-

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Index Funds with Mark Hebner

1 × $6.00

Index Funds with Mark Hebner

1 × $6.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

ETF and Leveraged ETF Trading Summit

1 × $23.00

ETF and Leveraged ETF Trading Summit

1 × $23.00 -

×

Directional Option Strategies for Swing and Day Trading with Dan Gibby - Master Trader

1 × $54.00

Directional Option Strategies for Swing and Day Trading with Dan Gibby - Master Trader

1 × $54.00 -

×

Secrets of Investors on WallStreet (Audio) with Ken Fisher

1 × $6.00

Secrets of Investors on WallStreet (Audio) with Ken Fisher

1 × $6.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Read The Market RTM Master Trader Course + Journals

1 × $5.00

Read The Market RTM Master Trader Course + Journals

1 × $5.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Option Alpha Signals

1 × $15.00

Option Alpha Signals

1 × $15.00 -

×

The 13-Week Cash Flow Model

1 × $15.00

The 13-Week Cash Flow Model

1 × $15.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00 -

×

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Main Online Course with MadCharts

1 × $5.00

Main Online Course with MadCharts

1 × $5.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Larry Connors Professional Day Trading for Success Program

1 × $62.00

Larry Connors Professional Day Trading for Success Program

1 × $62.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00 -

×

Reading & Understanding Charts with Andrew Baxter

1 × $6.00

Reading & Understanding Charts with Andrew Baxter

1 × $6.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Elite Price Action Tutorials with Wmd4x

1 × $8.00

Elite Price Action Tutorials with Wmd4x

1 × $8.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

Learn Before you Loose

1 × $6.00

Learn Before you Loose

1 × $6.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Price Analysis Webinar with Carolyn Boroden

1 × $6.00

Price Analysis Webinar with Carolyn Boroden

1 × $6.00 -

×

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

Gillen Predicts with Jack Gillen

1 × $6.00

Gillen Predicts with Jack Gillen

1 × $6.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

Quantifiable Edges - 3 Course Bundle

1 × $31.00

Quantifiable Edges - 3 Course Bundle

1 × $31.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Jim Rickards Intelligence Triggers with Agora Financial

1 × $5.00

Jim Rickards Intelligence Triggers with Agora Financial

1 × $5.00 -

×

Nora Bystra Legacy International Complete Course

1 × $6.00

Nora Bystra Legacy International Complete Course

1 × $6.00 -

×

Robotic trading interactive

1 × $31.00

Robotic trading interactive

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading

$120.00 Original price was: $120.00.$6.00Current price is: $6.00.

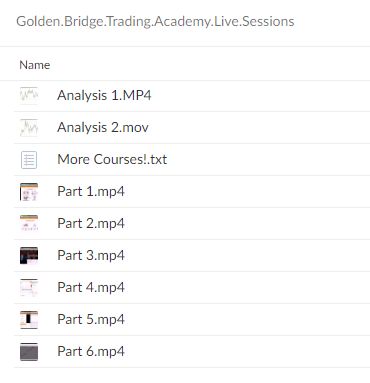

File Size: 5.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” below:

Understanding Market Turning Points: The Role of Big Banks by Golden Bridge Trading

Introduction to Market Dynamics

Welcome to a comprehensive guide on how the demand and supply controlled by big banking institutions can cause significant market turning points. This guide, presented by Golden Bridge Trading, will delve into the core dynamics that influence market fluctuations and how traders can leverage this knowledge for better trading decisions.

The Power of Big Banks

Big banks play a pivotal role in the financial markets. Their substantial capital resources and market influence can lead to significant price movements and shifts in market trends.

What is Golden Bridge Trading?

Golden Bridge Trading is a renowned financial education firm that specializes in teaching traders how to understand and capitalize on market forces driven by major financial institutions.

The Basics of Demand and Supply in Trading

Understanding Supply and Demand

Learn the fundamental concepts of how supply and demand affect financial markets, particularly in the context of large institutional trading activities.

Impact of Big Banks on Market Supply

How big banks’ supply decisions can lead to an oversupply or undersupply in the market, affecting prices and market stability.

Demand Influences by Big Banks

Explore how the demands of these financial giants sway market prices and lead to either bullish or bearish trends.

Analyzing Market Turning Points

Identifying Turning Points

A step-by-step guide on how to identify potential market turning points that could indicate significant changes in market trends.

Tools and Indicators

Discuss the essential tools and indicators used to detect shifts in market dynamics caused by the actions of big banks.

Historical Case Studies

Review several historical examples where big bank activities have directly led to notable market turning points.

Trading Strategies Around Market Dynamics

Strategy Development

How to develop robust trading strategies that account for the potential impact of big banks on market conditions.

Risk Management Techniques

Effective risk management techniques that help protect investments from volatility induced by big banks’ activities.

Leveraging Economic Reports

Understanding how to use economic reports and news releases as tools to predict and react to moves by big banks.

Advanced Insights into Institutional Trading

The Role of Algorithmic Trading

Examine how big banks use algorithmic trading to influence market conditions and how traders can adapt to this environment.

Behavioral Finance Insights

Insights into how behavioral finance plays into the trading decisions of big banks and the resulting market effects.

Predictive Analysis

How traders can use predictive analysis to anticipate the moves of big banks and position themselves advantageously in the market.

Educational Resources and Tools

Golden Bridge Trading’s Learning Platform

Introduction to the comprehensive learning resources offered by Golden Bridge Trading to help traders understand and exploit market dynamics.

Continuous Learning and Webinars

Information on ongoing educational opportunities, including webinars and online courses, focusing on big bank market impacts.

Community and Support

Benefits of joining the Golden Bridge Trading community for support, discussions, and shared learning about market dynamics.

Conclusion

Understanding the market turning points caused by the demand and supply dynamics of big banks is crucial for any trader looking to succeed in the financial markets. With the insights provided by Golden Bridge Trading, traders are better equipped to predict, understand, and capitalize on these pivotal market movements.

FAQs

- What causes market turning points?

- Market turning points are primarily caused by significant changes in demand and supply, often influenced by big banks and major financial institutions.

- How can a trader identify when a big bank is influencing the market?

- Traders can identify these influences by analyzing trading volumes, price movements, and economic reports that coincide with the activities of large institutions.

- What tools are most effective in analyzing big bank influences?

- Tools such as volume analysis, economic indicators, and advanced charting software are effective in analyzing the influence of big banks.

- Can individual traders compete with big banks?

- Yes, individual traders can compete by using strategic planning, advanced analysis, and by staying informed about the activities of these large institutions.

- How does Golden Bridge Trading help traders understand market dynamics?

- Golden Bridge Trading provides educational resources, real-time trading simulations, and expert insights into how big banks influence market dynamics.

Be the first to review “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.