-

×

Rapid Cash & Success System

1 × $31.00

Rapid Cash & Success System

1 × $31.00 -

×

Don Fishback ODDS The Key to 95 Winners

1 × $6.00

Don Fishback ODDS The Key to 95 Winners

1 × $6.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

Reversal Magic Video Course

1 × $15.00

Reversal Magic Video Course

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

The Basics of Swing Trading with Jason Bond

1 × $31.00

The Basics of Swing Trading with Jason Bond

1 × $31.00 -

×

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00 -

×

The Ultimate Trader Transformation

1 × $62.00

The Ultimate Trader Transformation

1 × $62.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Yuri Shamenko Videos

1 × $5.00

Yuri Shamenko Videos

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Beginner's Forex Course with Jossenia Pomare

1 × $60.00

Beginner's Forex Course with Jossenia Pomare

1 × $60.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00 -

×

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00

CREDIT SPREAD SURGERY - Bear Call and Bull Put Mastery with Hari Swaminathan

1 × $6.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

Technical Analysis Classes (Video, Manuals)

1 × $6.00

Technical Analysis Classes (Video, Manuals)

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

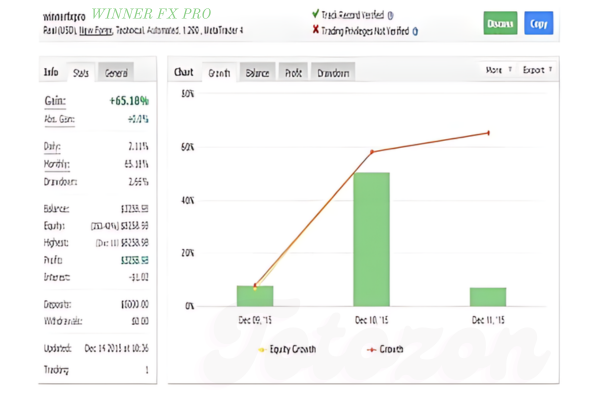

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Betfair Scalper Trading Course

1 × $15.00

Betfair Scalper Trading Course

1 × $15.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trading Order Power Strategies

1 × $6.00

Trading Order Power Strategies

1 × $6.00 -

×

The Triad Formula System with Jason Fielder

1 × $6.00

The Triad Formula System with Jason Fielder

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Real Motion Trading with MarketGauge

1 × $62.00

Real Motion Trading with MarketGauge

1 × $62.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

The Sellers Code Master Class with Flip2Freedom

1 × $31.00

The Sellers Code Master Class with Flip2Freedom

1 × $31.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Bollinger Band Jackpot with Mark Deaton

1 × $31.00

Bollinger Band Jackpot with Mark Deaton

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

S&P Market Timing Course For E-mini & Options Traders

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “S&P Market Timing Course For E-mini & Options Traders” below:

S&P Market Timing Course For E-mini & Options Traders

Understanding market timing is crucial for traders looking to maximize their returns and minimize risks. This article delves into the S&P Market Timing Course for E-mini & Options Traders, offering insights and strategies that can significantly enhance your trading skills. Whether you are a novice or an experienced trader, this course provides the tools needed to succeed in the fast-paced world of E-mini and options trading.

Introduction

What is Market Timing?

Market timing involves predicting future price movements in financial markets and making trading decisions based on these predictions. The goal is to enter and exit trades at optimal times to maximize profits.

Importance of Market Timing in Trading

Effective market timing can lead to substantial gains and help avoid significant losses. It allows traders to capitalize on market trends and mitigate risks associated with market volatility.

E-mini and Options Trading

What are E-mini Futures?

E-mini futures are electronically traded futures contracts that represent a fraction of the value of standard futures contracts. They are popular due to their liquidity and lower capital requirements.

What are Options?

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain period.

Core Concepts of the S&P Market Timing Course

Trend Analysis

Understanding and identifying market trends is a fundamental aspect of market timing. The course covers various techniques to analyze and predict trends in the S&P 500.

Technical Indicators

Technical indicators such as moving averages, RSI, and MACD are crucial tools for market timing. The course teaches how to use these indicators effectively to make informed trading decisions.

Chart Patterns

Recognizing chart patterns like head and shoulders, double tops, and triangles can provide valuable insights into potential market movements. The course offers comprehensive lessons on interpreting these patterns.

Strategies for E-mini Traders

1. Breakout Trading

Breakout trading involves entering a trade when the price breaks through a significant support or resistance level. This strategy aims to capture substantial price movements.

2. Scalping

Scalping is a short-term trading strategy that focuses on making small profits from minor price changes. The course teaches techniques to execute scalping trades efficiently.

3. Swing Trading

Swing trading involves holding positions for several days to weeks to profit from expected market swings. The course covers how to identify and capitalize on these swings.

Strategies for Options Traders

1. Covered Calls

A covered call strategy involves holding a long position in a stock while selling a call option on the same stock. This strategy generates additional income from the premium received from selling the call option.

2. Protective Puts

A protective put strategy involves buying a put option while holding the underlying stock. This provides downside protection against potential losses.

3. Iron Condor

An iron condor is an options strategy that involves selling a lower-strike put and a higher-strike call, while simultaneously buying a further lower-strike put and a further higher-strike call. This strategy profits from low volatility.

Risk Management Techniques

Position Sizing

Determining the appropriate position size is crucial to managing risk. The course covers methods to calculate position sizes based on account size and risk tolerance.

Stop-Loss Orders

Stop-loss orders are used to limit potential losses by automatically closing a position when the price reaches a specified level. The course teaches how to set effective stop-loss orders.

Diversification

Diversifying your trading portfolio can reduce risk by spreading investments across different assets. The course provides strategies for effective diversification.

Tools and Resources

Trading Platforms

The course recommends various trading platforms that offer advanced charting tools, technical indicators, and other features essential for market timing.

Educational Materials

Access to books, articles, and webinars is provided to enhance your understanding of market timing concepts and strategies.

Community Support

Joining a community of traders can provide valuable insights and support. The course includes access to forums and groups where you can share experiences and learn from others.

Advantages of the S&P Market Timing Course

Comprehensive Coverage

The course covers all essential aspects of market timing, from basic concepts to advanced strategies.

Practical Application

Emphasis is placed on practical application, with real-world examples and exercises to reinforce learning.

Expert Instruction

Learn from experienced traders and educators who provide insights and tips based on years of trading experience.

Challenges and Considerations

Market Volatility

Market conditions can change rapidly, affecting the performance of timing strategies. Stay informed and be ready to adapt.

Discipline and Patience

Successful market timing requires discipline and patience. Stick to your trading plan and avoid making impulsive decisions.

Continuous Learning

The market is constantly evolving. Continuously educate yourself and refine your strategies to stay ahead.

Conclusion

The S&P Market Timing Course for E-mini & Options Traders offers a comprehensive guide to mastering market timing. By understanding and implementing the strategies and techniques covered in this course, you can improve your trading performance and achieve greater success in the markets.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “S&P Market Timing Course For E-mini & Options Traders” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.