-

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

AIME System Forex Trading Course

1 × $6.00

AIME System Forex Trading Course

1 × $6.00 -

×

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00 -

×

Back to the Futures

1 × $31.00

Back to the Futures

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Unlock the Millionaire Within with Dan Lok

1 × $15.00

Unlock the Millionaire Within with Dan Lok

1 × $15.00 -

×

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00 -

×

The Complete Guide to Option Selling with James Cordier

1 × $6.00

The Complete Guide to Option Selling with James Cordier

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Extracted MBA with Kelly Vinal

1 × $6.00

The Extracted MBA with Kelly Vinal

1 × $6.00 -

×

FX Accelerator 2

1 × $31.00

FX Accelerator 2

1 × $31.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Charles Cottle Package ( Discount 50% )

1 × $23.00

Charles Cottle Package ( Discount 50% )

1 × $23.00 -

×

Trading Hub 2.0 Book

1 × $6.00

Trading Hub 2.0 Book

1 × $6.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Positive Thinking & Stress Management for Trading with Daley Personal Development

1 × $6.00

Positive Thinking & Stress Management for Trading with Daley Personal Development

1 × $6.00 -

×

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Bear Market Investing Strategies with Harry Schultz

1 × $6.00

Bear Market Investing Strategies with Harry Schultz

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00 -

×

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00 -

×

TradingTheTape - SMTTT

1 × $15.00

TradingTheTape - SMTTT

1 × $15.00 -

×

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00 -

×

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

1 × $109.00

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

1 × $109.00 -

×

Intra-Day Trading with Market Internals I with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals I with Greg Capra

1 × $6.00 -

×

Intermediate Weekly Calendars

1 × $4.00

Intermediate Weekly Calendars

1 × $4.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

MarketSharks Forex Training

1 × $31.00

MarketSharks Forex Training

1 × $31.00 -

×

On-Demand Options with Sang Lucci

1 × $6.00

On-Demand Options with Sang Lucci

1 × $6.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

Stop Loss Secrets

1 × $6.00

Stop Loss Secrets

1 × $6.00 -

×

Trading Analysis Crash Course

1 × $23.00

Trading Analysis Crash Course

1 × $23.00 -

×

Candlesticks Trading Course

1 × $31.00

Candlesticks Trading Course

1 × $31.00 -

×

Winning on the Stock Market with Brian J.Millard

1 × $6.00

Winning on the Stock Market with Brian J.Millard

1 × $6.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00 -

×

Special Bootcamp with Smart Earners Academy

1 × $5.00

Special Bootcamp with Smart Earners Academy

1 × $5.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Secrets of a Pivot Boss. Revealing Proven Methods for Profiting in The Market with Franklin Ochoa

1 × $6.00

Secrets of a Pivot Boss. Revealing Proven Methods for Profiting in The Market with Franklin Ochoa

1 × $6.00 -

×

Monthly Mastermind

1 × $6.00

Monthly Mastermind

1 × $6.00 -

×

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00 -

×

Professional Trader Series DVD Set (Full)

1 × $23.00

Professional Trader Series DVD Set (Full)

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

B.O.S.S. SPY Sniper with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. SPY Sniper with Pat Mitchell – Trick Trades

1 × $39.00 -

×

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00 -

×

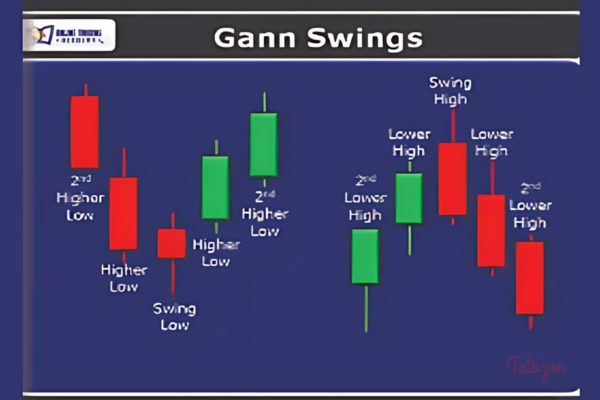

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

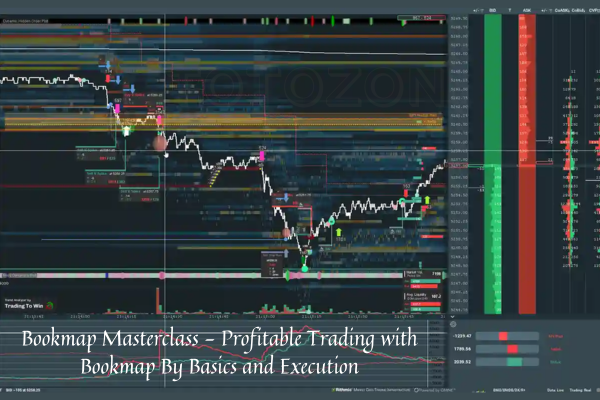

Bookmap Masterclass - Profitable Trading with Bookmap By Basics and Execution

1 × $8.00

Bookmap Masterclass - Profitable Trading with Bookmap By Basics and Execution

1 × $8.00 -

×

The Face of God Course

1 × $15.00

The Face of God Course

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

Newsbeat Bandits Program July 2019

1 × $23.00

Newsbeat Bandits Program July 2019

1 × $23.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

Trade on the Fly

1 × $6.00

Trade on the Fly

1 × $6.00 -

×

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00 -

×

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Tristan Edwards: "How To Set Up A Hedge Fund"

1 × $6.00

Tristan Edwards: "How To Set Up A Hedge Fund"

1 × $6.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Construction & Application of the MACD Indicator(video) with Gerald Appel

1 × $4.00

Construction & Application of the MACD Indicator(video) with Gerald Appel

1 × $4.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00 -

×

The Lucci Method with Sang Lucci

1 × $15.00

The Lucci Method with Sang Lucci

1 × $15.00 -

×

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00 -

×

Virtual Intensive Trader Training

1 × $31.00

Virtual Intensive Trader Training

1 × $31.00 -

×

Volatility Master Class

1 × $62.00

Volatility Master Class

1 × $62.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

Part-Time Day Trading Courses

1 × $54.00

Part-Time Day Trading Courses

1 × $54.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Best of the Professional Traders Journal. Market Timing with Larry Connors” below:

The Best of the Professional Traders Journal: Market Timing with Larry Connors

Market timing is a crucial aspect of trading that can significantly impact profitability. Larry Connors, a prominent figure in the trading community, has shared valuable insights on market timing through the Professional Traders Journal. This article explores The Best of the Professional Traders Journal: Market Timing with Larry Connors, offering you key strategies and techniques to enhance your trading success.

Introduction to Market Timing

What is Market Timing?

Market timing refers to the strategy of making buy or sell decisions of financial assets by attempting to predict future market price movements. It involves identifying the optimal times to enter or exit the market to maximize returns.

Why is Market Timing Important?

Effective market timing can lead to substantial gains and help avoid significant losses. It allows traders to capitalize on market trends and mitigate risks associated with market volatility.

Larry Connors’ Approach to Market Timing

Who is Larry Connors?

Larry Connors is a renowned trader, author, and educator known for his data-driven and systematic approach to trading. His strategies are based on extensive research and have been widely adopted by professional traders.

The Professional Traders Journal

The Professional Traders Journal, curated by Connors, is a publication that provides advanced trading strategies, market analysis, and insights from experienced traders.

Key Market Timing Strategies

1. The RSI Strategy

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Connors’ RSI strategy involves buying when the RSI indicates oversold conditions and selling when it indicates overbought conditions.

2. The 2-Period RSI Strategy

This strategy uses a short-term RSI to identify quick trading opportunities. Connors recommends buying when the 2-period RSI is below 10 and selling when it is above 90.

3. The VIX Strategy

The VIX, or Volatility Index, measures market volatility. Connors’ VIX strategy involves trading based on VIX levels, buying when the VIX is high and selling when it is low.

4. Moving Average Crossovers

Moving average crossovers are used to identify trend reversals. Connors suggests using the 50-day and 200-day moving averages to determine market direction.

5. The Advance/Decline Line

The advance/decline line is a breadth indicator that shows the number of advancing stocks versus declining stocks. Connors uses this indicator to gauge market strength and potential reversals.

Implementing Connors’ Market Timing Strategies

Step 1: Set Up Your Charts

Use charting software to set up the necessary indicators, such as RSI, moving averages, and the advance/decline line.

Step 2: Identify Entry Points

Look for signals from the indicators that suggest favorable entry points. For example, buy when the RSI is below 30 or when the VIX is high.

Step 3: Determine Exit Points

Set clear exit points based on the indicators. For example, sell when the RSI is above 70 or when the VIX drops.

Step 4: Apply Risk Management

Implement risk management techniques, such as stop-loss orders and position sizing, to protect your capital.

Step 5: Monitor and Adjust

Continuously monitor your trades and adjust your strategy as needed based on market conditions and performance.

Advantages of Connors’ Market Timing Strategies

High Probability Trades

Connors’ strategies are based on statistical analysis, providing high-probability trading setups.

Clear Entry and Exit Points

These strategies offer clear guidelines for entering and exiting trades, reducing ambiguity and emotional decision-making.

Flexibility

Connors’ market timing strategies can be applied to various markets, including stocks, ETFs, and forex.

Challenges and Considerations

Market Conditions

Market conditions can change rapidly, affecting the performance of timing strategies. Stay informed and be ready to adapt.

Discipline

Successful market timing requires discipline and patience. Stick to your trading plan and avoid making impulsive decisions.

Continuous Learning

The market is constantly evolving. Continuously educate yourself and refine your strategies to stay ahead.

Conclusion

The Best of the Professional Traders Journal: Market Timing with Larry Connors offers a wealth of knowledge and strategies to help traders succeed. By understanding and implementing these market timing techniques, you can improve your trading performance and achieve greater success in the markets.

FAQs

1. What is the main advantage of using Connors’ RSI strategy?

The RSI strategy helps identify overbought and oversold conditions, providing timely entry and exit points for trades.

2. How does the VIX strategy benefit market timing?

The VIX strategy takes advantage of market volatility, allowing traders to profit from significant price movements.

3. Can beginners use these strategies effectively?

Yes, but it requires a willingness to learn and practice. Starting with a demo account can help build confidence.

4. What are the risks associated with market timing?

The primary risks include market volatility and the potential for mistimed trades. Proper risk management is essential.

5. How can traders stay disciplined while using Connors’ strategies?

Creating a detailed trading plan and sticking to it can help maintain discipline. Continuous learning and practice also enhance discipline.

Be the first to review “The Best of the Professional Traders Journal. Market Timing with Larry Connors” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.