-

×

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

FX Utopia

1 × $6.00

FX Utopia

1 × $6.00 -

×

Phantom Trading Course 2.0

1 × $7.00

Phantom Trading Course 2.0

1 × $7.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

New York Super Conference 2016 Videos

1 × $31.00

New York Super Conference 2016 Videos

1 × $31.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

Oil Trading Academy Code 3 Video Course

1 × $6.00

Oil Trading Academy Code 3 Video Course

1 × $6.00 -

×

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

Wave Trading

1 × $23.00

Wave Trading

1 × $23.00 -

×

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

Trading Hub 4.0 Ebook

1 × $5.00

Trading Hub 4.0 Ebook

1 × $5.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

Trend Trader PRO Suite Training Course

1 × $5.00

Trend Trader PRO Suite Training Course

1 × $5.00 -

×

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

The RIMS Strategy 2023

1 × $5.00

The RIMS Strategy 2023

1 × $5.00 -

×

The 2021 TraderLion Stock Trading Conference with Trader Lion

1 × $5.00

The 2021 TraderLion Stock Trading Conference with Trader Lion

1 × $5.00 -

×

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00 -

×

Ultimate and Options Trading MasterClass Bundle with FX Evolution

1 × $54.00

Ultimate and Options Trading MasterClass Bundle with FX Evolution

1 × $54.00 -

×

Judgemental Trend Following (Audio) with Russell Sands

1 × $6.00

Judgemental Trend Following (Audio) with Russell Sands

1 × $6.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00 -

×

Rapid Revenue Formula with Kate Beeders

1 × $54.00

Rapid Revenue Formula with Kate Beeders

1 × $54.00 -

×

Gamma Options Boot Camp with Bigtrends

1 × $74.00

Gamma Options Boot Camp with Bigtrends

1 × $74.00 -

×

Developting a Forex Trading Plan Webminar

1 × $6.00

Developting a Forex Trading Plan Webminar

1 × $6.00 -

×

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00 -

×

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00 -

×

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00 -

×

The Big Volatility Short - The Best Trade On Wall Street

1 × $15.00

The Big Volatility Short - The Best Trade On Wall Street

1 × $15.00 -

×

Elliott Wave International Educational Series Volumes 1 - 10 with Robert Prechter, Dave Allman & Wayne Gorman

1 × $54.00

Elliott Wave International Educational Series Volumes 1 - 10 with Robert Prechter, Dave Allman & Wayne Gorman

1 × $54.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

The Foundation with Dan Maxwell

1 × $6.00

The Foundation with Dan Maxwell

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

Forex Breakthrough Academy

1 × $31.00

Forex Breakthrough Academy

1 × $31.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Trading Earnings Using Measured-Move Targets with Alphashark

$497.00 Original price was: $497.00.$6.00Current price is: $6.00.

File Size: 765.1 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

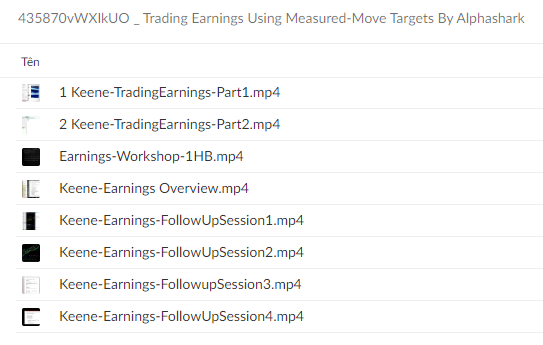

You may check content proof of “Trading Earnings Using Measured-Move Targets with Alphashark” below:

Trading Earnings Using Measured-Move Targets with Alphashark

Introduction to Earnings Trading

When it comes to trading during earnings season, precision and strategy are key. Alphashark offers a unique approach by utilizing measured-move targets to optimize earnings trades. This method not only enhances accuracy but also minimizes risk.

Understanding Measured-Move Targets

What Are Measured-Move Targets?

Measured-move targets are predictive chart patterns used by traders to determine potential price movements following a breakout or breakdown.

How They Work

These targets are calculated by measuring the size of the previous move and projecting it from the breakout or breakdown point.

Preparing for Earnings Season

Analyzing Historical Data

Before earnings season begins, it’s crucial to analyze historical performance to predict potential price movements.

Setting Up Your Charts

Proper chart setup is essential for accurately applying measured-move targets. This includes adjusting time frames and applying the right technical indicators.

Strategy Application

Step-by-Step Trading Strategy

Alphashark’s strategy involves several key steps:

- Identify the stock with a consistent earnings pattern.

- Apply measured-move concepts to the stock’s chart.

- Set entry points based on the breakout of patterns.

- Determine exit points using measured-move targets.

Risk Management Techniques

Effective risk management is vital, involving stop-loss settings and position sizing to manage potential losses.

Tools and Indicators

Essential Technical Indicators

Key indicators in this strategy include volume, RSI, and moving averages to confirm movements and targets.

Software and Platforms

Alphashark recommends specific trading platforms that offer advanced charting capabilities for applying measured moves.

Case Studies

Successful Trades Breakdown

Detailed case studies of successful earnings trades using this strategy provide insights into its practical application.

Adapting to Market Conditions

Flexibility in Strategy

The strategy’s flexibility allows traders to adjust to different market conditions, ensuring consistent performance.

Expert Insights

Tips from Alphashark

Alphashark shares expert tips on refining the strategy, such as the best times to trade and key signals to watch.

Conclusion

Trading earnings using measured-move targets offers a structured approach to navigating the complexities of earnings season. By following Alphashark’s method, traders can enhance their accuracy and reduce risk.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Trading Earnings Using Measured-Move Targets with Alphashark” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.