-

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Price Action Trading Volume 3 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 3 with Fractal Flow Pro

1 × $6.00 -

×

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Heretics of Finance with Andrew Lo & Jasmina Hasanhodzic

1 × $4.00

The Heretics of Finance with Andrew Lo & Jasmina Hasanhodzic

1 × $4.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

Forecasting Financial Markets (2nd Ed.)

1 × $6.00

Forecasting Financial Markets (2nd Ed.)

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The FX Swing Trading Blueprint with Swing FX

1 × $6.00

The FX Swing Trading Blueprint with Swing FX

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

Surplus Trader Secrets Masterclass Coaching Program

1 × $6.00

Surplus Trader Secrets Masterclass Coaching Program

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00 -

×

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Quality FX Academy

1 × $5.00

Quality FX Academy

1 × $5.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Profitable DayTrading with Precision - George Angell

1 × $6.00

Profitable DayTrading with Precision - George Angell

1 × $6.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

Five Trading Trends of 2005 with Dan Denning

1 × $6.00

Five Trading Trends of 2005 with Dan Denning

1 × $6.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

Risk Management with Aswath Damodaran

1 × $6.00

Risk Management with Aswath Damodaran

1 × $6.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00 -

×

Trading Online

1 × $6.00

Trading Online

1 × $6.00 -

×

Trading Course 2024 with ZMC x BMO

1 × $17.00

Trading Course 2024 with ZMC x BMO

1 × $17.00 -

×

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

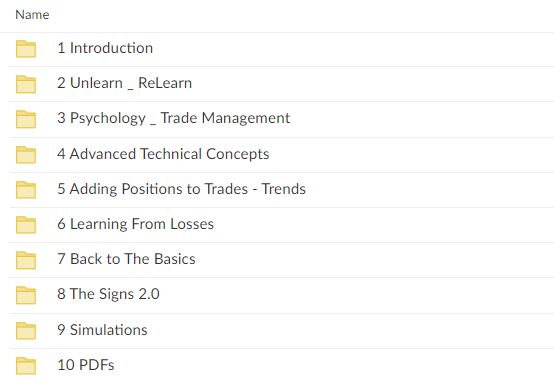

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.