-

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

The Complete Guide to Spread Trading

1 × $6.00

The Complete Guide to Spread Trading

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Advanced Iron Condor Course in 2021

1 × $6.00

Advanced Iron Condor Course in 2021

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00 -

×

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

Dan Sheridan Volatility Class

1 × $6.00

Dan Sheridan Volatility Class

1 × $6.00 -

×

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Extreme Events: Robust Portfolio Construction in the Presence of Fat Tails with Malcolm Kemp

1 × $6.00

Extreme Events: Robust Portfolio Construction in the Presence of Fat Tails with Malcolm Kemp

1 × $6.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00 -

×

Chaos. The New Map for Traders

1 × $15.00

Chaos. The New Map for Traders

1 × $15.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Dow Theory Redux with Michael Sheimo

1 × $6.00

Dow Theory Redux with Michael Sheimo

1 × $6.00 -

×

The New Technical Trader with Chande Kroll

1 × $6.00

The New Technical Trader with Chande Kroll

1 × $6.00 -

×

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Snapbacks CD

1 × $6.00

Snapbacks CD

1 × $6.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00 -

×

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00 -

×

Self-Managed Trading with Stochastics By George Lane

1 × $4.00

Self-Managed Trading with Stochastics By George Lane

1 × $4.00 -

×

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00 -

×

Arjoio’s MMT - Essential Package

1 × $5.00

Arjoio’s MMT - Essential Package

1 × $5.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Master The Markets 2.0 with French Trader

1 × $6.00

Master The Markets 2.0 with French Trader

1 × $6.00 -

×

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00 -

×

Tradeguider - Wyckoff VSA eBook Collection

1 × $23.00

Tradeguider - Wyckoff VSA eBook Collection

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

How to Use Gann Techniques to Implement a Trading System

1 × $6.00

How to Use Gann Techniques to Implement a Trading System

1 × $6.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00 -

×

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00 -

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Technical Analysis for Short-Term Traders

1 × $6.00

Technical Analysis for Short-Term Traders

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Lazy Emini Trader Master Class

1 × $15.00

Lazy Emini Trader Master Class

1 × $15.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Shecantrade – Day Trading Options

1 × $23.00

Shecantrade – Day Trading Options

1 × $23.00 -

×

Evidence Based Technical Analysis with David Aronson

1 × $6.00

Evidence Based Technical Analysis with David Aronson

1 × $6.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

Forex Mastery with Willis University

1 × $6.00

Forex Mastery with Willis University

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

The Psychology of Investing with John Nofsinger

1 × $6.00

The Psychology of Investing with John Nofsinger

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00

Mean Reversion Strategy with The Chartist

$900.00 Original price was: $900.00.$78.00Current price is: $78.00.

File Size: 269.7 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

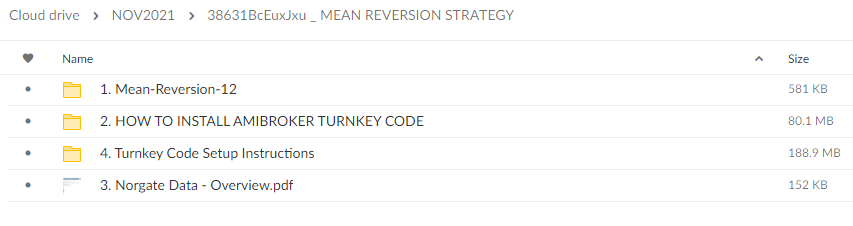

You may check content proof of “Mean Reversion Strategy with The Chartist” below:

Unveiling the Mean Reversion Strategy with The Chartist

In the dynamic world of trading, various strategies aim to capitalize on market inefficiencies and anomalies. One such strategy, known as mean reversion, has gained popularity among traders seeking to exploit temporary deviations from a security’s long-term trend. In this article, we delve into the mean reversion strategy with insights from The Chartist, exploring its principles, implementation, and potential benefits.

Understanding Mean Reversion

What is Mean Reversion?

Mean reversion is a trading strategy based on the belief that prices tend to revert to their historical mean or average over time. This strategy assumes that when prices deviate significantly from their average, they are likely to reverse direction and return to their mean.

Key Concepts in Mean Reversion

- Mean or Average: The central concept of mean reversion is the calculation of the mean or average price over a specified period.

- Standard Deviation: Traders often use standard deviation to measure the extent of price fluctuations around the mean. Deviations beyond a certain threshold may signal potential trading opportunities.

The Chartist’s Approach

Overview of The Chartist

The Chartist is a prominent figure in the trading community known for their expertise in technical analysis and market insights. Their approach to mean reversion combines quantitative analysis with charting techniques to identify potential entry and exit points.

Key Components of The Chartist’s Mean Reversion Strategy

- Identifying Overextended Moves: The Chartist looks for securities that have experienced significant price movements away from their mean, signaling potential opportunities for mean reversion.

- Confirmation Signals: To validate potential trading signals, The Chartist employs additional technical indicators or chart patterns to confirm the likelihood of a reversal.

- Risk Management: Effective risk management is paramount in The Chartist’s approach, with predefined stop-loss levels and position sizing strategies to mitigate potential losses.

Implementing the Strategy

Entry and Exit Criteria

- Entry: Traders may enter positions when a security’s price deviates significantly from its mean, combined with confirmation from technical indicators or chart patterns.

- Exit: Exiting positions may occur when prices revert towards the mean or when predetermined profit targets or stop-loss levels are reached.

Trade Management

The Chartist emphasizes the importance of actively managing trades, including adjusting stop-loss levels, trailing stop orders, and scaling in or out of positions as market conditions evolve.

Potential Benefits and Considerations

Benefits of Mean Reversion Trading

- Profit Potential: Mean reversion strategies can offer profit opportunities when prices revert to their mean.

- Risk Management: By employing strict risk management rules, traders can limit potential losses and preserve capital.

Considerations

- Market Conditions: Mean reversion strategies may perform differently in trending versus range-bound markets.

- Timing: Successfully timing entries and exits is crucial, as mean reversion relies on identifying reversals before they occur.

Conclusion

The mean reversion strategy with insights from The Chartist offers traders a systematic approach to capitalize on short-term price deviations from the long-term trend. By combining quantitative analysis with technical expertise, traders can potentially exploit market inefficiencies and achieve consistent returns.

FAQs

1. Can mean reversion strategies be applied to all financial markets?

Yes, mean reversion strategies can be applied to various markets, including stocks, forex, and commodities.

2. How do I determine the optimal lookback period for calculating the mean?

The optimal lookback period may vary depending on the characteristics of the security and market conditions. Experimentation and backtesting can help identify suitable parameters.

3. What risk management techniques are recommended when trading mean reversion?

Effective risk management techniques include setting stop-loss orders, diversifying positions, and adhering to position sizing rules to limit potential losses.

4. Are there any drawbacks to mean reversion trading?

Mean reversion strategies may underperform in strongly trending markets or during periods of high volatility. Additionally, mistimed entries or exits can lead to losses.

5. How can I learn more about implementing mean reversion strategies in my trading approach?

Consider studying The Chartist’s publications, attending educational webinars, or seeking guidance from experienced traders to deepen your understanding of mean reversion trading.

Be the first to review “Mean Reversion Strategy with The Chartist” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.