13.00

The Viper Advanced Program

1 × $13.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

The FOREX Blueprint with The Swag Academy

1 × $5.00

The FOREX Blueprint with The Swag Academy

1 × $5.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Scalping Betfair For Daily Profits

1 × $6.00

Scalping Betfair For Daily Profits

1 × $6.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Understanding Electronic DayTrading with Carol Troy

1 × $6.00

Understanding Electronic DayTrading with Carol Troy

1 × $6.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Astro FX 2.0

1 × $6.00

Astro FX 2.0

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00 -

×

The WallStreet Waltz with Ken Fisher

1 × $6.00

The WallStreet Waltz with Ken Fisher

1 × $6.00 -

×

Spotting Big Money with Market Profile with John Kepler

1 × $23.00

Spotting Big Money with Market Profile with John Kepler

1 × $23.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

The Complete FTMO Challenge Course with Petko Aleksandrov - EA Trading Academy

1 × $5.00

The Complete FTMO Challenge Course with Petko Aleksandrov - EA Trading Academy

1 × $5.00 -

×

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00 -

×

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00 -

×

Don Fishback ODDS The Key to 95 Winners

1 × $6.00

Don Fishback ODDS The Key to 95 Winners

1 × $6.00 -

×

Forex Knight Mentoring Program with Hector Deville

1 × $5.00

Forex Knight Mentoring Program with Hector Deville

1 × $5.00 -

×

GMMA Trend Volatility Management with Dary Guppy

1 × $6.00

GMMA Trend Volatility Management with Dary Guppy

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

International Trade & Economic Dynamics with Koji Shimomura

1 × $6.00

International Trade & Economic Dynamics with Koji Shimomura

1 × $6.00 -

×

BuySide Global Professional (Jul 2018)

1 × $101.00

BuySide Global Professional (Jul 2018)

1 × $101.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Rapid Cash & Success System

1 × $31.00

Rapid Cash & Success System

1 × $31.00 -

×

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

Hustle Trading FX Course

1 × $10.00

Hustle Trading FX Course

1 × $10.00 -

×

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Balance Trader – Market Profile Trading Course

1 × $23.00

Balance Trader – Market Profile Trading Course

1 × $23.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

The 1% Club with Trader Mike

1 × $5.00

The 1% Club with Trader Mike

1 × $5.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

Unlock the Millionaire Within with Dan Lok

1 × $15.00

Unlock the Millionaire Within with Dan Lok

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

Trade for Life - 5 Day Trading Laboratory

1 × $54.00

Trade for Life - 5 Day Trading Laboratory

1 × $54.00 -

×

Bollinger Band Jackpot with Mark Deaton

1 × $31.00

Bollinger Band Jackpot with Mark Deaton

1 × $31.00 -

×

QuantZilla

1 × $39.00

QuantZilla

1 × $39.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

Stock Patterns for DayTrading I & II with Barry Rudd

1 × $6.00

Stock Patterns for DayTrading I & II with Barry Rudd

1 × $6.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

Turtle Trading Concepts with Russell Sands

1 × $6.00

Turtle Trading Concepts with Russell Sands

1 × $6.00 -

×

Trading Order Power Strategies

1 × $6.00

Trading Order Power Strategies

1 × $6.00 -

×

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00 -

×

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00 -

×

The Bulls Eye System – Ready Aim Fire

1 × $31.00

The Bulls Eye System – Ready Aim Fire

1 × $31.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00 -

×

University Tutorial

1 × $6.00

University Tutorial

1 × $6.00 -

×

Ninja Order Flow Trader (NOFT)

1 × $39.00

Ninja Order Flow Trader (NOFT)

1 × $39.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

Secrets of a Pivot Boss. Revealing Proven Methods for Profiting in The Market with Franklin Ochoa

1 × $6.00

Secrets of a Pivot Boss. Revealing Proven Methods for Profiting in The Market with Franklin Ochoa

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

One Shot One Kill Trading with John Netto

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “One Shot One Kill Trading with John Netto” below:

One Shot One Kill Trading with John Netto

In the competitive world of trading, having a unique and effective strategy can make all the difference. John Netto’s “One Shot One Kill Trading” is a methodology designed to maximize efficiency and profitability by focusing on precision and timing. This article delves into the core concepts of Netto’s trading approach, its benefits, and how you can implement it in your trading routine.

Who is John Netto?

John Netto is a seasoned trader, author, and speaker known for his innovative approaches to trading. His experience spans multiple asset classes, and he is highly regarded for his ability to simplify complex trading strategies.

Netto’s Trading Philosophy

John Netto emphasizes the importance of precision, discipline, and timing in trading. His “One Shot One Kill” methodology reflects these principles, aiming to capture significant profits with minimal trades.

Understanding One Shot One Kill Trading

What is One Shot One Kill Trading?

One Shot One Kill Trading is a strategy that focuses on making high-probability trades with a single, well-timed entry and exit. The goal is to maximize returns while minimizing risk and market exposure.

Key Principles

- Precision: Carefully selecting trades based on rigorous analysis.

- Timing: Entering and exiting the market at the optimal moments.

- Discipline: Sticking to the plan and avoiding impulsive decisions.

Components of One Shot One Kill Trading

Market Analysis

Market analysis is the foundation of Netto’s strategy. This involves both technical and fundamental analysis to identify potential trade opportunities.

Technical Analysis

- Charts and Patterns: Analyzing price charts and identifying patterns.

- Indicators: Using technical indicators to support decision-making.

Fundamental Analysis

- Economic Data: Considering economic reports and data.

- Market Sentiment: Gauging market sentiment to anticipate movements.

Trade Execution

The execution of trades in One Shot One Kill Trading is critical. It involves precise entry and exit points to maximize profit and minimize risk.

Entry Points

Identifying the right entry points is essential for this strategy. Netto often uses technical indicators and price action to determine the best moments to enter a trade.

Exit Points

Knowing when to exit is just as important as knowing when to enter. This can be based on profit targets, stop-loss orders, or market conditions.

Risk Management

Effective risk management is a cornerstone of One Shot One Kill Trading. This involves setting stop-loss levels, managing position sizes, and maintaining a balanced portfolio.

Stop-Loss Orders

Using stop-loss orders helps protect against significant losses by automatically closing positions at predetermined levels.

Position Sizing

Proper position sizing ensures that no single trade can have a disproportionately large impact on your portfolio.

Benefits of One Shot One Kill Trading

Increased Efficiency

By focusing on high-probability trades, traders can potentially achieve higher returns with fewer trades, making the trading process more efficient.

Reduced Stress

Minimizing the number of trades can reduce the stress and emotional strain often associated with active trading.

Enhanced Discipline

The strategy encourages discipline by requiring traders to adhere to a well-defined plan and avoid impulsive decisions.

Implementing One Shot One Kill Trading

Step 1: Educate Yourself

Start by learning the basics of Netto’s strategy through his books, courses, and other resources.

Step 2: Develop a Trading Plan

Create a detailed trading plan that outlines your analysis methods, entry and exit criteria, and risk management rules.

Step 3: Practice

Use a demo account to practice the strategy without risking real money. This will help you gain confidence and refine your approach.

Step 4: Start Small

Begin trading with a small amount of capital and gradually increase your position sizes as you become more comfortable with the strategy.

Common Challenges and Solutions

Challenge 1: Market Volatility

Market volatility can make it difficult to time entries and exits accurately.

Solution: Stay Informed

Keep up with market news and adjust your strategy as needed to account for changing conditions.

Challenge 2: Emotional Trading

Emotional reactions can lead to impulsive decisions that deviate from your plan.

Solution: Maintain Discipline

Stick to your trading plan and use tools like stop-loss orders to enforce discipline.

Conclusion

John Netto’s “One Shot One Kill Trading” offers a unique and effective approach to trading that emphasizes precision, timing, and discipline. By focusing on high-probability trades and minimizing market exposure, traders can potentially achieve significant returns with less stress and effort. Whether you’re a seasoned trader or a beginner, this strategy provides valuable insights and techniques to enhance your trading performance.

FAQs

1. What is One Shot One Kill Trading?

- It is a trading strategy developed by John Netto that focuses on making high-probability trades with precise timing and minimal market exposure.

2. Who is John Netto?

- John Netto is a renowned trader, author, and speaker known for his innovative trading strategies and expertise across multiple asset classes.

3. How does this strategy benefit traders?

- The strategy increases efficiency, reduces stress, and enhances discipline by focusing on well-timed, high-probability trades.

4. What are the key components of One Shot One Kill Trading?

- The key components include market analysis, trade execution, and risk management.

5. How can I start implementing this strategy?

- Educate yourself on the strategy, develop a detailed trading plan, practice with a demo account, and start trading with a small amount of capital.

Be the first to review “One Shot One Kill Trading with John Netto” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.