-

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Ultimate Guide to Stock Investing

1 × $6.00

Ultimate Guide to Stock Investing

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

AstuceFX Mentorship 2023

1 × $27.00

AstuceFX Mentorship 2023

1 × $27.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Ultimate Titan Trader Bootcamp with Silas Peters

1 × $23.00

Ultimate Titan Trader Bootcamp with Silas Peters

1 × $23.00 -

×

Best Trading Set Ups Playbook with Stacey Burke Trading

1 × $5.00

Best Trading Set Ups Playbook with Stacey Burke Trading

1 × $5.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

![Trading The Elliott Wave Indicator (2003) [1 MP4] by Robert Prechter image](https://www.totozon.com/wp-content/uploads/2024/05/Trading-The-Elliott-Wave-Indicator-2003-1-MP4-by-Robert-Prechter-image.png) Trading The Elliott Wave Indicator (2003) [1 MP4] - Robert Prechter

1 × $6.00

Trading The Elliott Wave Indicator (2003) [1 MP4] - Robert Prechter

1 × $6.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

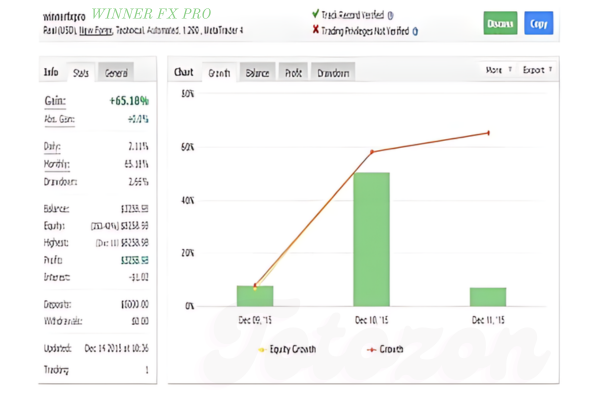

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Trade Australian Share CFDs with Brian Griffin

1 × $6.00

Trade Australian Share CFDs with Brian Griffin

1 × $6.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Tristan Edwards: "How To Set Up A Hedge Fund"

1 × $6.00

Tristan Edwards: "How To Set Up A Hedge Fund"

1 × $6.00 -

×

Blank Check Trade

1 × $31.00

Blank Check Trade

1 × $31.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

Broken Wing Butterfly Course

1 × $6.00

Broken Wing Butterfly Course

1 × $6.00 -

×

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Trading Power Tools with Ryan Litchfield

1 × $6.00

Trading Power Tools with Ryan Litchfield

1 × $6.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Weekly Playbook Workshop #1

1 × $31.00

Weekly Playbook Workshop #1

1 × $31.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

ART Trading – Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

$15.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

ART Trading – Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

In the world of trading, mastering money management and controlling trade risk are crucial for long-term success. ART Trading emphasizes these principles, providing traders with the tools and strategies needed to navigate the markets effectively. This article explores the key aspects of fine-tuning your money management skills and controlling your trade risk to enhance your trading performance.

Understanding ART Trading

What is ART Trading?

ART (Adaptive Risk Trading) Trading is a methodology that focuses on adapting risk management techniques to the ever-changing market conditions. It combines technical analysis, strategic planning, and disciplined execution to achieve consistent results.

Why is Money Management Important?

Money management is essential because it helps traders preserve capital, maximize profits, and reduce the impact of losses. Effective money management ensures that traders can stay in the game longer, even during challenging market conditions.

Fundamentals of Money Management

Setting Clear Goals

Establishing clear, achievable trading goals is the first step in effective money management. This includes defining your risk tolerance, profit targets, and time horizon for each trade.

Risk-Reward Ratio

Understanding and applying the risk-reward ratio is crucial. This ratio compares the potential profit of a trade to the potential loss. A favorable risk-reward ratio typically means risking $1 to make $3.

Position Sizing

Position sizing determines the number of shares or contracts to trade based on your risk tolerance and account size. Proper position sizing helps manage risk and prevents overexposure to any single trade.

Techniques for Controlling Trade Risk

Stop-Loss Orders

Stop-loss orders are essential for limiting potential losses. They automatically close a trade when the price reaches a predetermined level, protecting your capital from significant downturns.

Trailing Stops

Trailing stops are dynamic stop-loss orders that adjust as the price moves in your favor. They help lock in profits while minimizing the risk of losing gains if the market reverses.

Diversification

Diversifying your trades across different assets and sectors can spread risk. This strategy reduces the impact of a poor-performing trade on your overall portfolio.

Hedging

Hedging involves taking offsetting positions to mitigate risk. For example, you might short a correlated asset to protect against potential losses in your primary trade.

Advanced Money Management Strategies

The Kelly Criterion

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets. It helps maximize growth while minimizing the risk of ruin by balancing risk and reward.

Martingale Strategy

The Martingale strategy involves doubling your position size after each loss, aiming to recover losses with a single winning trade. This high-risk strategy requires careful consideration and sufficient capital.

Fixed Fractional Trading

Fixed fractional trading involves risking a fixed percentage of your account on each trade. This method ensures that your risk remains proportional to your account size, protecting your capital as it grows.

Psychological Aspects of Money Management

Discipline

Maintaining discipline is crucial for successful money management. This means sticking to your trading plan, following your risk management rules, and avoiding emotional decision-making.

Patience

Patience is essential in trading. Waiting for the right opportunities and not forcing trades helps preserve capital and reduces the likelihood of impulsive decisions.

Emotional Control

Emotional control is vital for managing stress and avoiding rash decisions. Traders should develop techniques to stay calm and focused, even during volatile market conditions.

Implementing Money Management in Your Trading Plan

Developing a Trading Plan

A comprehensive trading plan outlines your trading goals, strategies, risk management rules, and criteria for entering and exiting trades. It serves as a roadmap for consistent and disciplined trading.

Backtesting Strategies

Backtesting involves testing your trading strategies on historical data to evaluate their effectiveness. This helps identify strengths and weaknesses and refine your approach before risking real capital.

Regular Review and Adjustment

Regularly reviewing and adjusting your trading plan ensures that it remains effective in changing market conditions. This includes updating your strategies, risk management rules, and performance goals.

Tools for Enhancing Money Management

Trading Platforms

Choose a trading platform that offers advanced features for risk management, such as customizable stop-loss orders, trailing stops, and position sizing calculators.

Educational Resources

Utilize educational resources like books, webinars, and courses to deepen your understanding of money management and risk control. Continuous learning is key to improving your trading skills.

Trading Journals

Maintaining a trading journal helps track your performance, identify patterns, and learn from your mistakes. Documenting each trade provides valuable insights for refining your strategies.

Conclusion

Fine-tuning your money management skills and controlling your trade risk are essential components of successful trading. By implementing the strategies and techniques discussed in this article, you can enhance your trading performance and achieve consistent results. Remember, the key to long-term success in trading is not just making profits but preserving your capital through effective risk management.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “ART Trading – Fine Tuning Your Money Management Skills & Controlling Your Trade Risk” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.