-

×

New York Super Conference 2016 Videos

1 × $31.00

New York Super Conference 2016 Videos

1 × $31.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00 -

×

Main Online Course with Cue Banks

1 × $90.00

Main Online Course with Cue Banks

1 × $90.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Fast Track Forex Course

1 × $62.00

Fast Track Forex Course

1 × $62.00 -

×

QuantZilla

1 × $39.00

QuantZilla

1 × $39.00 -

×

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

The New Technical Trader with Chande Kroll

1 × $6.00

The New Technical Trader with Chande Kroll

1 × $6.00 -

×

Momentum Options Trading Course with Eric Jellerson

1 × $272.00

Momentum Options Trading Course with Eric Jellerson

1 × $272.00 -

×

The Ultimate Trader Transformation

1 × $62.00

The Ultimate Trader Transformation

1 × $62.00 -

×

Spyglass LSS Day Trading Workshop

1 × $15.00

Spyglass LSS Day Trading Workshop

1 × $15.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00 -

×

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00 -

×

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

The BFI Trading Course

1 × $6.00

The BFI Trading Course

1 × $6.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

Understanding the Markets with David Loader

1 × $6.00

Understanding the Markets with David Loader

1 × $6.00 -

×

Deflaction with A.Gary Shilling

1 × $6.00

Deflaction with A.Gary Shilling

1 × $6.00 -

×

Algorithmic Rules of Trend Lines

1 × $23.00

Algorithmic Rules of Trend Lines

1 × $23.00 -

×

Volume Analysis – Smart Money

1 × $6.00

Volume Analysis – Smart Money

1 × $6.00 -

×

The Zone Trader Training Series with Timon Weller

1 × $8.00

The Zone Trader Training Series with Timon Weller

1 × $8.00 -

×

Technical Analysis. The Basis with Glenn Ring

1 × $6.00

Technical Analysis. The Basis with Glenn Ring

1 × $6.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

The House Always Wins with jasonbondpicks

1 × $6.00

The House Always Wins with jasonbondpicks

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Main Online Course with MadCharts

1 × $5.00

Main Online Course with MadCharts

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

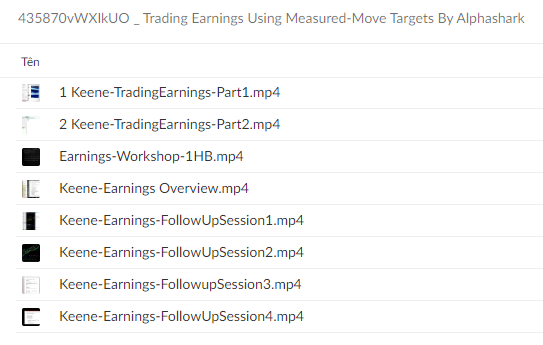

Trading Earnings Using Measured-Move Targets with Alphashark

$497.00 Original price was: $497.00.$6.00Current price is: $6.00.

File Size: 765.1 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Earnings Using Measured-Move Targets with Alphashark” below:

Trading Earnings Using Measured-Move Targets with Alphashark

Introduction to Earnings Trading

When it comes to trading during earnings season, precision and strategy are key. Alphashark offers a unique approach by utilizing measured-move targets to optimize earnings trades. This method not only enhances accuracy but also minimizes risk.

Understanding Measured-Move Targets

What Are Measured-Move Targets?

Measured-move targets are predictive chart patterns used by traders to determine potential price movements following a breakout or breakdown.

How They Work

These targets are calculated by measuring the size of the previous move and projecting it from the breakout or breakdown point.

Preparing for Earnings Season

Analyzing Historical Data

Before earnings season begins, it’s crucial to analyze historical performance to predict potential price movements.

Setting Up Your Charts

Proper chart setup is essential for accurately applying measured-move targets. This includes adjusting time frames and applying the right technical indicators.

Strategy Application

Step-by-Step Trading Strategy

Alphashark’s strategy involves several key steps:

- Identify the stock with a consistent earnings pattern.

- Apply measured-move concepts to the stock’s chart.

- Set entry points based on the breakout of patterns.

- Determine exit points using measured-move targets.

Risk Management Techniques

Effective risk management is vital, involving stop-loss settings and position sizing to manage potential losses.

Tools and Indicators

Essential Technical Indicators

Key indicators in this strategy include volume, RSI, and moving averages to confirm movements and targets.

Software and Platforms

Alphashark recommends specific trading platforms that offer advanced charting capabilities for applying measured moves.

Case Studies

Successful Trades Breakdown

Detailed case studies of successful earnings trades using this strategy provide insights into its practical application.

Adapting to Market Conditions

Flexibility in Strategy

The strategy’s flexibility allows traders to adjust to different market conditions, ensuring consistent performance.

Expert Insights

Tips from Alphashark

Alphashark shares expert tips on refining the strategy, such as the best times to trade and key signals to watch.

Conclusion

Trading earnings using measured-move targets offers a structured approach to navigating the complexities of earnings season. By following Alphashark’s method, traders can enhance their accuracy and reduce risk.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Trading Earnings Using Measured-Move Targets with Alphashark” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.