-

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Risk Management with Aswath Damodaran

1 × $6.00

Risk Management with Aswath Damodaran

1 × $6.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Trading Strategies with Larry Sanders

1 × $6.00

Trading Strategies with Larry Sanders

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

My Life as a Quant with Emanuel Derman

1 × $6.00

My Life as a Quant with Emanuel Derman

1 × $6.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

FruitFly For Consistent Income with Matt Williamson

1 × $6.00

FruitFly For Consistent Income with Matt Williamson

1 × $6.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

Stock Market 101 with Sabrina Peterson

1 × $4.00

Stock Market 101 with Sabrina Peterson

1 × $4.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

Penny Stock Mastery

1 × $31.00

Penny Stock Mastery

1 × $31.00 -

×

The Correlation Code with Jason Fielder

1 × $6.00

The Correlation Code with Jason Fielder

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Master Trader - Advander Management Strategies

1 × $39.00

Master Trader - Advander Management Strategies

1 × $39.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Advanced Price Action Course with ZenFX

1 × $5.00

Advanced Price Action Course with ZenFX

1 × $5.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

Trade Like a Market Maker with James Ramelli – AlphaShark

$99.00 Original price was: $99.00.$15.00Current price is: $15.00.

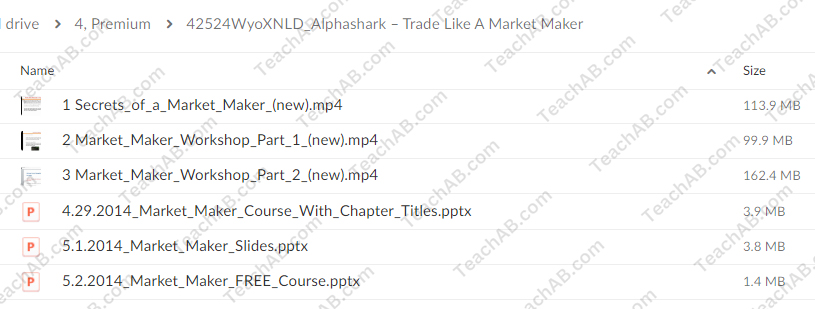

File Size: 385.3 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Trade Like a Market Maker with James Ramelli – AlphaShark” below:

Trade Like a Market Maker with James Ramelli – AlphaShark

Introduction

Trading in the financial markets can often seem like navigating a complex maze. However, learning to trade like a market maker can give you a significant edge. In this guide, we delve into the insights shared by James Ramelli from AlphaShark, helping you adopt the strategies of market makers. By the end, you’ll have a solid understanding of how to approach trading with a market maker’s mindset.

Understanding Market Makers

Who Are Market Makers?

Market makers are crucial participants in financial markets. They provide liquidity by being ready to buy and sell securities at any given time, thus facilitating smoother market operations.

Role of Market Makers

Market makers ensure that there are enough buyers and sellers for securities, which helps maintain price stability and reduces volatility. They profit from the spread between the bid and ask prices.

James Ramelli and AlphaShark

Who is James Ramelli?

James Ramelli is a seasoned trader and a prominent educator at AlphaShark Trading. With years of experience, he specializes in options trading and market making strategies.

About AlphaShark Trading

AlphaShark Trading is a leading educational platform that offers traders insights into advanced trading strategies, focusing on options and equity markets. It provides resources and tools to help traders improve their skills and profitability.

Key Concepts to Trade Like a Market Maker

1. Understanding the Bid-Ask Spread

The bid-ask spread is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Market makers capitalize on this spread.

2. Liquidity Provision

Providing liquidity means being ready to buy or sell securities at any time. This helps in executing trades more efficiently and stabilizes the market.

3. Managing Inventory

Market makers manage an inventory of securities to balance the buying and selling activities. This involves assessing market demand and supply to maintain optimal levels.

4. Risk Management

Effective risk management is crucial. Market makers use various strategies to hedge against potential losses, ensuring their positions are well-protected.

Steps to Trade Like a Market Maker

1. Analyze Market Depth

Market depth refers to the market’s ability to sustain large orders without affecting the price of the security. Analyzing market depth helps in understanding liquidity levels.

2. Utilize Technical Analysis

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Tools such as moving averages and Bollinger Bands are essential.

3. Focus on High Liquidity Securities

Trading highly liquid securities ensures that there is always a market for buying and selling, making it easier to manage trades and mitigate risks.

4. Implement a Robust Trading Plan

A well-defined trading plan that outlines your entry and exit strategies, risk tolerance, and profit targets is fundamental to successful trading.

5. Continuous Learning and Adaptation

The market is constantly evolving. Staying informed and adapting to new market conditions and strategies is key to long-term success.

Benefits of Trading Like a Market Maker

1. Enhanced Liquidity

By trading like a market maker, you contribute to market liquidity, making it easier for other traders to execute their trades.

2. Potential for Consistent Profits

Market makers often achieve consistent profits by capitalizing on the bid-ask spread and efficient inventory management.

3. Improved Risk Management

With a focus on risk management, market makers are better equipped to handle market volatility and protect their investments.

Common Challenges and How to Overcome Them

1. Market Volatility

Volatility can pose significant risks. To mitigate this, use hedging strategies and stay informed about market conditions.

2. Maintaining Liquidity

Ensuring liquidity requires constant market analysis and adjusting positions as necessary. Utilize market depth tools to stay ahead.

3. Technological Barriers

Access to advanced trading platforms and tools is essential. Invest in technology that offers real-time data and analytics to support your trading strategies.

Advanced Tips for Aspiring Market Makers

1. Master Order Flow Analysis

Understanding order flow can give you insights into market trends and potential price movements. It involves tracking the buying and selling orders in the market.

2. Develop a Scalping Strategy

Scalping involves making numerous small trades to take advantage of minor price changes. This can be a profitable strategy if executed correctly.

3. Leverage Algorithmic Trading

Algorithmic trading uses computer algorithms to execute trades based on predefined criteria. This can enhance trading efficiency and precision.

Conclusion

Trading like a market maker with insights from James Ramelli and AlphaShark Trading can transform your approach to the markets. By focusing on liquidity provision, risk management, and continuous learning, you can adopt a professional trading mindset. Remember, the journey to becoming a successful trader is ongoing, requiring dedication and adaptability.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trade Like a Market Maker with James Ramelli – AlphaShark” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.