-

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

ICT Charter Complete Course (2019)

1 × $13.00

ICT Charter Complete Course (2019)

1 × $13.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00 -

×

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00 -

×

George Bayer Squarring the Circle for Excel

1 × $6.00

George Bayer Squarring the Circle for Excel

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The New Goldrush Of 2021 with Keith Dougherty

$497.00 Original price was: $497.00.$46.00Current price is: $46.00.

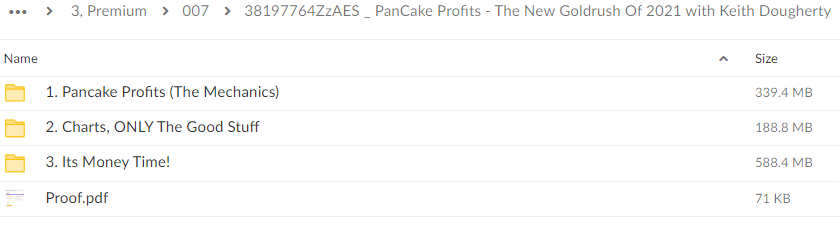

File Size: 1.09 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The New Goldrush Of 2021 with Keith Dougherty” below:

The New Goldrush Of 2021: Unveiling Opportunities with Keith Dougherty

In the ever-evolving landscape of investment opportunities, the year 2021 has witnessed a resurgence of interest in gold and precious metals. As markets continue to navigate uncertainty and volatility, investors are turning to assets like gold as a safe haven and hedge against inflation. In this comprehensive guide, we delve into the new gold rush of 2021 and explore the opportunities it presents for investors, with insights from renowned financial expert Keith Dougherty.

Understanding the Gold Market

1. Historical Significance of Gold

- Gold has long been revered as a store of value and a symbol of wealth, with a history dating back thousands of years.

2. Factors Driving Gold Prices

- Economic uncertainty, geopolitical tensions, inflationary pressures, and central bank policies are among the key factors influencing gold prices.

The New Gold Rush of 2021

1. Impact of the Pandemic

- The COVID-19 pandemic has accelerated interest in gold as a safe haven asset, with investors seeking refuge from market volatility and economic uncertainty.

2. Inflation Concerns

- Rising inflationary pressures have fueled demand for gold as a hedge against currency depreciation and purchasing power erosion.

3. Central Bank Policies

- Stimulus measures and accommodative monetary policies implemented by central banks worldwide have bolstered gold prices, as investors seek alternative stores of value.

Investment Opportunities

1. Physical Gold

- Investors can purchase physical gold in the form of bullion, coins, or bars, providing a tangible asset with intrinsic value.

2. Gold Exchange-Traded Funds (ETFs)

- Gold ETFs offer investors exposure to gold prices without the need for physical ownership, providing liquidity and ease of trading.

3. Gold Mining Stocks

- Investing in gold mining companies can offer leverage to gold prices, with potential for significant returns if gold prices continue to rise.

Conclusion

The new gold rush of 2021 presents compelling opportunities for investors looking to diversify their portfolios and protect their wealth in uncertain times. Whether through physical gold, ETFs, or gold mining stocks, gold remains a timeless asset with the potential to deliver long-term value.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “The New Goldrush Of 2021 with Keith Dougherty” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.