-

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Spread Trading

1 × $6.00

Spread Trading

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Price Action Room - The Scalper’s Boot Camp

1 × $15.00

Price Action Room - The Scalper’s Boot Camp

1 × $15.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

The Psychology of Investing with John Nofsinger

1 × $6.00

The Psychology of Investing with John Nofsinger

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading

$120.00 Original price was: $120.00.$6.00Current price is: $6.00.

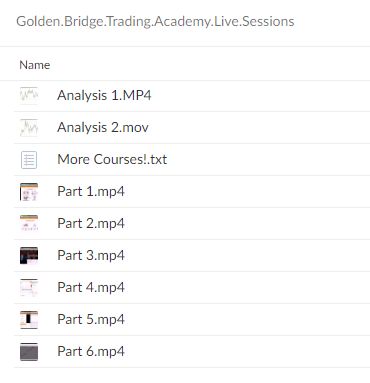

File Size: 5.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” below:

Understanding Market Turning Points: The Role of Big Banks by Golden Bridge Trading

Introduction to Market Dynamics

Welcome to a comprehensive guide on how the demand and supply controlled by big banking institutions can cause significant market turning points. This guide, presented by Golden Bridge Trading, will delve into the core dynamics that influence market fluctuations and how traders can leverage this knowledge for better trading decisions.

The Power of Big Banks

Big banks play a pivotal role in the financial markets. Their substantial capital resources and market influence can lead to significant price movements and shifts in market trends.

What is Golden Bridge Trading?

Golden Bridge Trading is a renowned financial education firm that specializes in teaching traders how to understand and capitalize on market forces driven by major financial institutions.

The Basics of Demand and Supply in Trading

Understanding Supply and Demand

Learn the fundamental concepts of how supply and demand affect financial markets, particularly in the context of large institutional trading activities.

Impact of Big Banks on Market Supply

How big banks’ supply decisions can lead to an oversupply or undersupply in the market, affecting prices and market stability.

Demand Influences by Big Banks

Explore how the demands of these financial giants sway market prices and lead to either bullish or bearish trends.

Analyzing Market Turning Points

Identifying Turning Points

A step-by-step guide on how to identify potential market turning points that could indicate significant changes in market trends.

Tools and Indicators

Discuss the essential tools and indicators used to detect shifts in market dynamics caused by the actions of big banks.

Historical Case Studies

Review several historical examples where big bank activities have directly led to notable market turning points.

Trading Strategies Around Market Dynamics

Strategy Development

How to develop robust trading strategies that account for the potential impact of big banks on market conditions.

Risk Management Techniques

Effective risk management techniques that help protect investments from volatility induced by big banks’ activities.

Leveraging Economic Reports

Understanding how to use economic reports and news releases as tools to predict and react to moves by big banks.

Advanced Insights into Institutional Trading

The Role of Algorithmic Trading

Examine how big banks use algorithmic trading to influence market conditions and how traders can adapt to this environment.

Behavioral Finance Insights

Insights into how behavioral finance plays into the trading decisions of big banks and the resulting market effects.

Predictive Analysis

How traders can use predictive analysis to anticipate the moves of big banks and position themselves advantageously in the market.

Educational Resources and Tools

Golden Bridge Trading’s Learning Platform

Introduction to the comprehensive learning resources offered by Golden Bridge Trading to help traders understand and exploit market dynamics.

Continuous Learning and Webinars

Information on ongoing educational opportunities, including webinars and online courses, focusing on big bank market impacts.

Community and Support

Benefits of joining the Golden Bridge Trading community for support, discussions, and shared learning about market dynamics.

Conclusion

Understanding the market turning points caused by the demand and supply dynamics of big banks is crucial for any trader looking to succeed in the financial markets. With the insights provided by Golden Bridge Trading, traders are better equipped to predict, understand, and capitalize on these pivotal market movements.

FAQs

- What causes market turning points?

- Market turning points are primarily caused by significant changes in demand and supply, often influenced by big banks and major financial institutions.

- How can a trader identify when a big bank is influencing the market?

- Traders can identify these influences by analyzing trading volumes, price movements, and economic reports that coincide with the activities of large institutions.

- What tools are most effective in analyzing big bank influences?

- Tools such as volume analysis, economic indicators, and advanced charting software are effective in analyzing the influence of big banks.

- Can individual traders compete with big banks?

- Yes, individual traders can compete by using strategic planning, advanced analysis, and by staying informed about the activities of these large institutions.

- How does Golden Bridge Trading help traders understand market dynamics?

- Golden Bridge Trading provides educational resources, real-time trading simulations, and expert insights into how big banks influence market dynamics.

Be the first to review “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.