-

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

Magical Forex Trading System

1 × $6.00

Magical Forex Trading System

1 × $6.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

Simpler Options - Double Diagonals Class

1 × $6.00

Simpler Options - Double Diagonals Class

1 × $6.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

How I Trade Options with Jon Najarian

1 × $4.00

How I Trade Options with Jon Najarian

1 × $4.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

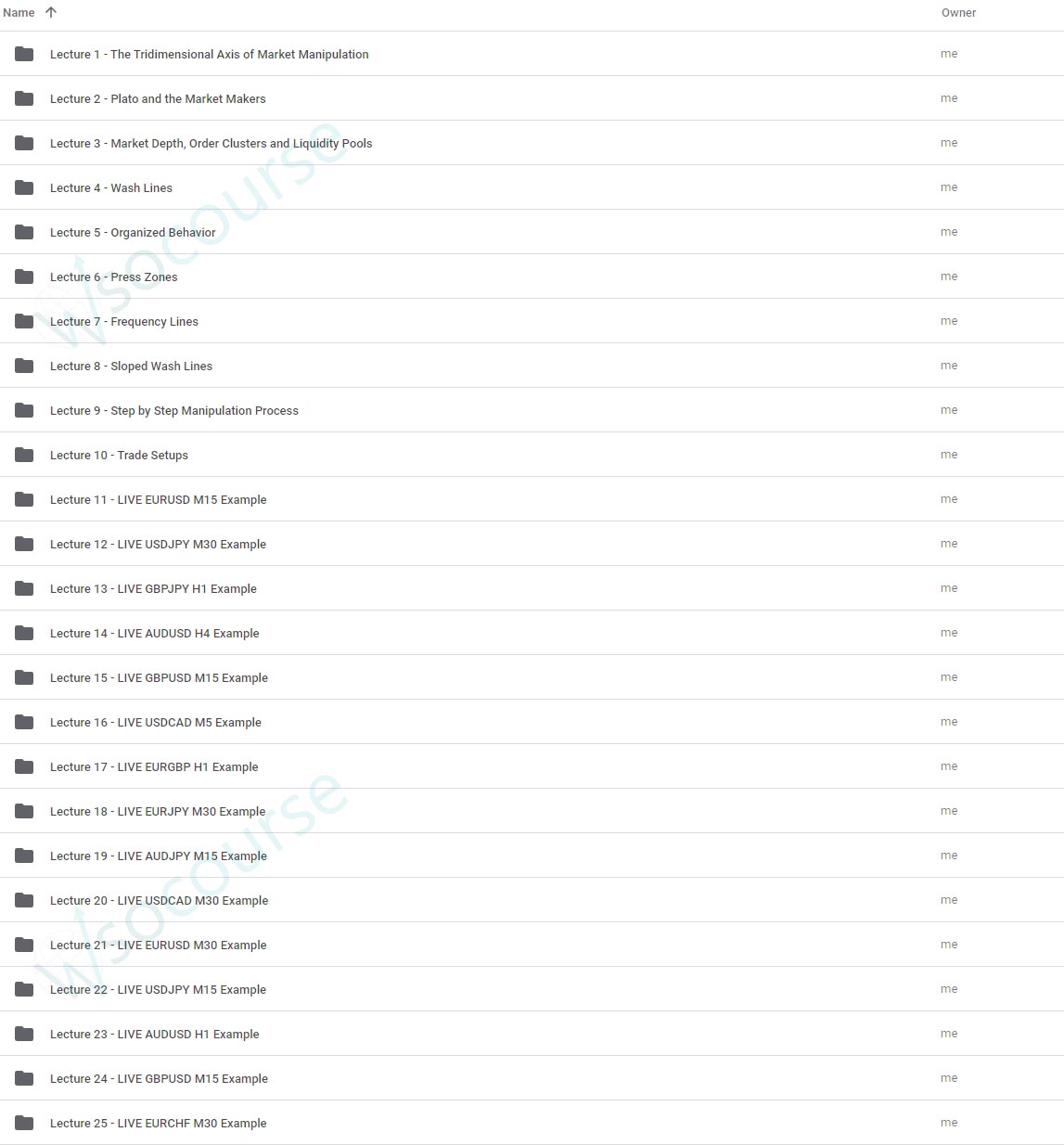

Market Maker Strategy Video Course with Fractal Flow Pro

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

File Size: 450 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Market Maker Strategy Video Course with Fractal Flow Pro” below:

Market Maker Strategy Video Course with Fractal Flow Pro

Introduction

Embark on a journey to master the market maker strategy through the “Market Maker Strategy Video Course with Fractal Flow Pro.” This comprehensive course offers a deep dive into the tactics and tools that market makers use to influence market movements effectively.

Understanding the Market Maker Role

What is a Market Maker?

A market maker is an entity or individual that provides liquidity to markets by buying and selling large quantities of securities, ensuring trading stability and efficiency.

Importance of Market Makers

- Liquidity Provision: Ensuring that there is enough volume for transactions without large price fluctuations.

- Price Discovery: Helping establish fair market prices through supply and demand balance.

Core Principles of Market Making

The Bid-Ask Spread

- Concept Explanation: Understanding the difference between the buying price and the selling price.

- Profit Mechanism: How market makers earn from the spread.

Inventory Management

- Balancing Act: Techniques to manage large volumes of stocks or assets.

- Risk Considerations: Strategies to minimize potential losses.

Fractal Flow Pro Tools for Market Making

Advanced Analytical Software

Leverage Fractal Flow Pro’s capabilities to predict market movements and optimize trading strategies.

Integration with Trading Platforms

How to seamlessly integrate Fractal Flow Pro into existing trading setups for enhanced performance.

Trading Strategies Explained

Order Book Manipulation

- Tactics Used by Market Makers: Understanding order padding, spoofing, and layering.

- Ethical and Legal Considerations: Ensuring compliance with trading regulations.

High-Frequency Trading (HFT) Techniques

- Algorithmic Trading: Utilizing algorithms for faster decision-making.

- Impact on Liquidity and Volatility: How HFT affects the markets.

Behavioral Analysis in Market Making

Psychological Aspects

- Trader Psychology: How market sentiments can affect market maker decisions.

- Anticipating Market Moves: Predicting trader behavior based on market conditions.

Market Sentiment Tools

- Using Fractal Flow Pro: Analyzing market sentiment and adjusting strategies accordingly.

Risk Management

Mitigating Financial Exposure

- Hedging Strategies: Techniques to offset potential losses.

- Diversification: Spreading risk across various assets or markets.

Educational Content and Resources

Video Tutorials

- Comprehensive Guides: Step-by-step instructions on market maker strategies.

- Real-Time Examples: Live trade demonstrations using Fractal Flow Pro.

Supporting Documents

- Downloadable Resources: Checklists, templates, and charts to aid in learning.

- Continuous Learning Materials: Access to updates and additional resources.

Course Enrollment and Benefits

How to Enroll

- Registration Details: Steps to sign up and start learning.

- Course Access: Information on how to access the course content.

Advantages of Completing the Course

- Skill Enhancement: Gain an edge in trading by understanding market maker strategies.

- Certification: Receive a certificate of completion that can enhance your professional credentials.

Conclusion

The “Market Maker Strategy Video Course with Fractal Flow Pro” equips traders with the knowledge and tools needed to operate like a market maker, providing insights that go beyond conventional trading wisdom. This course is an invaluable resource for anyone looking to deepen their trading strategy and effectiveness.

FAQs

- Who should take this course?

- Traders of all levels interested in understanding and applying market maker strategies in their trading activities.

- What prerequisites are required?

- Basic knowledge of trading concepts and familiarity with technical analysis tools is recommended.

- How long does it take to complete the course?

- Typically, the course can be completed within 4 to 6 weeks, depending on the learner’s pace.

- Can these strategies be applied in any financial market?

- Yes, the principles taught in this course are applicable across various financial markets, including stocks, forex, and commodities.

- What support is available after completing the course?

- Learners have access to a dedicated support forum and can also participate in regular webinars for ongoing guidance.

Be the first to review “Market Maker Strategy Video Course with Fractal Flow Pro” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.