-

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00 -

×

Quant Edge Online Home Study Course with T3 Live

1 × $39.00

Quant Edge Online Home Study Course with T3 Live

1 × $39.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

Trading Hub 4.0 with Mr. Khan

1 × $27.00

Trading Hub 4.0 with Mr. Khan

1 × $27.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

Market Maker Strategy Video Course with Fractal Flow Pro

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

File Size: 450 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

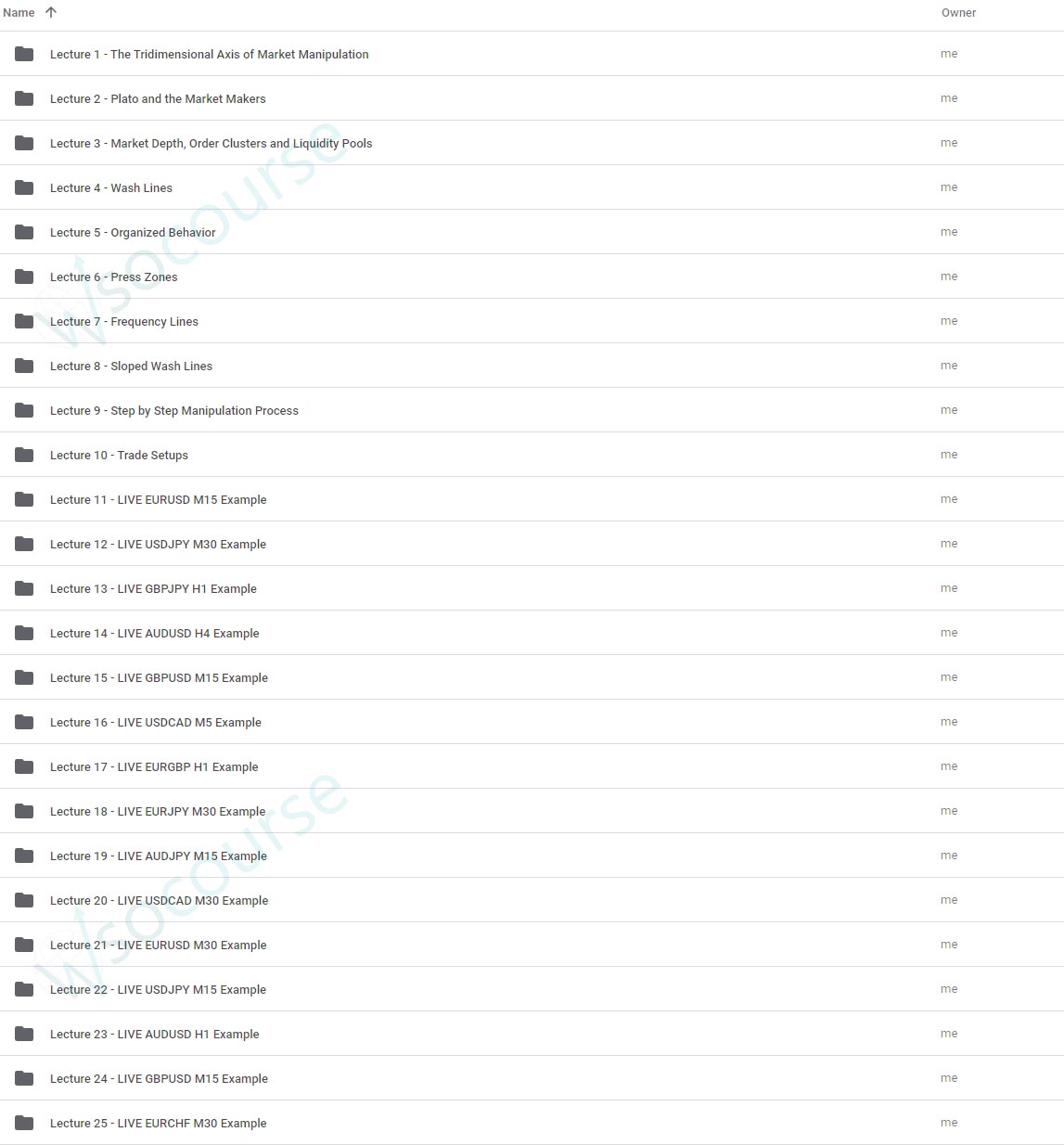

You may check content proof of “Market Maker Strategy Video Course with Fractal Flow Pro” below:

Market Maker Strategy Video Course with Fractal Flow Pro

Introduction

Embark on a journey to master the market maker strategy through the “Market Maker Strategy Video Course with Fractal Flow Pro.” This comprehensive course offers a deep dive into the tactics and tools that market makers use to influence market movements effectively.

Understanding the Market Maker Role

What is a Market Maker?

A market maker is an entity or individual that provides liquidity to markets by buying and selling large quantities of securities, ensuring trading stability and efficiency.

Importance of Market Makers

- Liquidity Provision: Ensuring that there is enough volume for transactions without large price fluctuations.

- Price Discovery: Helping establish fair market prices through supply and demand balance.

Core Principles of Market Making

The Bid-Ask Spread

- Concept Explanation: Understanding the difference between the buying price and the selling price.

- Profit Mechanism: How market makers earn from the spread.

Inventory Management

- Balancing Act: Techniques to manage large volumes of stocks or assets.

- Risk Considerations: Strategies to minimize potential losses.

Fractal Flow Pro Tools for Market Making

Advanced Analytical Software

Leverage Fractal Flow Pro’s capabilities to predict market movements and optimize trading strategies.

Integration with Trading Platforms

How to seamlessly integrate Fractal Flow Pro into existing trading setups for enhanced performance.

Trading Strategies Explained

Order Book Manipulation

- Tactics Used by Market Makers: Understanding order padding, spoofing, and layering.

- Ethical and Legal Considerations: Ensuring compliance with trading regulations.

High-Frequency Trading (HFT) Techniques

- Algorithmic Trading: Utilizing algorithms for faster decision-making.

- Impact on Liquidity and Volatility: How HFT affects the markets.

Behavioral Analysis in Market Making

Psychological Aspects

- Trader Psychology: How market sentiments can affect market maker decisions.

- Anticipating Market Moves: Predicting trader behavior based on market conditions.

Market Sentiment Tools

- Using Fractal Flow Pro: Analyzing market sentiment and adjusting strategies accordingly.

Risk Management

Mitigating Financial Exposure

- Hedging Strategies: Techniques to offset potential losses.

- Diversification: Spreading risk across various assets or markets.

Educational Content and Resources

Video Tutorials

- Comprehensive Guides: Step-by-step instructions on market maker strategies.

- Real-Time Examples: Live trade demonstrations using Fractal Flow Pro.

Supporting Documents

- Downloadable Resources: Checklists, templates, and charts to aid in learning.

- Continuous Learning Materials: Access to updates and additional resources.

Course Enrollment and Benefits

How to Enroll

- Registration Details: Steps to sign up and start learning.

- Course Access: Information on how to access the course content.

Advantages of Completing the Course

- Skill Enhancement: Gain an edge in trading by understanding market maker strategies.

- Certification: Receive a certificate of completion that can enhance your professional credentials.

Conclusion

The “Market Maker Strategy Video Course with Fractal Flow Pro” equips traders with the knowledge and tools needed to operate like a market maker, providing insights that go beyond conventional trading wisdom. This course is an invaluable resource for anyone looking to deepen their trading strategy and effectiveness.

FAQs

- Who should take this course?

- Traders of all levels interested in understanding and applying market maker strategies in their trading activities.

- What prerequisites are required?

- Basic knowledge of trading concepts and familiarity with technical analysis tools is recommended.

- How long does it take to complete the course?

- Typically, the course can be completed within 4 to 6 weeks, depending on the learner’s pace.

- Can these strategies be applied in any financial market?

- Yes, the principles taught in this course are applicable across various financial markets, including stocks, forex, and commodities.

- What support is available after completing the course?

- Learners have access to a dedicated support forum and can also participate in regular webinars for ongoing guidance.

Be the first to review “Market Maker Strategy Video Course with Fractal Flow Pro” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.