-

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Investor’s Guide to Charting By Alistair Blair

1 × $6.00

Investor’s Guide to Charting By Alistair Blair

1 × $6.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

ProfileTraders - Advanced Market Profile (May 2014)

1 × $6.00

ProfileTraders - Advanced Market Profile (May 2014)

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Advanced Trading Course with DovyFX

1 × $5.00

Advanced Trading Course with DovyFX

1 × $5.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Design for Six Sigma with Subir Chowdhury

1 × $6.00

Design for Six Sigma with Subir Chowdhury

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

All About Market Timing with Leslie N.Masonson

1 × $6.00

All About Market Timing with Leslie N.Masonson

1 × $6.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

My Forex League - The Course

1 × $5.00

My Forex League - The Course

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading

$120.00 Original price was: $120.00.$6.00Current price is: $6.00.

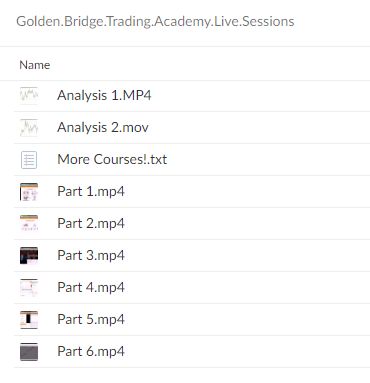

File Size: 5.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” below:

Understanding Market Turning Points: The Role of Big Banks by Golden Bridge Trading

Introduction to Market Dynamics

Welcome to a comprehensive guide on how the demand and supply controlled by big banking institutions can cause significant market turning points. This guide, presented by Golden Bridge Trading, will delve into the core dynamics that influence market fluctuations and how traders can leverage this knowledge for better trading decisions.

The Power of Big Banks

Big banks play a pivotal role in the financial markets. Their substantial capital resources and market influence can lead to significant price movements and shifts in market trends.

What is Golden Bridge Trading?

Golden Bridge Trading is a renowned financial education firm that specializes in teaching traders how to understand and capitalize on market forces driven by major financial institutions.

The Basics of Demand and Supply in Trading

Understanding Supply and Demand

Learn the fundamental concepts of how supply and demand affect financial markets, particularly in the context of large institutional trading activities.

Impact of Big Banks on Market Supply

How big banks’ supply decisions can lead to an oversupply or undersupply in the market, affecting prices and market stability.

Demand Influences by Big Banks

Explore how the demands of these financial giants sway market prices and lead to either bullish or bearish trends.

Analyzing Market Turning Points

Identifying Turning Points

A step-by-step guide on how to identify potential market turning points that could indicate significant changes in market trends.

Tools and Indicators

Discuss the essential tools and indicators used to detect shifts in market dynamics caused by the actions of big banks.

Historical Case Studies

Review several historical examples where big bank activities have directly led to notable market turning points.

Trading Strategies Around Market Dynamics

Strategy Development

How to develop robust trading strategies that account for the potential impact of big banks on market conditions.

Risk Management Techniques

Effective risk management techniques that help protect investments from volatility induced by big banks’ activities.

Leveraging Economic Reports

Understanding how to use economic reports and news releases as tools to predict and react to moves by big banks.

Advanced Insights into Institutional Trading

The Role of Algorithmic Trading

Examine how big banks use algorithmic trading to influence market conditions and how traders can adapt to this environment.

Behavioral Finance Insights

Insights into how behavioral finance plays into the trading decisions of big banks and the resulting market effects.

Predictive Analysis

How traders can use predictive analysis to anticipate the moves of big banks and position themselves advantageously in the market.

Educational Resources and Tools

Golden Bridge Trading’s Learning Platform

Introduction to the comprehensive learning resources offered by Golden Bridge Trading to help traders understand and exploit market dynamics.

Continuous Learning and Webinars

Information on ongoing educational opportunities, including webinars and online courses, focusing on big bank market impacts.

Community and Support

Benefits of joining the Golden Bridge Trading community for support, discussions, and shared learning about market dynamics.

Conclusion

Understanding the market turning points caused by the demand and supply dynamics of big banks is crucial for any trader looking to succeed in the financial markets. With the insights provided by Golden Bridge Trading, traders are better equipped to predict, understand, and capitalize on these pivotal market movements.

FAQs

- What causes market turning points?

- Market turning points are primarily caused by significant changes in demand and supply, often influenced by big banks and major financial institutions.

- How can a trader identify when a big bank is influencing the market?

- Traders can identify these influences by analyzing trading volumes, price movements, and economic reports that coincide with the activities of large institutions.

- What tools are most effective in analyzing big bank influences?

- Tools such as volume analysis, economic indicators, and advanced charting software are effective in analyzing the influence of big banks.

- Can individual traders compete with big banks?

- Yes, individual traders can compete by using strategic planning, advanced analysis, and by staying informed about the activities of these large institutions.

- How does Golden Bridge Trading help traders understand market dynamics?

- Golden Bridge Trading provides educational resources, real-time trading simulations, and expert insights into how big banks influence market dynamics.

Be the first to review “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.