-

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Broken Wing Butterfly Options Strategy with Greg Loehr

1 × $23.00

The Broken Wing Butterfly Options Strategy with Greg Loehr

1 × $23.00 -

×

War Room Psychology Vol.3 with Trick Trades

1 × $23.00

War Room Psychology Vol.3 with Trick Trades

1 × $23.00 -

×

Carter FX 2.0 with CFX University

1 × $5.00

Carter FX 2.0 with CFX University

1 × $5.00 -

×

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

Beginner To Winner Boot Camp with Pips2Profit

1 × $41.00

Beginner To Winner Boot Camp with Pips2Profit

1 × $41.00 -

×

Applied Portfolio Management with Catherine Shenoy

1 × $6.00

Applied Portfolio Management with Catherine Shenoy

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

Module 3 – Volume, Trendlines and Indicators

1 × $31.00

Module 3 – Volume, Trendlines and Indicators

1 × $31.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00 -

×

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00 -

×

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00 -

×

Master Strategies of Super Achievers By Steven Scott

1 × $23.00

Master Strategies of Super Achievers By Steven Scott

1 × $23.00 -

×

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00 -

×

Day Trading Stocks - Gap Trading

1 × $23.00

Day Trading Stocks - Gap Trading

1 × $23.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00 -

×

Positive Thinking & Stress Management for Trading with Daley Personal Development

1 × $6.00

Positive Thinking & Stress Management for Trading with Daley Personal Development

1 × $6.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00 -

×

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00 -

×

The Futures Edge with Joshua Martinez

1 × $155.00

The Futures Edge with Joshua Martinez

1 × $155.00 -

×

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00 -

×

Forex Mentor - FX Winning Strategies

1 × $15.00

Forex Mentor - FX Winning Strategies

1 × $15.00 -

×

Forex Trading: Comprehensive & Concise Forex Trading Course with Luciano Kelly & Learn Forex Mentor

1 × $6.00

Forex Trading: Comprehensive & Concise Forex Trading Course with Luciano Kelly & Learn Forex Mentor

1 × $6.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00 -

×

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00 -

×

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

The A.M. Trader with MarketGauge

1 × $31.00

The A.M. Trader with MarketGauge

1 × $31.00 -

×

RVM Secrets with Sam Bart

1 × $23.00

RVM Secrets with Sam Bart

1 × $23.00 -

×

Disciplined Trading How to Trade Your Wav to Financial Freedom Video

1 × $6.00

Disciplined Trading How to Trade Your Wav to Financial Freedom Video

1 × $6.00 -

×

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Linear Regression 3030 with David Elliott

1 × $6.00

Linear Regression 3030 with David Elliott

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

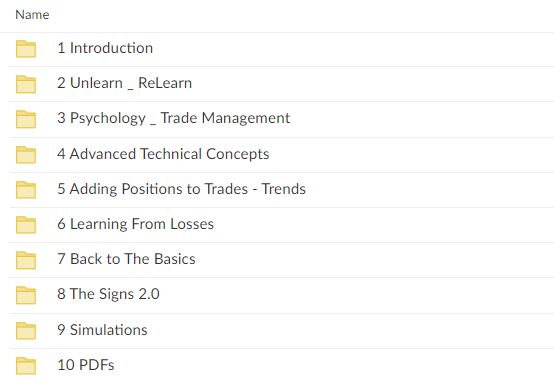

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.