-

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

The Cash Flow Bootcamp with John Macgregor

1 × $233.00

The Cash Flow Bootcamp with John Macgregor

1 × $233.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Option, Futures and Other Derivates 9th Edition

1 × $6.00

Option, Futures and Other Derivates 9th Edition

1 × $6.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Toni’s Market Club with Toni Turner

1 × $6.00

Toni’s Market Club with Toni Turner

1 × $6.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

Part I Basic and Part II Beyond the Basic with Strategic Trading

1 × $6.00

Part I Basic and Part II Beyond the Basic with Strategic Trading

1 × $6.00 -

×

The Best Mechanical DayTrading System I Know with Bruce Babcock

1 × $6.00

The Best Mechanical DayTrading System I Know with Bruce Babcock

1 × $6.00 -

×

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Online Investing Hacks with Bonnie Biafore

1 × $6.00

Online Investing Hacks with Bonnie Biafore

1 × $6.00 -

×

Precise Exits & Entries with Charles LeBeau

1 × $6.00

Precise Exits & Entries with Charles LeBeau

1 × $6.00 -

×

Alfred White’s Rules of Planetary Pictures with Witte, Rudolph, Lefeldt

1 × $6.00

Alfred White’s Rules of Planetary Pictures with Witte, Rudolph, Lefeldt

1 × $6.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00

Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading

$120.00 Original price was: $120.00.$6.00Current price is: $6.00.

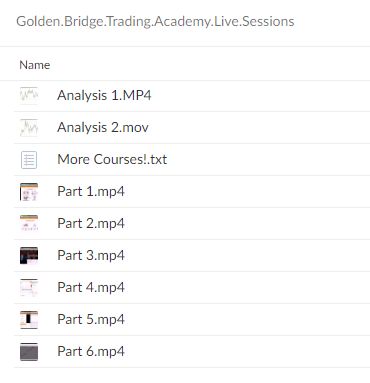

File Size: 5.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” below:

Understanding Market Turning Points: The Role of Big Banks by Golden Bridge Trading

Introduction to Market Dynamics

Welcome to a comprehensive guide on how the demand and supply controlled by big banking institutions can cause significant market turning points. This guide, presented by Golden Bridge Trading, will delve into the core dynamics that influence market fluctuations and how traders can leverage this knowledge for better trading decisions.

The Power of Big Banks

Big banks play a pivotal role in the financial markets. Their substantial capital resources and market influence can lead to significant price movements and shifts in market trends.

What is Golden Bridge Trading?

Golden Bridge Trading is a renowned financial education firm that specializes in teaching traders how to understand and capitalize on market forces driven by major financial institutions.

The Basics of Demand and Supply in Trading

Understanding Supply and Demand

Learn the fundamental concepts of how supply and demand affect financial markets, particularly in the context of large institutional trading activities.

Impact of Big Banks on Market Supply

How big banks’ supply decisions can lead to an oversupply or undersupply in the market, affecting prices and market stability.

Demand Influences by Big Banks

Explore how the demands of these financial giants sway market prices and lead to either bullish or bearish trends.

Analyzing Market Turning Points

Identifying Turning Points

A step-by-step guide on how to identify potential market turning points that could indicate significant changes in market trends.

Tools and Indicators

Discuss the essential tools and indicators used to detect shifts in market dynamics caused by the actions of big banks.

Historical Case Studies

Review several historical examples where big bank activities have directly led to notable market turning points.

Trading Strategies Around Market Dynamics

Strategy Development

How to develop robust trading strategies that account for the potential impact of big banks on market conditions.

Risk Management Techniques

Effective risk management techniques that help protect investments from volatility induced by big banks’ activities.

Leveraging Economic Reports

Understanding how to use economic reports and news releases as tools to predict and react to moves by big banks.

Advanced Insights into Institutional Trading

The Role of Algorithmic Trading

Examine how big banks use algorithmic trading to influence market conditions and how traders can adapt to this environment.

Behavioral Finance Insights

Insights into how behavioral finance plays into the trading decisions of big banks and the resulting market effects.

Predictive Analysis

How traders can use predictive analysis to anticipate the moves of big banks and position themselves advantageously in the market.

Educational Resources and Tools

Golden Bridge Trading’s Learning Platform

Introduction to the comprehensive learning resources offered by Golden Bridge Trading to help traders understand and exploit market dynamics.

Continuous Learning and Webinars

Information on ongoing educational opportunities, including webinars and online courses, focusing on big bank market impacts.

Community and Support

Benefits of joining the Golden Bridge Trading community for support, discussions, and shared learning about market dynamics.

Conclusion

Understanding the market turning points caused by the demand and supply dynamics of big banks is crucial for any trader looking to succeed in the financial markets. With the insights provided by Golden Bridge Trading, traders are better equipped to predict, understand, and capitalize on these pivotal market movements.

FAQs

- What causes market turning points?

- Market turning points are primarily caused by significant changes in demand and supply, often influenced by big banks and major financial institutions.

- How can a trader identify when a big bank is influencing the market?

- Traders can identify these influences by analyzing trading volumes, price movements, and economic reports that coincide with the activities of large institutions.

- What tools are most effective in analyzing big bank influences?

- Tools such as volume analysis, economic indicators, and advanced charting software are effective in analyzing the influence of big banks.

- Can individual traders compete with big banks?

- Yes, individual traders can compete by using strategic planning, advanced analysis, and by staying informed about the activities of these large institutions.

- How does Golden Bridge Trading help traders understand market dynamics?

- Golden Bridge Trading provides educational resources, real-time trading simulations, and expert insights into how big banks influence market dynamics.

Be the first to review “Introduction To Market Turning Points Caused – The Demand & Supply Of Big Banks Institution – Golden Bridge Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.