-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Inner Circle Trader

1 × $6.00

Inner Circle Trader

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

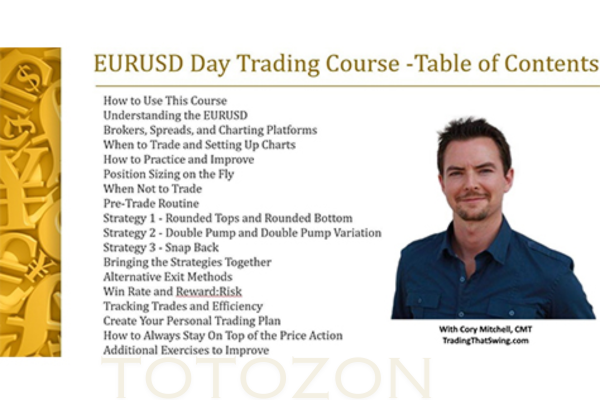

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Using the Techniques of Andrews & Babson

1 × $6.00

Using the Techniques of Andrews & Babson

1 × $6.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

The Double Thurst Stock Trading System

1 × $15.00

The Double Thurst Stock Trading System

1 × $15.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

The Volatility Surface with Jim Gatheral

1 × $6.00

The Volatility Surface with Jim Gatheral

1 × $6.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Optionetics Trading Strategies

1 × $5.00

Optionetics Trading Strategies

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading with Fibonacci and Market Structure - Price Action Volume Trader

1 × $23.00

Trading with Fibonacci and Market Structure - Price Action Volume Trader

1 × $23.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

Bookmap Masterclass with Trading To Win

1 × $6.00

Bookmap Masterclass with Trading To Win

1 × $6.00 -

×

Harmonic Multi-Patterns with Scan Watchlist for Thinkorswim and Mobile

1 × $6.00

Harmonic Multi-Patterns with Scan Watchlist for Thinkorswim and Mobile

1 × $6.00 -

×

Bobokus Training Program

1 × $6.00

Bobokus Training Program

1 × $6.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

Complete 32+ Hour Video Training Course 2008

1 × $23.00

Complete 32+ Hour Video Training Course 2008

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

Pivot Day Trader for NinjaTrader

1 × $31.00

Pivot Day Trader for NinjaTrader

1 × $31.00 -

×

Recover Your Losses & Double Your Account Size with Tokyo The Trader - PLFCrypto

1 × $6.00

Recover Your Losses & Double Your Account Size with Tokyo The Trader - PLFCrypto

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Trading Harmonically with the Universe By John Jace

1 × $4.00

Trading Harmonically with the Universe By John Jace

1 × $4.00 -

×

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00

One Shot One Kill Trading with John Netto

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “One Shot One Kill Trading with John Netto” below:

One Shot One Kill Trading with John Netto

In the competitive world of trading, having a unique and effective strategy can make all the difference. John Netto’s “One Shot One Kill Trading” is a methodology designed to maximize efficiency and profitability by focusing on precision and timing. This article delves into the core concepts of Netto’s trading approach, its benefits, and how you can implement it in your trading routine.

Who is John Netto?

John Netto is a seasoned trader, author, and speaker known for his innovative approaches to trading. His experience spans multiple asset classes, and he is highly regarded for his ability to simplify complex trading strategies.

Netto’s Trading Philosophy

John Netto emphasizes the importance of precision, discipline, and timing in trading. His “One Shot One Kill” methodology reflects these principles, aiming to capture significant profits with minimal trades.

Understanding One Shot One Kill Trading

What is One Shot One Kill Trading?

One Shot One Kill Trading is a strategy that focuses on making high-probability trades with a single, well-timed entry and exit. The goal is to maximize returns while minimizing risk and market exposure.

Key Principles

- Precision: Carefully selecting trades based on rigorous analysis.

- Timing: Entering and exiting the market at the optimal moments.

- Discipline: Sticking to the plan and avoiding impulsive decisions.

Components of One Shot One Kill Trading

Market Analysis

Market analysis is the foundation of Netto’s strategy. This involves both technical and fundamental analysis to identify potential trade opportunities.

Technical Analysis

- Charts and Patterns: Analyzing price charts and identifying patterns.

- Indicators: Using technical indicators to support decision-making.

Fundamental Analysis

- Economic Data: Considering economic reports and data.

- Market Sentiment: Gauging market sentiment to anticipate movements.

Trade Execution

The execution of trades in One Shot One Kill Trading is critical. It involves precise entry and exit points to maximize profit and minimize risk.

Entry Points

Identifying the right entry points is essential for this strategy. Netto often uses technical indicators and price action to determine the best moments to enter a trade.

Exit Points

Knowing when to exit is just as important as knowing when to enter. This can be based on profit targets, stop-loss orders, or market conditions.

Risk Management

Effective risk management is a cornerstone of One Shot One Kill Trading. This involves setting stop-loss levels, managing position sizes, and maintaining a balanced portfolio.

Stop-Loss Orders

Using stop-loss orders helps protect against significant losses by automatically closing positions at predetermined levels.

Position Sizing

Proper position sizing ensures that no single trade can have a disproportionately large impact on your portfolio.

Benefits of One Shot One Kill Trading

Increased Efficiency

By focusing on high-probability trades, traders can potentially achieve higher returns with fewer trades, making the trading process more efficient.

Reduced Stress

Minimizing the number of trades can reduce the stress and emotional strain often associated with active trading.

Enhanced Discipline

The strategy encourages discipline by requiring traders to adhere to a well-defined plan and avoid impulsive decisions.

Implementing One Shot One Kill Trading

Step 1: Educate Yourself

Start by learning the basics of Netto’s strategy through his books, courses, and other resources.

Step 2: Develop a Trading Plan

Create a detailed trading plan that outlines your analysis methods, entry and exit criteria, and risk management rules.

Step 3: Practice

Use a demo account to practice the strategy without risking real money. This will help you gain confidence and refine your approach.

Step 4: Start Small

Begin trading with a small amount of capital and gradually increase your position sizes as you become more comfortable with the strategy.

Common Challenges and Solutions

Challenge 1: Market Volatility

Market volatility can make it difficult to time entries and exits accurately.

Solution: Stay Informed

Keep up with market news and adjust your strategy as needed to account for changing conditions.

Challenge 2: Emotional Trading

Emotional reactions can lead to impulsive decisions that deviate from your plan.

Solution: Maintain Discipline

Stick to your trading plan and use tools like stop-loss orders to enforce discipline.

Conclusion

John Netto’s “One Shot One Kill Trading” offers a unique and effective approach to trading that emphasizes precision, timing, and discipline. By focusing on high-probability trades and minimizing market exposure, traders can potentially achieve significant returns with less stress and effort. Whether you’re a seasoned trader or a beginner, this strategy provides valuable insights and techniques to enhance your trading performance.

FAQs

1. What is One Shot One Kill Trading?

- It is a trading strategy developed by John Netto that focuses on making high-probability trades with precise timing and minimal market exposure.

2. Who is John Netto?

- John Netto is a renowned trader, author, and speaker known for his innovative trading strategies and expertise across multiple asset classes.

3. How does this strategy benefit traders?

- The strategy increases efficiency, reduces stress, and enhances discipline by focusing on well-timed, high-probability trades.

4. What are the key components of One Shot One Kill Trading?

- The key components include market analysis, trade execution, and risk management.

5. How can I start implementing this strategy?

- Educate yourself on the strategy, develop a detailed trading plan, practice with a demo account, and start trading with a small amount of capital.

Be the first to review “One Shot One Kill Trading with John Netto” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.