-

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

March 2023 Intensive Live Trading Event with Apteros Trading

1 × $5.00

March 2023 Intensive Live Trading Event with Apteros Trading

1 × $5.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

Tape Reading Big Caps 1 on 1 with Jtrader

1 × $6.00

Tape Reading Big Caps 1 on 1 with Jtrader

1 × $6.00 -

×

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00 -

×

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00 -

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

Larry Connors Professional Day Trading for Success Program

1 × $62.00

Larry Connors Professional Day Trading for Success Program

1 × $62.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

The Ultimate Investor with Dean LeBaron

1 × $4.00

The Ultimate Investor with Dean LeBaron

1 × $4.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

OrderFlows Trader Package, (Sep 2015)

1 × $54.00

OrderFlows Trader Package, (Sep 2015)

1 × $54.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Forex Trader Package 2010

1 × $15.00

Forex Trader Package 2010

1 × $15.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

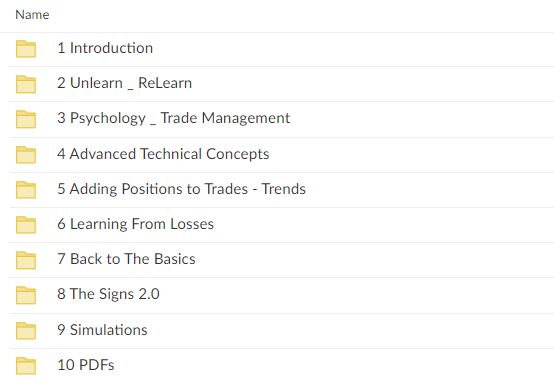

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.