-

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00 -

×

Trading Straddles, Strangles, Long Gamma, VXX & UVXY with Option Pit

1 × $39.00

Trading Straddles, Strangles, Long Gamma, VXX & UVXY with Option Pit

1 × $39.00 -

×

Private Seminar with Alan Andrew

1 × $6.00

Private Seminar with Alan Andrew

1 × $6.00 -

×

A Bull in China with Jim Rogers

1 × $6.00

A Bull in China with Jim Rogers

1 × $6.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

Shorting for Profit

1 × $31.00

Shorting for Profit

1 × $31.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00 -

×

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Trade Like a Market Maker with James Ramelli – AlphaShark

$99.00 Original price was: $99.00.$15.00Current price is: $15.00.

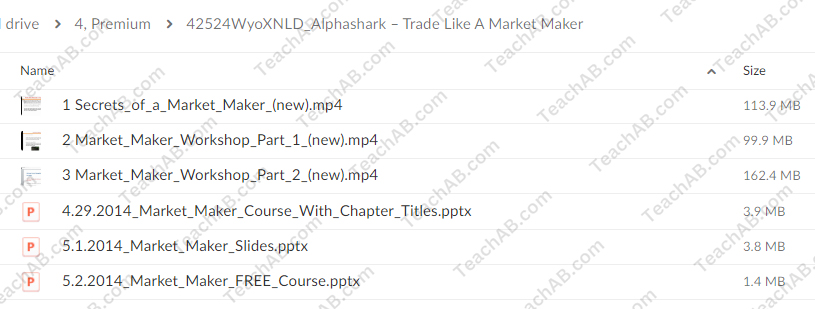

File Size: 385.3 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Trade Like a Market Maker with James Ramelli – AlphaShark” below:

Trade Like a Market Maker with James Ramelli – AlphaShark

Introduction

Trading in the financial markets can often seem like navigating a complex maze. However, learning to trade like a market maker can give you a significant edge. In this guide, we delve into the insights shared by James Ramelli from AlphaShark, helping you adopt the strategies of market makers. By the end, you’ll have a solid understanding of how to approach trading with a market maker’s mindset.

Understanding Market Makers

Who Are Market Makers?

Market makers are crucial participants in financial markets. They provide liquidity by being ready to buy and sell securities at any given time, thus facilitating smoother market operations.

Role of Market Makers

Market makers ensure that there are enough buyers and sellers for securities, which helps maintain price stability and reduces volatility. They profit from the spread between the bid and ask prices.

James Ramelli and AlphaShark

Who is James Ramelli?

James Ramelli is a seasoned trader and a prominent educator at AlphaShark Trading. With years of experience, he specializes in options trading and market making strategies.

About AlphaShark Trading

AlphaShark Trading is a leading educational platform that offers traders insights into advanced trading strategies, focusing on options and equity markets. It provides resources and tools to help traders improve their skills and profitability.

Key Concepts to Trade Like a Market Maker

1. Understanding the Bid-Ask Spread

The bid-ask spread is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Market makers capitalize on this spread.

2. Liquidity Provision

Providing liquidity means being ready to buy or sell securities at any time. This helps in executing trades more efficiently and stabilizes the market.

3. Managing Inventory

Market makers manage an inventory of securities to balance the buying and selling activities. This involves assessing market demand and supply to maintain optimal levels.

4. Risk Management

Effective risk management is crucial. Market makers use various strategies to hedge against potential losses, ensuring their positions are well-protected.

Steps to Trade Like a Market Maker

1. Analyze Market Depth

Market depth refers to the market’s ability to sustain large orders without affecting the price of the security. Analyzing market depth helps in understanding liquidity levels.

2. Utilize Technical Analysis

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Tools such as moving averages and Bollinger Bands are essential.

3. Focus on High Liquidity Securities

Trading highly liquid securities ensures that there is always a market for buying and selling, making it easier to manage trades and mitigate risks.

4. Implement a Robust Trading Plan

A well-defined trading plan that outlines your entry and exit strategies, risk tolerance, and profit targets is fundamental to successful trading.

5. Continuous Learning and Adaptation

The market is constantly evolving. Staying informed and adapting to new market conditions and strategies is key to long-term success.

Benefits of Trading Like a Market Maker

1. Enhanced Liquidity

By trading like a market maker, you contribute to market liquidity, making it easier for other traders to execute their trades.

2. Potential for Consistent Profits

Market makers often achieve consistent profits by capitalizing on the bid-ask spread and efficient inventory management.

3. Improved Risk Management

With a focus on risk management, market makers are better equipped to handle market volatility and protect their investments.

Common Challenges and How to Overcome Them

1. Market Volatility

Volatility can pose significant risks. To mitigate this, use hedging strategies and stay informed about market conditions.

2. Maintaining Liquidity

Ensuring liquidity requires constant market analysis and adjusting positions as necessary. Utilize market depth tools to stay ahead.

3. Technological Barriers

Access to advanced trading platforms and tools is essential. Invest in technology that offers real-time data and analytics to support your trading strategies.

Advanced Tips for Aspiring Market Makers

1. Master Order Flow Analysis

Understanding order flow can give you insights into market trends and potential price movements. It involves tracking the buying and selling orders in the market.

2. Develop a Scalping Strategy

Scalping involves making numerous small trades to take advantage of minor price changes. This can be a profitable strategy if executed correctly.

3. Leverage Algorithmic Trading

Algorithmic trading uses computer algorithms to execute trades based on predefined criteria. This can enhance trading efficiency and precision.

Conclusion

Trading like a market maker with insights from James Ramelli and AlphaShark Trading can transform your approach to the markets. By focusing on liquidity provision, risk management, and continuous learning, you can adopt a professional trading mindset. Remember, the journey to becoming a successful trader is ongoing, requiring dedication and adaptability.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trade Like a Market Maker with James Ramelli – AlphaShark” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.