-

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trading Psychology Masterclass with Jared Tendler - TraderLion

1 × $5.00

Trading Psychology Masterclass with Jared Tendler - TraderLion

1 × $5.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Ultimate Guide to Stock Investing

1 × $6.00

Ultimate Guide to Stock Investing

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Wave Trading

1 × $23.00

Wave Trading

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Trading the Elliott Waves with Robert Prechter

1 × $15.00

Trading the Elliott Waves with Robert Prechter

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

International Assignments with Linda K.Stroh

1 × $6.00

International Assignments with Linda K.Stroh

1 × $6.00 -

×

Forex Powerband Dominator

1 × $6.00

Forex Powerband Dominator

1 × $6.00 -

×

Evolution Forex Trading

1 × $31.00

Evolution Forex Trading

1 × $31.00 -

×

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00 -

×

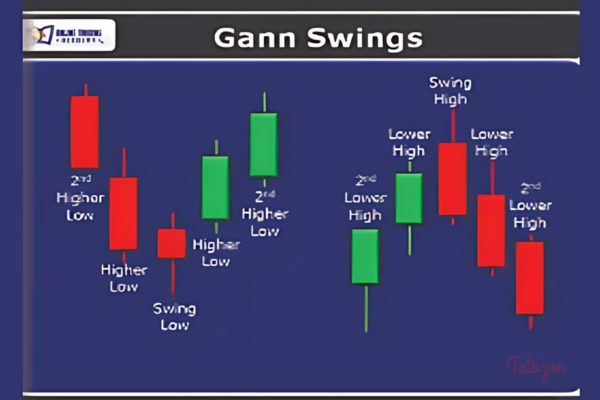

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Forex Masterclass with 20 Minute Trader

1 × $23.00

Forex Masterclass with 20 Minute Trader

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00 -

×

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00 -

×

Opportunity Investing with Gerald Appel

1 × $6.00

Opportunity Investing with Gerald Appel

1 × $6.00 -

×

New York Super Conference 2016 Videos

1 × $31.00

New York Super Conference 2016 Videos

1 × $31.00 -

×

The New Multi-10x on Steroids Pro Package

1 × $78.00

The New Multi-10x on Steroids Pro Package

1 × $78.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

Intermarket Analysis with John Murphy

1 × $6.00

Intermarket Analysis with John Murphy

1 × $6.00 -

×

PiScaled

1 × $6.00

PiScaled

1 × $6.00 -

×

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00 -

×

Market Wizards with Jack Schwager

1 × $6.00

Market Wizards with Jack Schwager

1 × $6.00 -

×

Day Trade to Win E-Course with John Paul

1 × $6.00

Day Trade to Win E-Course with John Paul

1 × $6.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

The Inve$tment A$trology Articles with Alan Richter

1 × $6.00

The Inve$tment A$trology Articles with Alan Richter

1 × $6.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00 -

×

Support Resistance

1 × $23.00

Support Resistance

1 × $23.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00 -

×

Insider Signal Exclusive Forex Course with Andy X

1 × $7.00

Insider Signal Exclusive Forex Course with Andy X

1 × $7.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

Market Mindfields - 2 DVDs with Ryan Litchfield

1 × $6.00

Market Mindfields - 2 DVDs with Ryan Litchfield

1 × $6.00 -

×

Technical Analysis with Alexander Elder Video Series

1 × $6.00

Technical Analysis with Alexander Elder Video Series

1 × $6.00 -

×

Limitless FX Academy Course

1 × $5.00

Limitless FX Academy Course

1 × $5.00 -

×

Stock Trading Success System 14 DVD with Steve Nison & Ken Calhoun

1 × $23.00

Stock Trading Success System 14 DVD with Steve Nison & Ken Calhoun

1 × $23.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

MACK - PATS Simple ES Scalping Strategy

1 × $15.00

MACK - PATS Simple ES Scalping Strategy

1 × $15.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Complete Cryptocurrency Trading 2021

1 × $5.00

Complete Cryptocurrency Trading 2021

1 × $5.00 -

×

European Fixed Income Markets with Jonathan Batten

1 × $6.00

European Fixed Income Markets with Jonathan Batten

1 × $6.00 -

×

Mining for Golden Trading Opportunities with Jake Bernstein

1 × $8.00

Mining for Golden Trading Opportunities with Jake Bernstein

1 × $8.00 -

×

Options University - 3rd Anual Forex Superconference

1 × $3.00

Options University - 3rd Anual Forex Superconference

1 × $3.00 -

×

The New Trading For a Living with Alexander Elder

1 × $23.00

The New Trading For a Living with Alexander Elder

1 × $23.00 -

×

Level 2 Trading Warfare

1 × $6.00

Level 2 Trading Warfare

1 × $6.00 -

×

Flipping Markets Video Course (2022)

1 × $5.00

Flipping Markets Video Course (2022)

1 × $5.00 -

×

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00 -

×

SOAP. Served On A Platter CD with David Elliott

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

1 × $6.00 -

×

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00 -

×

Flux Trigger Pack - Back To The Future Trading

1 × $15.00

Flux Trigger Pack - Back To The Future Trading

1 × $15.00 -

×

The Mango Trade 2017

1 × $6.00

The Mango Trade 2017

1 × $6.00 -

×

AdjustMax

1 × $31.00

AdjustMax

1 × $31.00 -

×

The Art Of Adaptive Trading Using Market Profile & Market Delta

1 × $23.00

The Art Of Adaptive Trading Using Market Profile & Market Delta

1 × $23.00 -

×

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

One Shot One Kill Trading with John Netto

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “One Shot One Kill Trading with John Netto” below:

One Shot One Kill Trading with John Netto

In the competitive world of trading, having a unique and effective strategy can make all the difference. John Netto’s “One Shot One Kill Trading” is a methodology designed to maximize efficiency and profitability by focusing on precision and timing. This article delves into the core concepts of Netto’s trading approach, its benefits, and how you can implement it in your trading routine.

Who is John Netto?

John Netto is a seasoned trader, author, and speaker known for his innovative approaches to trading. His experience spans multiple asset classes, and he is highly regarded for his ability to simplify complex trading strategies.

Netto’s Trading Philosophy

John Netto emphasizes the importance of precision, discipline, and timing in trading. His “One Shot One Kill” methodology reflects these principles, aiming to capture significant profits with minimal trades.

Understanding One Shot One Kill Trading

What is One Shot One Kill Trading?

One Shot One Kill Trading is a strategy that focuses on making high-probability trades with a single, well-timed entry and exit. The goal is to maximize returns while minimizing risk and market exposure.

Key Principles

- Precision: Carefully selecting trades based on rigorous analysis.

- Timing: Entering and exiting the market at the optimal moments.

- Discipline: Sticking to the plan and avoiding impulsive decisions.

Components of One Shot One Kill Trading

Market Analysis

Market analysis is the foundation of Netto’s strategy. This involves both technical and fundamental analysis to identify potential trade opportunities.

Technical Analysis

- Charts and Patterns: Analyzing price charts and identifying patterns.

- Indicators: Using technical indicators to support decision-making.

Fundamental Analysis

- Economic Data: Considering economic reports and data.

- Market Sentiment: Gauging market sentiment to anticipate movements.

Trade Execution

The execution of trades in One Shot One Kill Trading is critical. It involves precise entry and exit points to maximize profit and minimize risk.

Entry Points

Identifying the right entry points is essential for this strategy. Netto often uses technical indicators and price action to determine the best moments to enter a trade.

Exit Points

Knowing when to exit is just as important as knowing when to enter. This can be based on profit targets, stop-loss orders, or market conditions.

Risk Management

Effective risk management is a cornerstone of One Shot One Kill Trading. This involves setting stop-loss levels, managing position sizes, and maintaining a balanced portfolio.

Stop-Loss Orders

Using stop-loss orders helps protect against significant losses by automatically closing positions at predetermined levels.

Position Sizing

Proper position sizing ensures that no single trade can have a disproportionately large impact on your portfolio.

Benefits of One Shot One Kill Trading

Increased Efficiency

By focusing on high-probability trades, traders can potentially achieve higher returns with fewer trades, making the trading process more efficient.

Reduced Stress

Minimizing the number of trades can reduce the stress and emotional strain often associated with active trading.

Enhanced Discipline

The strategy encourages discipline by requiring traders to adhere to a well-defined plan and avoid impulsive decisions.

Implementing One Shot One Kill Trading

Step 1: Educate Yourself

Start by learning the basics of Netto’s strategy through his books, courses, and other resources.

Step 2: Develop a Trading Plan

Create a detailed trading plan that outlines your analysis methods, entry and exit criteria, and risk management rules.

Step 3: Practice

Use a demo account to practice the strategy without risking real money. This will help you gain confidence and refine your approach.

Step 4: Start Small

Begin trading with a small amount of capital and gradually increase your position sizes as you become more comfortable with the strategy.

Common Challenges and Solutions

Challenge 1: Market Volatility

Market volatility can make it difficult to time entries and exits accurately.

Solution: Stay Informed

Keep up with market news and adjust your strategy as needed to account for changing conditions.

Challenge 2: Emotional Trading

Emotional reactions can lead to impulsive decisions that deviate from your plan.

Solution: Maintain Discipline

Stick to your trading plan and use tools like stop-loss orders to enforce discipline.

Conclusion

John Netto’s “One Shot One Kill Trading” offers a unique and effective approach to trading that emphasizes precision, timing, and discipline. By focusing on high-probability trades and minimizing market exposure, traders can potentially achieve significant returns with less stress and effort. Whether you’re a seasoned trader or a beginner, this strategy provides valuable insights and techniques to enhance your trading performance.

FAQs

1. What is One Shot One Kill Trading?

- It is a trading strategy developed by John Netto that focuses on making high-probability trades with precise timing and minimal market exposure.

2. Who is John Netto?

- John Netto is a renowned trader, author, and speaker known for his innovative trading strategies and expertise across multiple asset classes.

3. How does this strategy benefit traders?

- The strategy increases efficiency, reduces stress, and enhances discipline by focusing on well-timed, high-probability trades.

4. What are the key components of One Shot One Kill Trading?

- The key components include market analysis, trade execution, and risk management.

5. How can I start implementing this strategy?

- Educate yourself on the strategy, develop a detailed trading plan, practice with a demo account, and start trading with a small amount of capital.

Be the first to review “One Shot One Kill Trading with John Netto” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.