-

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

Dhia’s Journal 2022

1 × $6.00

Dhia’s Journal 2022

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

Predicting Next Weeks’s Range with Charles Drummond

1 × $6.00

Predicting Next Weeks’s Range with Charles Drummond

1 × $6.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

All in One Forex Course with VintagEducation

1 × $31.00

All in One Forex Course with VintagEducation

1 × $31.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00 -

×

How to Trade in Stocks

1 × $6.00

How to Trade in Stocks

1 × $6.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

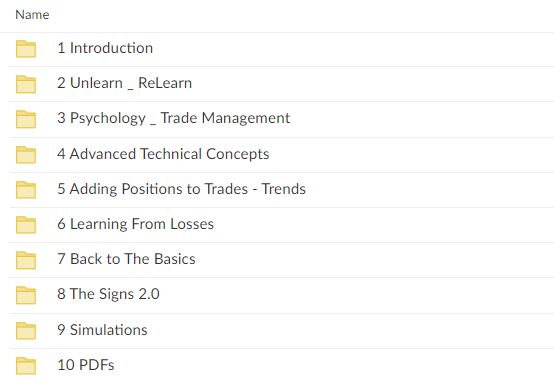

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.