-

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

How I Trade Options with Jon Najarian

1 × $4.00

How I Trade Options with Jon Najarian

1 × $4.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Tornado Trend Trading System with John Bartlett

1 × $6.00

Tornado Trend Trading System with John Bartlett

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00 -

×

What Works in Online Trading with Mark Etzkorn

1 × $6.00

What Works in Online Trading with Mark Etzkorn

1 × $6.00 -

×

NQ Price Action Mastery with Trade Smart

1 × $15.00

NQ Price Action Mastery with Trade Smart

1 × $15.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

Forex EURUSD Trader Live Training (2012)

1 × $6.00

Forex EURUSD Trader Live Training (2012)

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

Activedaytrader - Workshop: Unusual Options

1 × $6.00

Activedaytrader - Workshop: Unusual Options

1 × $6.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

Vertex Investing Course

1 × $6.00

Vertex Investing Course

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Power Charting - Robert’s Indicator Webinar

1 × $6.00

Power Charting - Robert’s Indicator Webinar

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

The Heretics of Finance with Andrew Lo & Jasmina Hasanhodzic

1 × $4.00

The Heretics of Finance with Andrew Lo & Jasmina Hasanhodzic

1 × $4.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Forecasting Financial Markets (2nd Ed.)

1 × $6.00

Forecasting Financial Markets (2nd Ed.)

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Charting Made Easy with John J.Murphy

1 × $6.00

Charting Made Easy with John J.Murphy

1 × $6.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

Traders Secret Library

1 × $6.00

Traders Secret Library

1 × $6.00 -

×

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

Duxinator: High Odds Penny Trading Presented with Steven Dux

1 × $6.00

Duxinator: High Odds Penny Trading Presented with Steven Dux

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

Ultimate Options Blue Print Course

1 × $23.00

Ultimate Options Blue Print Course

1 × $23.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

E75 Forex System with James de Wet

1 × $6.00

E75 Forex System with James de Wet

1 × $6.00 -

×

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

Advanced Nasdaq Trading Techniques with Alan Rich

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

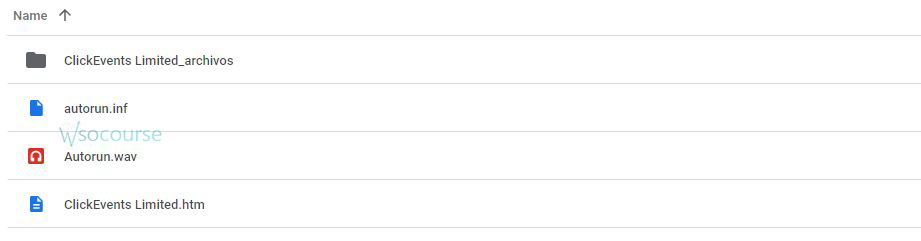

Content Proof: Watch Here!

You may check content proof of “Advanced Nasdaq Trading Techniques with Alan Rich” below:

Advanced Nasdaq Trading Techniques with Alan Rich

Introduction to Advanced Nasdaq Trading

Navigating the Nasdaq requires a blend of skill, knowledge, and advanced techniques. Alan Rich, a renowned trading expert, offers profound insights into mastering the complexities of Nasdaq trading. In this article, we explore Rich’s advanced trading techniques, providing traders with the tools to enhance their performance in this dynamic market.

Understanding the Nasdaq Market

What is the Nasdaq?

The Nasdaq is a global electronic marketplace for buying and selling securities. Known for its high concentration of technology and biotech companies, the Nasdaq is a barometer of the tech industry’s health.

Importance of the Nasdaq

As one of the world’s largest stock exchanges, the Nasdaq plays a crucial role in the global financial market. Its performance influences investor sentiment and economic forecasts.

Alan Rich’s Approach to Nasdaq Trading

Rich’s Trading Philosophy

Alan Rich emphasizes a disciplined approach to trading. He combines technical analysis, market trends, and risk management to make informed decisions.

Core Principles of Rich’s Methodology

- Technical Analysis: Using charts and indicators to identify trading opportunities.

- Market Trends: Following market trends to predict future movements.

- Risk Management: Implementing strategies to minimize losses and protect gains.

Advanced Technical Analysis Techniques

Understanding Price Charts

Price charts are essential for visualizing market movements and identifying trends.

Types of Price Charts

- Line Charts: Show closing prices over a period.

- Bar Charts: Display opening, closing, high, and low prices for each period.

- Candlestick Charts: Offer detailed information about price movements.

Using Advanced Indicators

Advanced indicators provide deeper insights into market trends and potential reversals.

Moving Averages

Moving averages smooth out price data to identify trends.

- Simple Moving Average (SMA): The average price over a specific period.

- Exponential Moving Average (EMA): Gives more weight to recent prices.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements, indicating overbought or oversold conditions.

MACD (Moving Average Convergence Divergence)

MACD shows the relationship between two moving averages, helping identify potential buy and sell signals.

Volume Analysis

Volume analysis confirms trends and indicates the strength of market movements. High volume often accompanies strong trends, while low volume can indicate potential reversals.

Advanced Trading Strategies

Breakout Trading

Breakout trading involves entering a position when the price breaks through a significant support or resistance level.

Steps for Breakout Trading

- Identify Key Levels: Use technical analysis to find support and resistance levels.

- Wait for Confirmation: Ensure the breakout is supported by increased volume.

- Enter the Trade: Buy or sell when the price moves beyond the key level.

Trend Following

Trend following involves riding the market trend to maximize gains.

Steps for Trend Following

- Identify the Trend: Use moving averages and trendlines.

- Confirm the Trend: Look for consistent higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

- Enter the Trade: Follow the trend, using pullbacks as entry points.

Swing Trading

Swing trading aims to capture short- to medium-term gains within a trend.

Steps for Swing Trading

- Identify Potential Swings: Use technical indicators like RSI and MACD.

- Set Entry and Exit Points: Based on support and resistance levels.

- Monitor Trades: Regularly check and adjust your positions.

Risk Management Techniques

Setting Stop-Loss Orders

Stop-loss orders automatically sell a stock when it reaches a certain price, protecting against significant losses.

Position Sizing

Determine the number of shares to buy or sell based on account size and risk tolerance.

Diversification

Diversifying investments across different sectors reduces risk and exposure to any single asset.

Practical Applications of Rich’s Techniques

Case Study: Successful Breakout Trade

A trader used Rich’s breakout strategy to enter a tech stock position. By identifying key levels and waiting for volume confirmation, they achieved a substantial profit.

Case Study: Trend Following in Biotech

Applying trend-following techniques, a trader capitalized on a sustained uptrend in a biotech stock, maximizing their gains.

Tools and Resources for Advanced Trading

Trading Platforms

Choose platforms with robust charting tools and real-time data, such as MetaTrader or Thinkorswim.

Educational Resources

Books, online courses, and trading communities provide valuable knowledge and support.

Market News and Analysis

Stay informed with reliable sources for market news and updates.

Challenges in Advanced Trading

Market Volatility

The Nasdaq is known for its volatility, requiring quick adaptation to changing conditions.

Emotional Bias

Emotional decisions can lead to poor trading outcomes. Adhering to a disciplined trading plan helps mitigate emotional bias.

Continuous Learning

The fast-paced nature of the Nasdaq necessitates ongoing education and staying updated with market trends.

Conclusion

Advanced Nasdaq trading techniques, as taught by Alan Rich, can significantly enhance your trading success. By mastering technical analysis, employing advanced strategies, and implementing robust risk management practices, traders can navigate the Nasdaq with confidence.

Frequently Asked Questions:

1. What are the main components of Alan Rich’s trading approach?

Alan Rich combines technical analysis, market trends, and risk management to make informed trading decisions.

2. How does breakout trading work?

Breakout trading involves entering a position when the price breaks through a significant support or resistance level, confirmed by increased volume.

3. Why is risk management important in trading?

Risk management is crucial to minimize losses and protect gains, ensuring long-term trading success.

4. What are some advanced technical indicators used in Nasdaq trading?

Advanced indicators include moving averages, RSI, and MACD, which help identify trends and potential entry and exit points.

5. How can I stay informed about Nasdaq market trends?

Use reliable sources for market news and analysis, and continuously educate yourself through books, online courses, and trading communities.

Be the first to review “Advanced Nasdaq Trading Techniques with Alan Rich” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.