-

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

TRADING WITH TIME with Frank Barillaro

1 × $8.00

TRADING WITH TIME with Frank Barillaro

1 × $8.00 -

×

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00 -

×

PRICE ACTION MASTERY

1 × $39.00

PRICE ACTION MASTERY

1 × $39.00 -

×

Options Mastery 32 DVDs

1 × $6.00

Options Mastery 32 DVDs

1 × $6.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00 -

×

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00 -

×

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00 -

×

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00 -

×

Technical Analysis Package with Martin Pring

1 × $4.00

Technical Analysis Package with Martin Pring

1 × $4.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

Confidence to Hypnotize

1 × $6.00

Confidence to Hypnotize

1 × $6.00 -

×

Beginner to Advanced Trader with Mikesh Shah

1 × $6.00

Beginner to Advanced Trader with Mikesh Shah

1 × $6.00 -

×

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00 -

×

MLT Divergence Indicator with Major League Trading

1 × $23.00

MLT Divergence Indicator with Major League Trading

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00 -

×

The Next Big Investment Boom with Mark Shipman

1 × $6.00

The Next Big Investment Boom with Mark Shipman

1 × $6.00 -

×

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00 -

×

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00 -

×

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00 -

×

Forex Made Easy: 6 Ways to Trade the Dollar with James Dicks

1 × $6.00

Forex Made Easy: 6 Ways to Trade the Dollar with James Dicks

1 × $6.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

Forex Mastery Course [6 DVDs (30 FLVs) + (PDF)]

1 × $15.00

Forex Mastery Course [6 DVDs (30 FLVs) + (PDF)]

1 × $15.00 -

×

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

Rich Jerk Program

1 × $15.00

Rich Jerk Program

1 × $15.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Profit Freedom Blueprint with High Performance Trading

1 × $5.00

Profit Freedom Blueprint with High Performance Trading

1 × $5.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Introduction to Candlestick (Article) with Arthur A.Hill

1 × $6.00

Introduction to Candlestick (Article) with Arthur A.Hill

1 × $6.00 -

×

The Power of the Hexagon

1 × $6.00

The Power of the Hexagon

1 × $6.00 -

×

Bennett McDowell – A Trader’s Money Management System

1 × $6.00

Bennett McDowell – A Trader’s Money Management System

1 × $6.00 -

×

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00 -

×

Level II Profit System with Sammy Chua

1 × $6.00

Level II Profit System with Sammy Chua

1 × $6.00 -

×

Encyclopedia of Planetary Aspects for Short Term TradingPatrick Mikula – Encyclopedia of Planetary Aspects for Short Term Trading

1 × $4.00

Encyclopedia of Planetary Aspects for Short Term TradingPatrick Mikula – Encyclopedia of Planetary Aspects for Short Term Trading

1 × $4.00 -

×

AstuceFX Mentorship 2023

1 × $27.00

AstuceFX Mentorship 2023

1 × $27.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

On-Demand Options with Sang Lucci

1 × $6.00

On-Demand Options with Sang Lucci

1 × $6.00 -

×

Unedited Superconference 2010

1 × $15.00

Unedited Superconference 2010

1 × $15.00 -

×

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Trade Queen Pro with Tamia Johnson

1 × $54.00

Trade Queen Pro with Tamia Johnson

1 × $54.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00 -

×

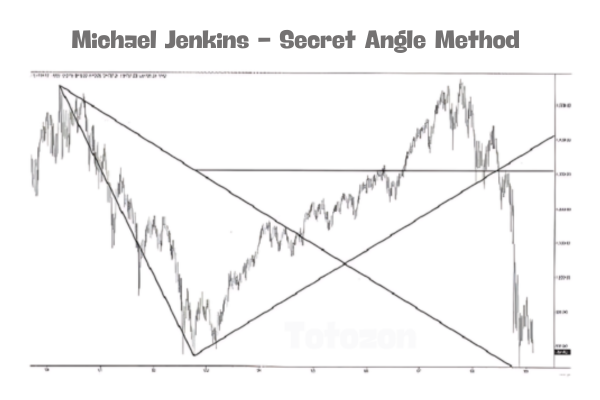

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

Trading Using Ocean Theory with Pat Raffolovich

$4.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Mastering Ocean Theory for Trading with Pat Raffolovich

Introduction

Ocean Theory, introduced by Pat Raffolovich, offers a novel approach to trading by drawing parallels between market movements and oceanic waves. This method emphasizes the cyclical nature of markets, aiming to help traders predict trends and make informed decisions. In this article, we delve into the fundamentals of Ocean Theory, explore its practical applications, and provide insights into how traders can leverage this unique approach to enhance their trading strategies.

Who is Pat Raffolovich?

Background and Expertise

Pat Raffolovich is a seasoned trader and market analyst with a deep understanding of market dynamics. His innovative Ocean Theory has gained recognition for its ability to simplify complex market movements and provide actionable insights.

Contributions to Trading

Raffolovich’s contributions extend beyond Ocean Theory. He has authored several books and articles, sharing his expertise and helping traders navigate the financial markets with confidence.

Understanding Ocean Theory

What is Ocean Theory?

Ocean Theory is a trading methodology that likens market movements to the behavior of ocean waves. Just as waves have cycles of rising and falling, markets exhibit similar patterns that can be analyzed and predicted.

Key Principles of Ocean Theory

Wave Cycles

Wave cycles are fundamental to Ocean Theory. These cycles include crest (peak), trough (bottom), and the movement between these points, representing market highs and lows.

Tidal Forces

Tidal forces in Ocean Theory refer to the broader market trends that influence individual wave cycles. Understanding these forces helps traders align their strategies with the prevailing market direction.

Market Sentiment

Market sentiment, akin to the mood of the ocean, plays a crucial role in Ocean Theory. Traders need to gauge sentiment to anticipate market movements effectively.

Applying Ocean Theory in Trading

Identifying Wave Cycles

Crests and Troughs

Traders should identify the crests and troughs of market cycles. This involves analyzing historical price data to pinpoint previous highs and lows.

Wave Length and Amplitude

Understanding the length (duration) and amplitude (height) of waves is essential. Longer cycles may indicate significant market trends, while shorter cycles could represent minor fluctuations.

Analyzing Tidal Forces

Trend Identification

Use technical analysis tools like moving averages and trend lines to identify overarching market trends. This helps in aligning trades with the broader market direction.

Sentiment Analysis

Gauge market sentiment through indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). Positive sentiment often aligns with rising waves, while negative sentiment corresponds with falling waves.

Developing a Trading Strategy

Combining Ocean Theory with Technical Analysis

Support and Resistance Levels

Identify key support and resistance levels based on wave cycles. These levels act as critical points for entering or exiting trades.

Indicators and Oscillators

Incorporate indicators like Bollinger Bands and Stochastic Oscillators to refine entry and exit points. These tools complement Ocean Theory by providing additional confirmation.

Risk Management

Setting Stop-Loss Orders

Implement stop-loss orders at strategic points to manage risk. These should be placed below troughs for long positions and above crests for short positions.

Position Sizing

Adjust position sizes based on the strength and duration of wave cycles. Larger positions may be warranted in strong trending markets, while smaller positions are advisable in volatile conditions.

Practical Examples

Case Study: Forex Trading with Ocean Theory

Setup and Analysis

Analyze currency pairs to identify wave cycles and prevailing tidal forces. Use historical data to map out crests and troughs.

Trade Execution

Execute trades based on the identified patterns. For instance, buy at troughs during an upward trend and sell at crests during a downward trend.

Case Study: Stock Market Analysis

Identifying Patterns

Apply Ocean Theory to stock indices to recognize wave cycles. Combine this with sentiment analysis to forecast market movements.

Trade Implementation

Implement trades aligned with the broader market trend. Use technical indicators to confirm entry and exit points, enhancing the probability of success.

Benefits of Using Ocean Theory

Enhanced Market Insight

Ocean Theory provides a clear framework for understanding market movements, helping traders anticipate trends and make informed decisions.

Structured Approach

The method’s structured approach reduces emotional trading, promoting discipline and consistency.

Long-Term Perspective

Ocean Theory’s emphasis on cycles and trends offers a long-term perspective, aiding in strategic planning and investment decisions.

Challenges and Considerations

Complexity of Analysis

While Ocean Theory simplifies market movements, it requires diligent analysis and interpretation. Traders must invest time in mastering the principles and applying them effectively.

Integration with Other Methods

Combining Ocean Theory with other trading methodologies enhances its effectiveness. Traders should be open to integrating various tools and techniques.

Market Variability

Market conditions can change rapidly. Ocean Theory should be applied flexibly, with adjustments made as necessary to adapt to evolving market dynamics.

Conclusion

Trading using Ocean Theory, as developed by Pat Raffolovich, offers a unique and insightful approach to market analysis. By understanding and applying the principles of wave cycles, tidal forces, and market sentiment, traders can enhance their strategies and improve their trading outcomes. While the method requires dedication and practice, its benefits in providing structured and disciplined trading cannot be overstated.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trading Using Ocean Theory with Pat Raffolovich” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.