-

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

Stonhill Forex 201 Advanced Course

1 × $5.00

Stonhill Forex 201 Advanced Course

1 × $5.00 -

×

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Footprint Deep Dive

1 × $15.00

Footprint Deep Dive

1 × $15.00 -

×

Marus FX 2023

1 × $5.00

Marus FX 2023

1 × $5.00 -

×

Fish Forex Robot 4G

1 × $6.00

Fish Forex Robot 4G

1 × $6.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00 -

×

Nasdaq Scalper Complete Video Course with Vadym Graifer - RealityTrader

1 × $23.00

Nasdaq Scalper Complete Video Course with Vadym Graifer - RealityTrader

1 × $23.00 -

×

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

Forex Trading Make Your First Trader Today with Corey Halliday

1 × $6.00

Forex Trading Make Your First Trader Today with Corey Halliday

1 × $6.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

DOTS Method with Dean Malone

1 × $54.00

DOTS Method with Dean Malone

1 × $54.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Trading the Line. How to Use Trendlines to Spot Reversals and Ride Trends

1 × $6.00

Trading the Line. How to Use Trendlines to Spot Reversals and Ride Trends

1 × $6.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Stock Split Secrets (2nd Ed.)

1 × $6.00

Stock Split Secrets (2nd Ed.)

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

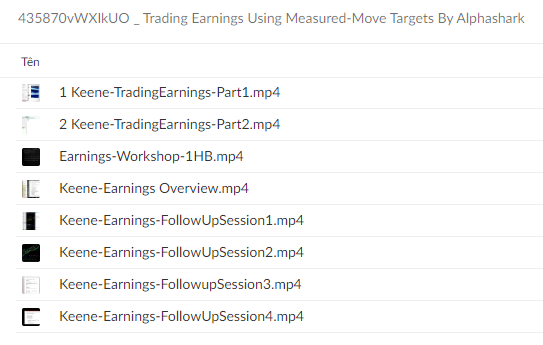

Trading Earnings Using Measured-Move Targets with Alphashark

$497.00 Original price was: $497.00.$6.00Current price is: $6.00.

File Size: 765.1 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Earnings Using Measured-Move Targets with Alphashark” below:

Trading Earnings Using Measured-Move Targets with Alphashark

Introduction to Earnings Trading

When it comes to trading during earnings season, precision and strategy are key. Alphashark offers a unique approach by utilizing measured-move targets to optimize earnings trades. This method not only enhances accuracy but also minimizes risk.

Understanding Measured-Move Targets

What Are Measured-Move Targets?

Measured-move targets are predictive chart patterns used by traders to determine potential price movements following a breakout or breakdown.

How They Work

These targets are calculated by measuring the size of the previous move and projecting it from the breakout or breakdown point.

Preparing for Earnings Season

Analyzing Historical Data

Before earnings season begins, it’s crucial to analyze historical performance to predict potential price movements.

Setting Up Your Charts

Proper chart setup is essential for accurately applying measured-move targets. This includes adjusting time frames and applying the right technical indicators.

Strategy Application

Step-by-Step Trading Strategy

Alphashark’s strategy involves several key steps:

- Identify the stock with a consistent earnings pattern.

- Apply measured-move concepts to the stock’s chart.

- Set entry points based on the breakout of patterns.

- Determine exit points using measured-move targets.

Risk Management Techniques

Effective risk management is vital, involving stop-loss settings and position sizing to manage potential losses.

Tools and Indicators

Essential Technical Indicators

Key indicators in this strategy include volume, RSI, and moving averages to confirm movements and targets.

Software and Platforms

Alphashark recommends specific trading platforms that offer advanced charting capabilities for applying measured moves.

Case Studies

Successful Trades Breakdown

Detailed case studies of successful earnings trades using this strategy provide insights into its practical application.

Adapting to Market Conditions

Flexibility in Strategy

The strategy’s flexibility allows traders to adjust to different market conditions, ensuring consistent performance.

Expert Insights

Tips from Alphashark

Alphashark shares expert tips on refining the strategy, such as the best times to trade and key signals to watch.

Conclusion

Trading earnings using measured-move targets offers a structured approach to navigating the complexities of earnings season. By following Alphashark’s method, traders can enhance their accuracy and reduce risk.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Trading Earnings Using Measured-Move Targets with Alphashark” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.