-

×

Rapid Cash & Success System

1 × $31.00

Rapid Cash & Success System

1 × $31.00 -

×

Don Fishback ODDS The Key to 95 Winners

1 × $6.00

Don Fishback ODDS The Key to 95 Winners

1 × $6.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

Reversal Magic Video Course

1 × $15.00

Reversal Magic Video Course

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

The Basics of Swing Trading with Jason Bond

1 × $31.00

The Basics of Swing Trading with Jason Bond

1 × $31.00 -

×

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00 -

×

The Ultimate Trader Transformation

1 × $62.00

The Ultimate Trader Transformation

1 × $62.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Yuri Shamenko Videos

1 × $5.00

Yuri Shamenko Videos

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Beginner's Forex Course with Jossenia Pomare

1 × $60.00

Beginner's Forex Course with Jossenia Pomare

1 × $60.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00 -

×

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

Technical Analysis Classes (Video, Manuals)

1 × $6.00

Technical Analysis Classes (Video, Manuals)

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

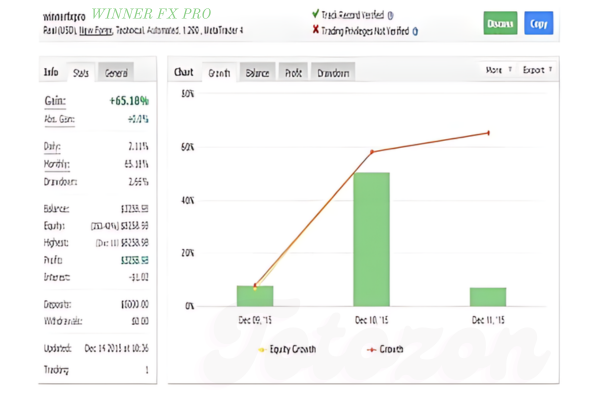

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Betfair Scalper Trading Course

1 × $15.00

Betfair Scalper Trading Course

1 × $15.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trading Order Power Strategies

1 × $6.00

Trading Order Power Strategies

1 × $6.00 -

×

The Triad Formula System with Jason Fielder

1 × $6.00

The Triad Formula System with Jason Fielder

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Real Motion Trading with MarketGauge

1 × $62.00

Real Motion Trading with MarketGauge

1 × $62.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

The Sellers Code Master Class with Flip2Freedom

1 × $31.00

The Sellers Code Master Class with Flip2Freedom

1 × $31.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Bollinger Band Jackpot with Mark Deaton

1 × $31.00

Bollinger Band Jackpot with Mark Deaton

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Pivot Day Trader for NinjaTrader

1 × $31.00

Pivot Day Trader for NinjaTrader

1 × $31.00 -

×

The Face of God Course

1 × $15.00

The Face of God Course

1 × $15.00 -

×

Bear Trap Indicator with Markay Latimer

1 × $5.00

Bear Trap Indicator with Markay Latimer

1 × $5.00 -

×

Low Stress Options Trading with Low Stress Training

1 × $23.00

Low Stress Options Trading with Low Stress Training

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Elite Day Trading Bundle (Series 4) with The Swag Academy

1 × $101.00

Elite Day Trading Bundle (Series 4) with The Swag Academy

1 × $101.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

Astro FX 2.0

1 × $6.00

Astro FX 2.0

1 × $6.00 -

×

Interactive Brokers Data Downloader 3.0 (software)

1 × $6.00

Interactive Brokers Data Downloader 3.0 (software)

1 × $6.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market with Gil Morales

1 × $6.00

Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market with Gil Morales

1 × $6.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

TTM Trading with the Anchor Indicators Video

1 × $6.00

TTM Trading with the Anchor Indicators Video

1 × $6.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The In-N-Out Butterfly

1 × $6.00

The In-N-Out Butterfly

1 × $6.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Monthly Mastermind

1 × $6.00

Monthly Mastermind

1 × $6.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

TrendFund.com – 11 DVDs

1 × $69.00

TrendFund.com – 11 DVDs

1 × $69.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

Middle Market M & A: Handbook for Investment Banking and Business Consulting (1st Edition) – Kenneth Marks

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Middle Market M&A: Handbook for Investment Banking and Business Consulting (1st Edition) – Kenneth Marks

Navigating the complex world of middle market mergers and acquisitions (M&A) requires a deep understanding of investment banking and business consulting. Kenneth Marks’ “Middle Market M&A: Handbook for Investment Banking and Business Consulting (1st Edition)” provides a comprehensive guide for professionals in this field. In this article, we will explore the key insights and strategies from this essential handbook.

Introduction to Middle Market M&A

Middle market M&A refers to transactions involving companies with revenues typically between $10 million and $1 billion. These transactions are crucial for economic growth and business development.

Why Focus on Middle Market M&A?

- Economic Impact: Significant contributor to the economy.

- Growth Opportunities: Offers substantial growth potential for companies.

- Strategic Importance: Plays a key role in strategic business planning.

About Kenneth Marks

Kenneth Marks is a renowned expert in the field of middle market M&A. His extensive experience and practical approach have made his handbook a go-to resource for professionals.

Kenneth Marks’ Expertise

- Investment Banking: Deep knowledge of investment banking principles.

- Business Consulting: Expertise in advising businesses on growth and development strategies.

Key Concepts in Middle Market M&A

Understanding Valuation

Valuation is a critical component of M&A transactions. It involves determining the worth of a company to ensure fair pricing.

Valuation Methods

- Comparable Company Analysis: Comparing similar companies to determine value.

- Discounted Cash Flow (DCF): Projecting future cash flows and discounting them to present value.

- Precedent Transactions: Analyzing past transactions involving similar companies.

Due Diligence Process

Due diligence is the investigation and evaluation of a company’s financials, operations, and legal aspects before completing an M&A transaction.

Key Areas of Due Diligence

- Financial Due Diligence: Examining financial statements and performance.

- Operational Due Diligence: Assessing business operations and processes.

- Legal Due Diligence: Reviewing legal documents and compliance issues.

Deal Structuring

Structuring the deal correctly is essential for the success of the transaction. This involves deciding on the terms and conditions of the sale.

Types of Deal Structures

- Asset Purchase: Buying specific assets of a company.

- Stock Purchase: Acquiring the company’s stock.

- Merger: Combining two companies into one entity.

Strategies for Successful M&A

Negotiation Techniques

Effective negotiation is crucial for achieving favorable terms in M&A transactions.

Key Negotiation Strategies

- Preparation: Thoroughly preparing and understanding both parties’ goals.

- Clear Communication: Ensuring transparent and effective communication.

- Win-Win Approach: Striving for solutions that benefit both parties.

Integration Planning

Post-transaction integration is vital for realizing the synergies and benefits of the M&A.

Steps for Successful Integration

- Develop a Detailed Plan: Outline the integration process and timelines.

- Assign Responsibilities: Clearly define roles and responsibilities.

- Monitor Progress: Regularly review and adjust the integration plan as needed.

Risk Management

Identifying and managing risks is essential for a successful M&A transaction.

Common M&A Risks

- Cultural Misalignment: Differences in corporate culture can affect integration.

- Financial Risks: Unexpected financial issues can arise post-transaction.

- Regulatory Risks: Compliance with legal and regulatory requirements.

Tools and Resources for M&A Professionals

Financial Modeling Software

Utilize financial modeling software to analyze and project financial scenarios.

Data Room Solutions

Secure data rooms facilitate the due diligence process by providing a secure platform for document sharing.

Consulting Services

Engage with consulting services for expert advice and support throughout the M&A process.

Case Studies of Successful Middle Market M&A

Case Study 1: Technology Sector

A mid-sized tech company successfully merged with a larger competitor, resulting in expanded market share and increased revenue.

Case Study 2: Healthcare Industry

A healthcare provider acquired a smaller clinic, enhancing its service offerings and geographical reach.

Conclusion

Kenneth Marks’ “Middle Market M&A: Handbook for Investment Banking and Business Consulting” is an invaluable resource for anyone involved in M&A transactions. By understanding the key concepts, employing effective strategies, and utilizing the right tools, professionals can navigate the complexities of middle market M&A and achieve successful outcomes.

FAQs

1. What is middle market M&A?

Middle market M&A involves transactions with companies typically having revenues between $10 million and $1 billion.

2. Why is valuation important in M&A?

Valuation ensures that the company is priced fairly, which is crucial for both buyers and sellers.

3. What are the key areas of due diligence?

Key areas include financial, operational, and legal due diligence.

4. How can negotiation techniques impact M&A transactions?

Effective negotiation can help achieve favorable terms and create win-win situations for both parties.

5. What are common risks in M&A transactions?

Common risks include cultural misalignment, financial issues, and regulatory compliance challenges.

Be the first to review “Middle Market M & A: Handbook for Investment Banking and Business Consulting (1st Edition) – Kenneth Marks” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.