-

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

Volatility Master Class

1 × $62.00

Volatility Master Class

1 × $62.00 -

×

Elliott Wave Street Course with Juan Maldonado

1 × $17.00

Elliott Wave Street Course with Juan Maldonado

1 × $17.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

Mechanics of Trading Module

1 × $6.00

Mechanics of Trading Module

1 × $6.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Discover the MEM Simple Moving Average Formula with Mary Ellen McGonagle

1 × $15.00

Discover the MEM Simple Moving Average Formula with Mary Ellen McGonagle

1 × $15.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading

$120.00 Original price was: $120.00.$6.00Current price is: $6.00.

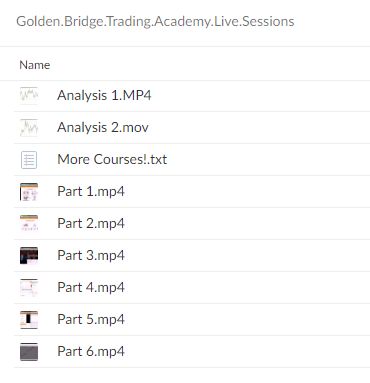

File Size: 5.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” below:

Understanding Market Turning Points: The Role of Big Banks by Golden Bridge Trading

Introduction to Market Dynamics

Welcome to a comprehensive guide on how the demand and supply controlled by big banking institutions can cause significant market turning points. This guide, presented by Golden Bridge Trading, will delve into the core dynamics that influence market fluctuations and how traders can leverage this knowledge for better trading decisions.

The Power of Big Banks

Big banks play a pivotal role in the financial markets. Their substantial capital resources and market influence can lead to significant price movements and shifts in market trends.

What is Golden Bridge Trading?

Golden Bridge Trading is a renowned financial education firm that specializes in teaching traders how to understand and capitalize on market forces driven by major financial institutions.

The Basics of Demand and Supply in Trading

Understanding Supply and Demand

Learn the fundamental concepts of how supply and demand affect financial markets, particularly in the context of large institutional trading activities.

Impact of Big Banks on Market Supply

How big banks’ supply decisions can lead to an oversupply or undersupply in the market, affecting prices and market stability.

Demand Influences by Big Banks

Explore how the demands of these financial giants sway market prices and lead to either bullish or bearish trends.

Analyzing Market Turning Points

Identifying Turning Points

A step-by-step guide on how to identify potential market turning points that could indicate significant changes in market trends.

Tools and Indicators

Discuss the essential tools and indicators used to detect shifts in market dynamics caused by the actions of big banks.

Historical Case Studies

Review several historical examples where big bank activities have directly led to notable market turning points.

Trading Strategies Around Market Dynamics

Strategy Development

How to develop robust trading strategies that account for the potential impact of big banks on market conditions.

Risk Management Techniques

Effective risk management techniques that help protect investments from volatility induced by big banks’ activities.

Leveraging Economic Reports

Understanding how to use economic reports and news releases as tools to predict and react to moves by big banks.

Advanced Insights into Institutional Trading

The Role of Algorithmic Trading

Examine how big banks use algorithmic trading to influence market conditions and how traders can adapt to this environment.

Behavioral Finance Insights

Insights into how behavioral finance plays into the trading decisions of big banks and the resulting market effects.

Predictive Analysis

How traders can use predictive analysis to anticipate the moves of big banks and position themselves advantageously in the market.

Educational Resources and Tools

Golden Bridge Trading’s Learning Platform

Introduction to the comprehensive learning resources offered by Golden Bridge Trading to help traders understand and exploit market dynamics.

Continuous Learning and Webinars

Information on ongoing educational opportunities, including webinars and online courses, focusing on big bank market impacts.

Community and Support

Benefits of joining the Golden Bridge Trading community for support, discussions, and shared learning about market dynamics.

Conclusion

Understanding the market turning points caused by the demand and supply dynamics of big banks is crucial for any trader looking to succeed in the financial markets. With the insights provided by Golden Bridge Trading, traders are better equipped to predict, understand, and capitalize on these pivotal market movements.

FAQs

- What causes market turning points?

- Market turning points are primarily caused by significant changes in demand and supply, often influenced by big banks and major financial institutions.

- How can a trader identify when a big bank is influencing the market?

- Traders can identify these influences by analyzing trading volumes, price movements, and economic reports that coincide with the activities of large institutions.

- What tools are most effective in analyzing big bank influences?

- Tools such as volume analysis, economic indicators, and advanced charting software are effective in analyzing the influence of big banks.

- Can individual traders compete with big banks?

- Yes, individual traders can compete by using strategic planning, advanced analysis, and by staying informed about the activities of these large institutions.

- How does Golden Bridge Trading help traders understand market dynamics?

- Golden Bridge Trading provides educational resources, real-time trading simulations, and expert insights into how big banks influence market dynamics.

Be the first to review “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.