-

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Order Flow Trading Course with Orderflows

1 × $23.00

Order Flow Trading Course with Orderflows

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

King Zulfan Academy – Course with Malaysian Trader

1 × $5.00

King Zulfan Academy – Course with Malaysian Trader

1 × $5.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

Trend Hunter Strategy

1 × $5.00

Trend Hunter Strategy

1 × $5.00 -

×

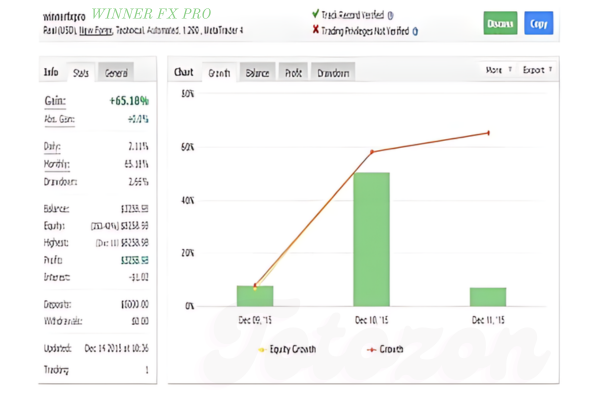

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

GMB Master Academy

1 × $31.00

GMB Master Academy

1 × $31.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Developting a Forex Trading Plan Webminar

1 × $6.00

Developting a Forex Trading Plan Webminar

1 × $6.00 -

×

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00 -

×

Atlas Forex Trading Course

1 × $5.00

Atlas Forex Trading Course

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Options Foundations Class

1 × $23.00

Options Foundations Class

1 × $23.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Mastering The Markets

1 × $4.00

Mastering The Markets

1 × $4.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Options University - 3rd Anual Forex Superconference

1 × $3.00

Options University - 3rd Anual Forex Superconference

1 × $3.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

Back to the Futures

1 × $31.00

Back to the Futures

1 × $31.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

Getting Rich in America with Dwight Lee

1 × $6.00

Getting Rich in America with Dwight Lee

1 × $6.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

Winning with Value Charts with Dave Stendahl

1 × $6.00

Winning with Value Charts with Dave Stendahl

1 × $6.00 -

×

Winning the Mental Game on Wall Street with John Magee

1 × $6.00

Winning the Mental Game on Wall Street with John Magee

1 × $6.00 -

×

Rate of Change Indicator with Alphashark

1 × $31.00

Rate of Change Indicator with Alphashark

1 × $31.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

KvngSolz Fx Mentorship

1 × $27.00

KvngSolz Fx Mentorship

1 × $27.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

The Next Big Investment Boom with Mark Shipman

1 × $6.00

The Next Big Investment Boom with Mark Shipman

1 × $6.00

Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer” below:

Steidlmayer on Markets: Trading with Market Profile with J. Peter Steidlmayer

Introduction

Navigating the markets with a unique and effective methodology can be a game changer for traders. J. Peter Steidlmayer, a notable figure in the trading world, developed the Market Profile—a powerful tool that provides traders with a clear view of market activity and helps them make more informed decisions. Let’s delve into how Market Profile can transform your trading strategy.

Who is J. Peter Steidlmayer?

J. Peter Steidlmayer is a seasoned trader and former member of the Chicago Board of Trade (CBOT). Recognized for his innovative approach to the markets, Steidlmayer’s creation of the Market Profile has been instrumental in changing how traders view price action.

Understanding Market Profile

What is Market Profile?

Market Profile is a graphical representation that shows price and time information as a distribution, helping traders identify trading opportunities based on real market dynamics.

Components of Market Profile

- Price: Displayed along the y-axis.

- Time: Displayed along the x-axis.

- Volume: Represented by the width of the price bars.

Benefits of Using Market Profile

- Market transparency: Offers a clear view of market activity, highlighting the most traded price levels.

- Improved decision making: Provides an organized way to interpret market data and make strategic trading decisions.

Key Concepts of Market Profile Trading

Value Area

1. Definition

The range where a significant portion of trading activity occurs, usually around 70% of the day’s trades.

2. Importance

Understanding the value area helps traders pinpoint high-probability trading zones.

Point of Control

The highest volume price level

This is the price level where the highest volume occurred during the session, indicating strong buyer or seller activity.

Implementing Market Profile in Your Trading Strategy

Day Trading with Market Profile

- Identifying Breakouts

- Capitalizing on Market Reversals

These strategies are pivotal for day traders looking to leverage short-term price movements.

Swing Trading Approaches

Using Market Profile for Swing Trades

- Longer Time Frames: Helps in identifying overarching market trends.

- Entry and Exit Points: Enhances accuracy for entering and exiting positions.

Tools and Indicators to Combine with Market Profile

Technical Analysis Tools

- Moving Averages

- Oscillators

Integrating these tools with Market Profile can provide a comprehensive view of market conditions.

Market Profile Case Studies

Successful Trades Using Market Profile

We will explore real-life examples where Market Profile has been effectively used to capture significant market moves.

Common Challenges and Solutions in Market Profile Trading

Data Overload

Simplifying Data Interpretation

Using filters and focusing on key data points can prevent information overload and improve trading efficiency.

Market Volatility

Adjusting to Sudden Market Changes

Being adaptable and using Market Profile’s flexibility can help navigate through volatile conditions.

Conclusion

Market Profile, as developed by J. Peter Steidlmayer, is more than just a trading tool—it’s a comprehensive approach that enhances how traders perceive and react to market dynamics. By understanding and applying the principles of Market Profile, traders can significantly improve their market insights and trading performance.

FAQs

- What is the best time frame to use with Market Profile?

- Market Profile is versatile and can be applied across various time frames, but it is particularly effective in day trading and swing trading.

- How does the Point of Control affect trading decisions?

- The Point of Control indicates the price level with the highest trading activity, serving as a key reference point for entry and exit decisions.

- Can Market Profile be used in all market conditions?

- Yes, Market Profile is adaptable to different market conditions and can provide valuable insights in both trending and range-bound markets.

- What should a new trader know before using Market Profile?

- New traders should understand the basic concepts of market structure and price action to effectively utilize Market Profile.

- How does Market Profile differ from traditional technical analysis?

- Unlike traditional technical analysis, which focuses on price movements and patterns, Market Profile emphasizes the distribution of price over time, providing a different perspective on market dynamics.

Be the first to review “Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.