-

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Investors Underground - Tandem Trader

1 × $5.00

Investors Underground - Tandem Trader

1 × $5.00 -

×

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00 -

×

Trading With DiNapoli Levels

1 × $6.00

Trading With DiNapoli Levels

1 × $6.00 -

×

Jim Rickards Intelligence Triggers with Agora Financial

1 × $5.00

Jim Rickards Intelligence Triggers with Agora Financial

1 × $5.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

The Rare Writings of W.D Gann

1 × $6.00

The Rare Writings of W.D Gann

1 × $6.00 -

×

PowerWave Trading with Dar Wong

1 × $4.00

PowerWave Trading with Dar Wong

1 × $4.00 -

×

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00 -

×

Forex Trader Package 2010

1 × $15.00

Forex Trader Package 2010

1 × $15.00 -

×

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Programming in Python For Traders

1 × $78.00

Programming in Python For Traders

1 × $78.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

The Stock Selector System with Michael Sheimo

1 × $6.00

The Stock Selector System with Michael Sheimo

1 × $6.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00 -

×

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Extreme Events: Robust Portfolio Construction in the Presence of Fat Tails with Malcolm Kemp

1 × $6.00

Extreme Events: Robust Portfolio Construction in the Presence of Fat Tails with Malcolm Kemp

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

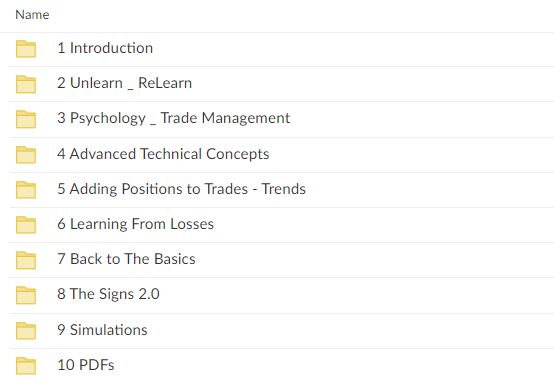

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.